Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

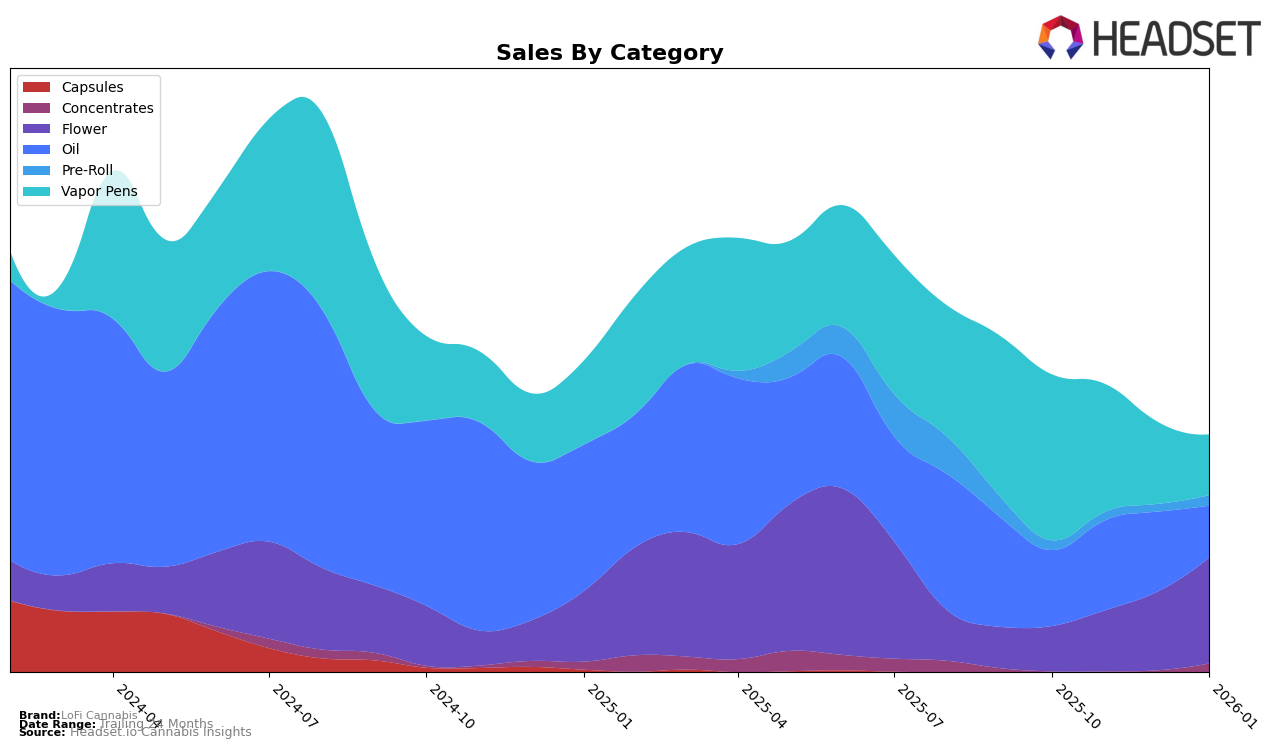

LoFi Cannabis has shown a varied performance across different categories and regions. In British Columbia, the brand made a significant entry into the Oil category, securing the 10th position by January 2026, which indicates a promising upward trajectory given its previous absence from the top 30. However, their performance in the Vapor Pens category seems less impressive, as they were ranked 63rd in October 2025 and dropped to 72nd by November, eventually falling out of the top 30. This suggests a potential area for improvement or a shift in consumer preference that the brand might need to address.

In Ontario, LoFi Cannabis has maintained a relatively stable presence in the Oil category, with rankings fluctuating slightly between 11th and 15th from October 2025 to January 2026. Despite this consistency, there was a noticeable decline in sales from November to January, which could indicate seasonal trends or increased competition. Conversely, their performance within the Vapor Pens category in Ontario highlights a more challenging landscape, as they consistently ranked outside the top 70, peaking at 71st in October 2025 and later dropping to 92nd by January 2026. This persistent lower ranking suggests that LoFi Cannabis might need to innovate or re-strategize to capture more market share in this category.

Competitive Landscape

In the Ontario vapor pens category, LoFi Cannabis has experienced a notable decline in both rank and sales over the past few months, which could be a cause for concern. Starting at rank 71 in October 2025, LoFi Cannabis slipped to rank 92 by January 2026, indicating a downward trend in market position. This decline in rank is mirrored by a consistent drop in sales, from 39,020 in October to 18,919 by January. Competitors such as Wildcard Extracts have shown a more stable performance, maintaining a rank close to LoFi Cannabis but with less volatility, suggesting a more consistent market presence. Meanwhile, MediPharm Labs and Sauce Rosin Labs have fluctuated in and out of the top 100, indicating potential opportunities for LoFi Cannabis to regain its footing if strategic adjustments are made. The competitive landscape in Ontario's vapor pen market is dynamic, and LoFi Cannabis may need to innovate or adjust its marketing strategies to reverse its current trajectory.

Notable Products

In January 2026, the top-performing product for LoFi Cannabis was Nostalgia (7g) from the Flower category, ascending from its previous second-place ranking in December 2025 to the top, with notable sales of 798. Following closely was Nostalgia Craft Hemp (7g), also from the Flower category, which moved up to second place from the third spot in December. The CBD:THC 1:1 Nostalgia x Rainbow Driver Cured Resin Cartridge (1g) from the Vapor Pens category ranked third, maintaining a consistent presence in the top five despite fluctuating sales. The CBD Super Strength Oil (30ml) experienced a drop to fourth place after leading in December, indicating a shift in consumer preference. Nostalgia 2.0 Cured Resin Cartridge (1g) remained steady in fifth place, showing a significant decline from its top position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.