Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

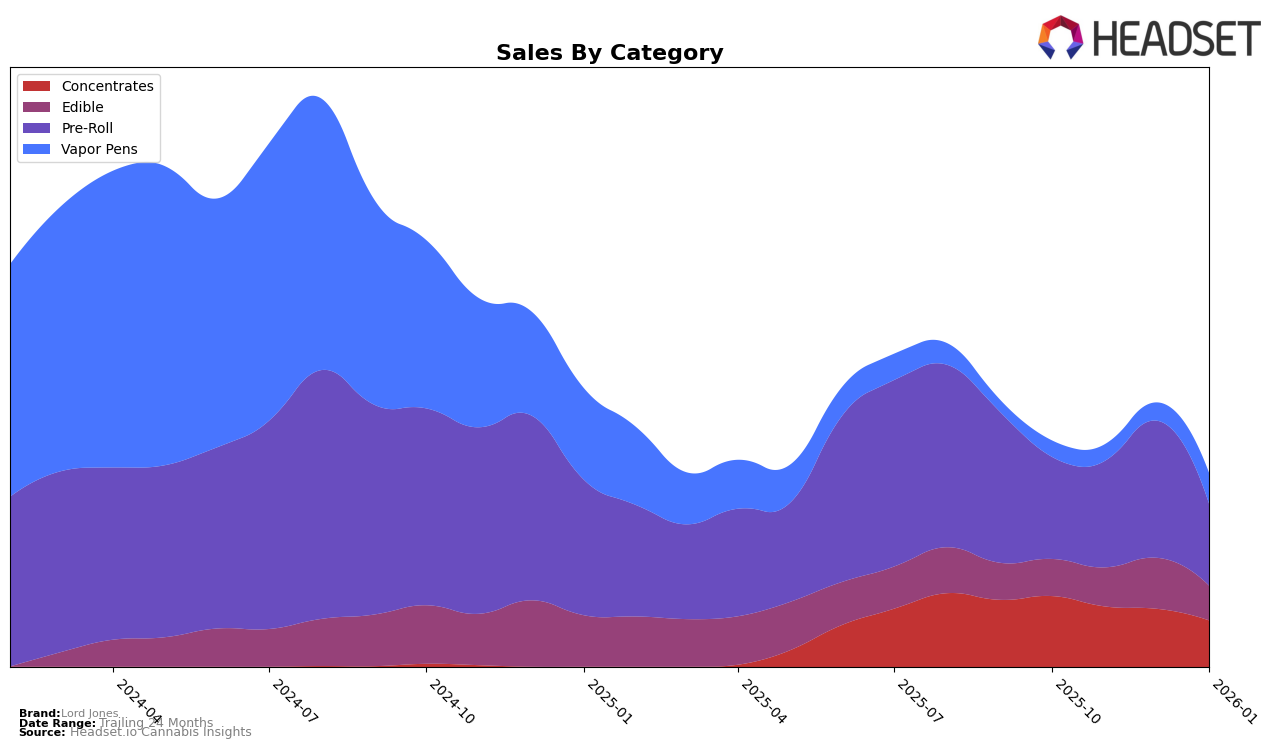

Lord Jones has experienced notable shifts across various categories and states. In Alberta, the brand's performance in the concentrates category has seen a consistent decline, dropping from 6th to 19th place from October 2025 to January 2026, indicating a significant decrease in market presence. Conversely, in the edibles category within Ontario, Lord Jones has shown resilience, improving its rank from 24th to 22nd, despite fluctuating sales figures. The brand's presence in the vapor pens category in Ontario is also noteworthy, climbing from 97th in October to 63rd in January, suggesting a growing acceptance or demand for their products in this segment.

In British Columbia, Lord Jones has experienced mixed results. While the edibles category has seen a slight improvement, maintaining a consistent rank around the 20s, their performance in pre-rolls has been volatile, peaking at 53rd in December before dropping back to 78th in January. The absence of Lord Jones in the top 30 for vapor pens in Alberta during December suggests a challenging environment or product reception in that category. Meanwhile, in Saskatchewan, the brand's disappearance from the top rankings in the edibles category after November could point to increased competition or a strategic shift in focus. These movements highlight the dynamic nature of the cannabis market and the varying consumer preferences across different regions.

Competitive Landscape

In the competitive landscape of the Alberta pre-roll market, Lord Jones has experienced fluctuating rankings, with notable shifts from 66th in October 2025 to 59th by January 2026. Despite these fluctuations, Lord Jones remains outside the top 50, indicating room for growth. Comparatively, 7 Acres and Ritual Green / Ritual Gold have maintained stronger positions, with rankings consistently in the 40s and 50s, suggesting a more stable market presence. XPLOR and SUPER TOAST also show competitive standings, often ranking close to or above Lord Jones. The sales trends reflect these rankings, with Lord Jones experiencing a dip in November 2025 but recovering in December, although still trailing behind the sales figures of its competitors. This indicates a need for strategic marketing and product differentiation to improve market positioning and sales performance in Alberta's pre-roll category.

Notable Products

In January 2026, the top-performing product for Lord Jones was the CBD/THC 1:1 Salted Caramel Crunch Fusions Chocolate 5-Pack, maintaining its consistent rank of 1 since October 2025, with sales reaching 10,309 units. The Cookies & Cream Fusion Chocolate 5-Pack held steady at the second position, although its sales saw a decline from December 2025. The Orange Velvet Live Resin Caviar remained in the third spot, continuing its downward sales trend. The Sour Diesel x Orange Velvet Infused Pre-Roll 3-Pack improved its rank from fifth in December 2025 to fourth in January 2026. Lastly, the Sour Blueberry Liquid Diamonds Live Cartridge debuted in January 2026 at the fifth position, marking its entry into the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.