Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

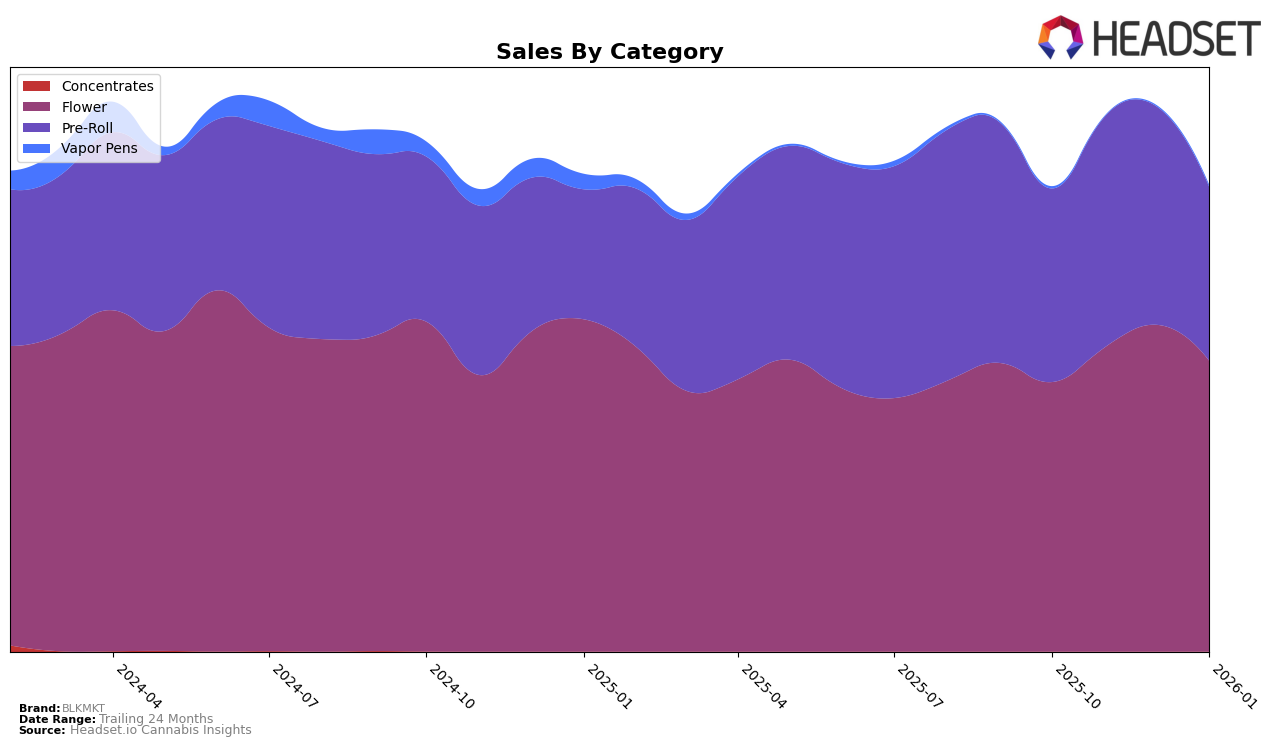

In the cannabis market, BLKMKT has shown varied performance across different provinces and categories. In British Columbia, the brand's presence in the Flower category has seen a gradual improvement from October 2025 to January 2026, moving from a rank of 66 to 51. This upward trend is mirrored in the Pre-Roll category, where BLKMKT climbed from 78 to 51 during the same period. However, the brand's sales in the Flower category experienced a dip in January 2026, indicating potential market challenges. On the other hand, Ontario presents a different story; BLKMKT maintained a relatively stable presence in the Flower category, consistently ranking within the top 30. The Pre-Roll category, however, saw a decline in ranking from 38 in October 2025 to 43 in January 2026, suggesting a potential need for strategic adjustments.

In Saskatchewan, the brand's performance in the Flower category is more volatile. BLKMKT did not make it into the top 30 in October 2025, but by November, it had jumped to 33, only to drop to 41 by December. This fluctuation indicates a competitive market environment and possibly varying consumer preferences. The absence of BLKMKT in the top 30 for October 2025 in Saskatchewan could be seen as a challenge, but the subsequent entry into the rankings suggests an opportunity for growth. While these insights provide a snapshot of BLKMKT's market dynamics, further analysis could delve into the factors influencing these movements and how the brand can leverage its strengths to improve its market position.

Competitive Landscape

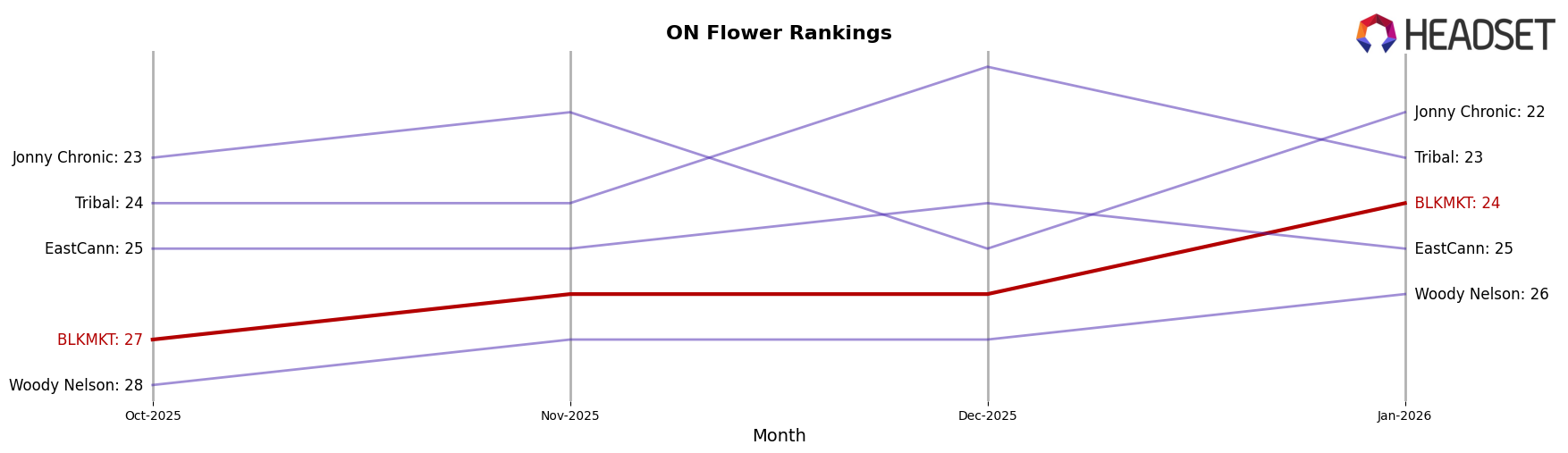

In the competitive landscape of the Flower category in Ontario, BLKMKT has shown a gradual improvement in its rank from October 2025 to January 2026, moving from 27th to 24th position. This upward trend suggests a positive reception in the market, despite not being in the top 20. Notably, Jonny Chronic and Tribal have maintained stronger positions, with ranks fluctuating around the low 20s. Jonny Chronic consistently outperformed BLKMKT in sales, indicating a robust consumer base. Meanwhile, EastCann and Woody Nelson have shown similar sales figures to BLKMKT, but with slightly better rankings, suggesting competitive pressure. The data indicates that while BLKMKT is gaining traction, it faces stiff competition from these established brands, necessitating strategic marketing efforts to enhance its market position further.

Notable Products

In January 2026, Rainbow P Pre-Roll (1g) maintained its position as the top-selling product for BLKMKT, with sales reaching 6973 units. Jealousy Pre-Roll (1g) also held steady at the second rank, showing consistent demand over the months. Tex F2 Pre-Roll (1g) climbed to third place from its previous fifth position in October 2025, demonstrating a notable increase in popularity. Blk Mlk Pre-Roll (1g) dropped to fourth place after being absent from the rankings in December 2025. Upside Down Cake Pre-Roll (1g) remained in fifth place, despite a decrease in sales figures compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.