Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

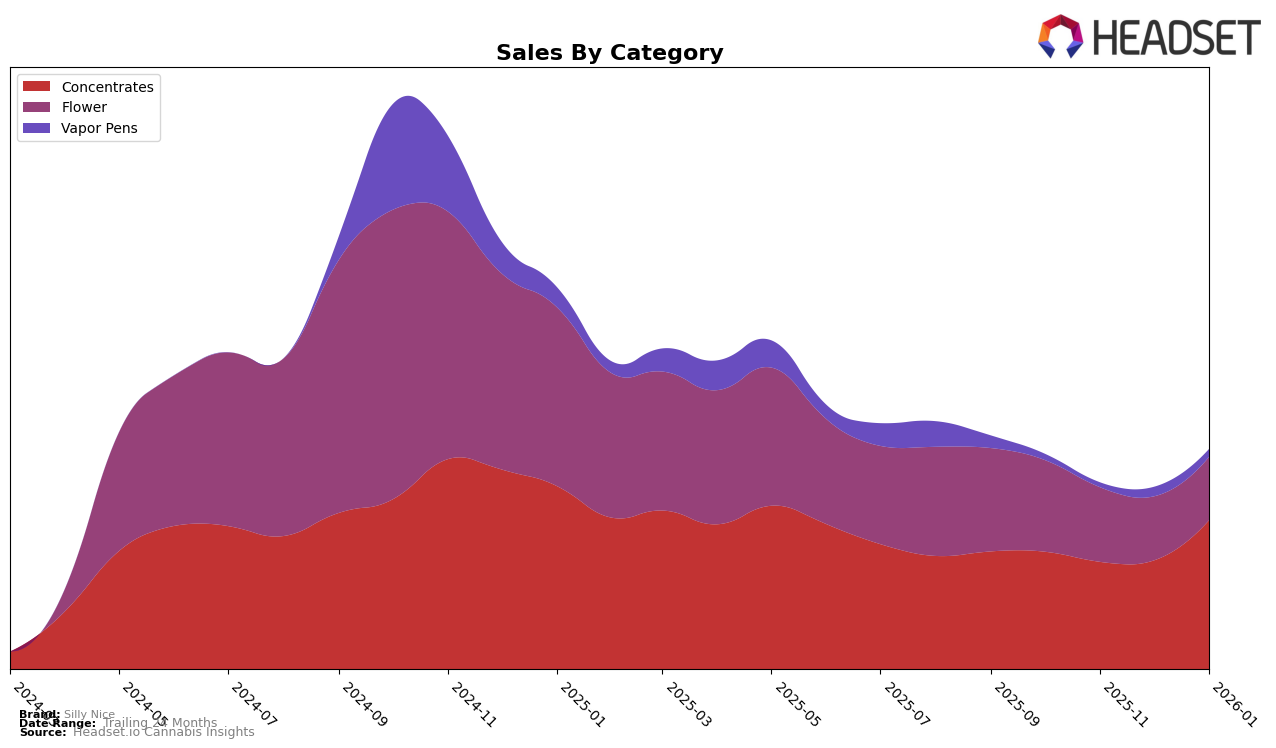

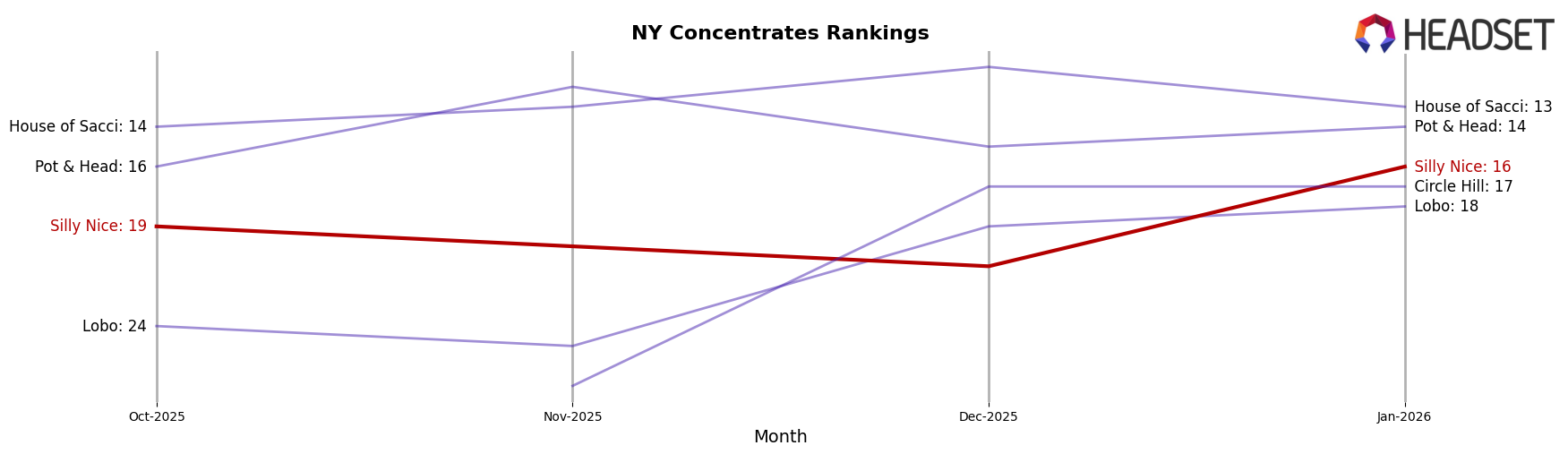

Silly Nice has shown a dynamic performance in the New York market, particularly in the Concentrates category. Over the past few months, the brand has experienced some fluctuations in its rankings, starting at 19th place in October 2025 and slightly declining to 21st by December 2025. However, a notable improvement was observed in January 2026, where Silly Nice rose to 16th place. This upward movement in the rankings coincided with a significant increase in sales, suggesting effective strategies or product launches that resonated well with consumers during this period.

Interestingly, while Silly Nice consistently remained within the top 30 brands in the Concentrates category in New York, their absence from the top 30 in other states or categories could be seen as a potential area for growth or a strategic decision to focus on specific markets. The brand's ability to rebound in rankings within a competitive market like New York highlights its potential to capitalize on consumer preferences and market trends. However, the data does leave room for further exploration of their performance in other regions or categories, which could provide deeper insights into their overall market strategy and adaptability.

Competitive Landscape

In the competitive landscape of the New York concentrates market, Silly Nice has shown a notable fluctuation in its rankings from October 2025 to January 2026. While Silly Nice started at rank 19 in October 2025, it experienced a dip to rank 21 in December, before climbing to a commendable rank 16 in January 2026. This upward trajectory in January is significant, especially when compared to competitors like Lobo, which improved steadily from rank 24 to 18, and Circle Hill, which re-entered the top 20 in December and maintained its position. Meanwhile, House of Sacci and Pot & Head consistently outperformed Silly Nice, maintaining higher ranks throughout the period. Despite the competition, Silly Nice's sales in January 2026 saw a significant boost, indicating a positive response to market strategies that could potentially enhance its competitive edge further.

Notable Products

In January 2026, Silly Nice THCA Diamond Powder (0.5g) maintained its position as the top-performing product in the Concentrates category, with sales reaching $755. Silly Nice Sifted Bubble Hash (1g) saw a notable rise, climbing from third to second place, showcasing a strong sales increase from previous months. Silly Nice Frosted Hash Ball (1g) experienced a slight dip in ranking, moving from second to third place, yet it recorded a consistent sales performance. Papaya Wine Infused Frosted Flower (3.5g) held steady in the fourth position, indicating stable demand within the Flower category. Overall, Silly Nice products demonstrated consistent performance, with slight shifts in rankings reflecting dynamic consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.