Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

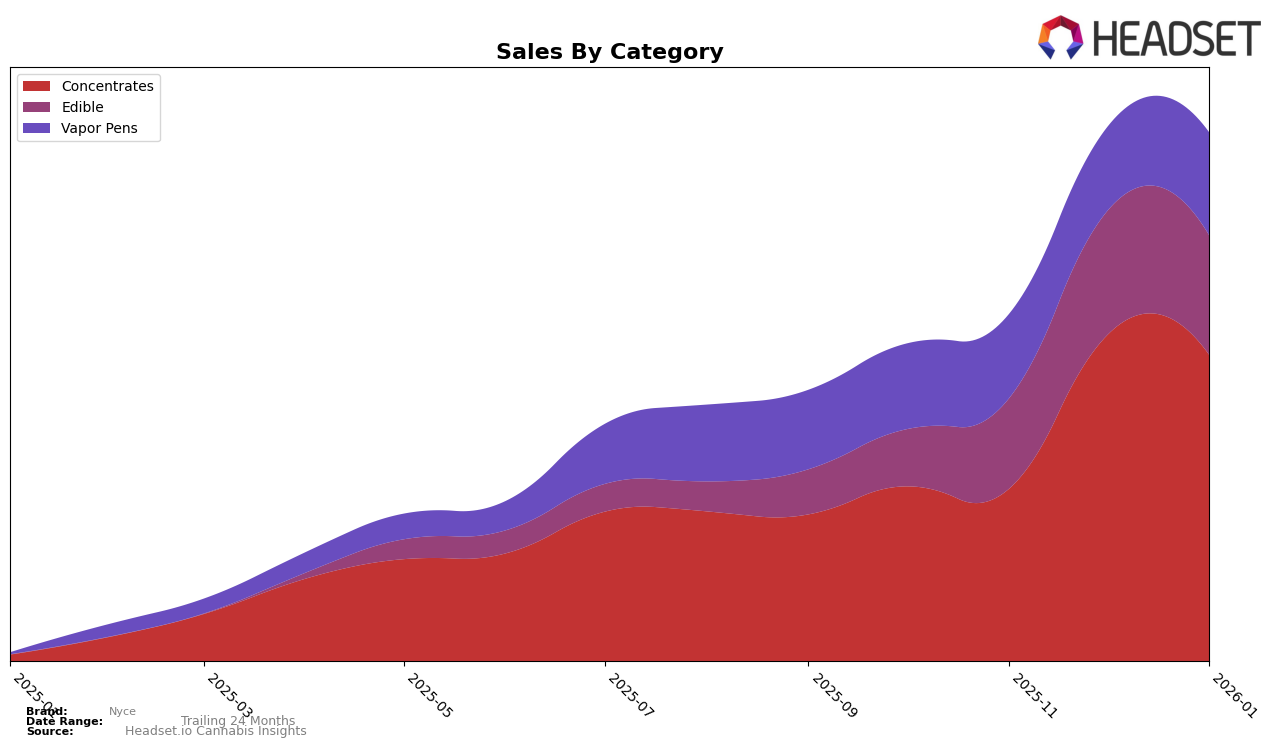

Nyce has shown a strong presence in the New York concentrates category, maintaining a top 6 position over the past four months, peaking at a rank of 4 in January 2026. This upward movement from a rank of 6 in November 2025 to 4 in January 2026 indicates a positive trend, as the brand has managed to climb the ranks despite fluctuations in sales volumes. However, in the vapor pens category, Nyce has not consistently secured a spot within the top 50, with rankings fluctuating between 52 and 61. This inconsistency might be a point of concern as it suggests challenges in maintaining a competitive edge in this category within the state.

In the edibles category, Nyce has seen a gradual improvement in its rankings in New York, moving from 32 in October 2025 to 27 by December 2025, with the same rank maintained into January 2026. Although the brand did not break into the top 25, the steady climb over the months suggests a growing acceptance or strategic improvements in their edible offerings. The absence of Nyce from the top 30 in some months could be seen as a missed opportunity for greater market penetration, but the overall trajectory in the edibles category remains promising.

Competitive Landscape

In the competitive landscape of the New York concentrates market, Nyce has shown a promising upward trajectory in rankings and sales over the past few months. Starting from a rank of 5th in October 2025, Nyce improved to 4th by January 2026, indicating a positive shift in consumer preference or strategic market positioning. This improvement is significant when compared to competitors like Hudson Cannabis, which experienced a decline from 3rd to 5th place during the same period. Meanwhile, Mfny (Marijuana Farms New York) and Jetpacks maintained their stronghold at the top two positions, suggesting that while Nyce is gaining ground, there remains a significant gap to close with the market leaders. Notably, Nyce's sales nearly doubled from November to December 2025, a growth pattern that outpaced Blotter, which saw more modest sales increases. This data suggests that Nyce is effectively capturing market share and could continue to climb the ranks if these trends persist.

Notable Products

In January 2026, the top-performing product from Nyce was the Blueberry Sugar Free Live Hash Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its rank as number one with sales of 1068 units. The Guava Papaya Cold Cure Live Hash Rosin (1g) emerged as a strong contender in the Concentrates category, securing the second position in its debut month. Trop Cherry x Purple Punch Cold Cure Live Hash Rosin (1g) also made an impressive entry, ranking third in the Concentrates category. The Tangerine Live Hash Rosin Gummies 10-Pack (100mg) remained steady at fourth place, while the Peach Live Hash Rosin Gummies 10-Pack (100mg) slipped slightly to fifth from its previous third-place standing. Notably, the Blueberry Gummies have consistently held the top spot since November 2025, underscoring their popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.