Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

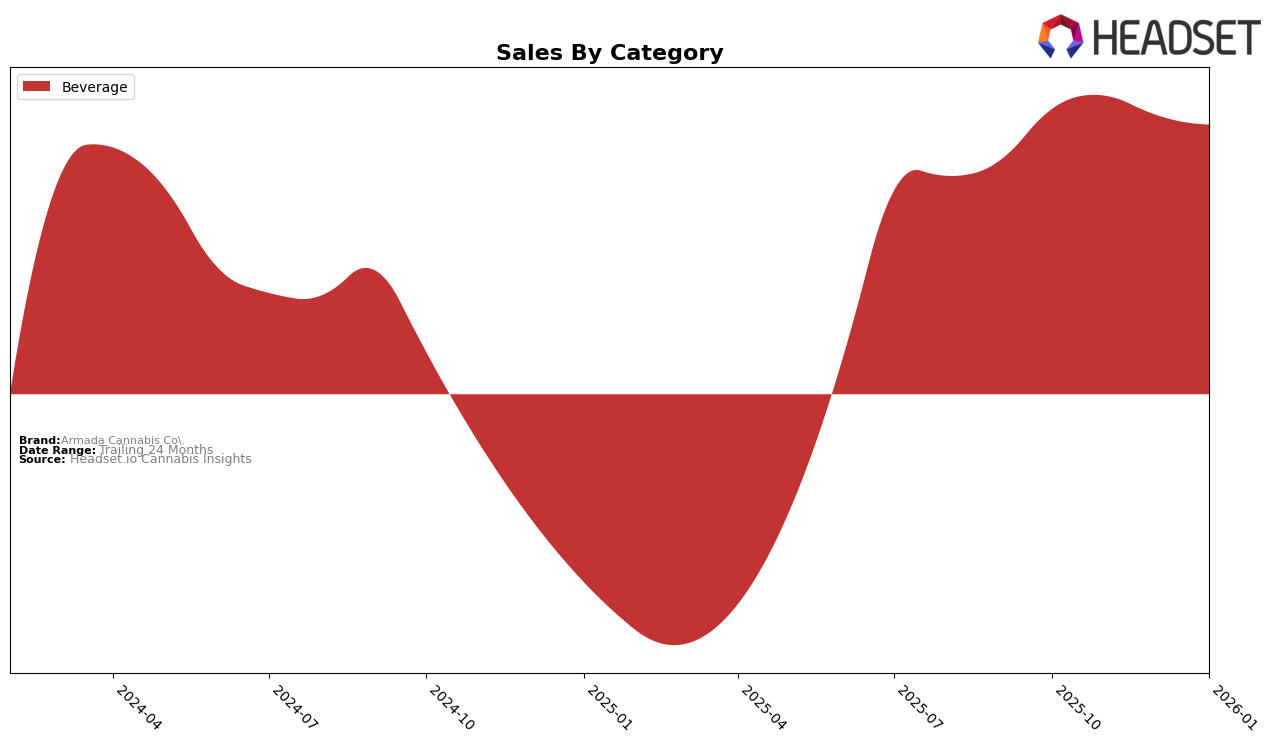

Armada Cannabis Co. has shown a consistent upward trend in the beverage category within the state of Michigan. The brand improved its ranking from 10th place in October 2025 to 8th place by December 2025, maintaining this position into January 2026. This steady climb in rankings, despite a slight dip in sales from November to January, indicates a strengthening market presence and potentially increasing consumer preference for their beverage products. It's noteworthy that Armada Cannabis Co. managed to stay within the top 10 in Michigan, a competitive market, suggesting a robust brand strategy and product appeal.

However, the absence of Armada Cannabis Co. in the top 30 rankings for other states and categories could be seen as a limitation in their market reach or competitiveness outside of Michigan's beverage category. The lack of presence in these rankings highlights potential areas for growth or the need for strategic adjustments to broaden their market influence. This disparity suggests that while the brand is performing well in a specific niche, there may be untapped opportunities or challenges in diversifying their product line or expanding geographically.

Competitive Landscape

In the Michigan beverage category, Armada Cannabis Co. has shown a steady improvement in its rankings, moving from 10th place in October 2025 to 8th place by December 2025, maintaining this position into January 2026. This upward trend suggests a positive reception of their products, even as they face stiff competition from brands like Chill Medicated and Pleasantea, which consistently rank higher. Notably, tonic experienced a drop in rank from 4th to 7th over the same period, indicating potential market volatility that Armada could capitalize on. While The Best Dirty Lemonade remains outside the top 10 for most of the observed months, Armada's stable sales figures suggest resilience and the potential for further growth in market share.

Notable Products

In January 2026, Armada Cannabis Co.'s top-performing product was Apple Cider (20mg THC, 417ml) in the Beverage category, maintaining its first-place ranking consistently from October through January with sales of 8,860 units. Sparkling Sweet Apple (20mg THC, 12oz, 355ml) retained its second-place position from December, showing a notable increase from its third-place ranking in October and November. Apple Cider (20mg THC, 16oz, 473ml) held the third spot in January, consistent with its ranking in October and November, but a step up from December's third position. Notably, Cold Brew Coffee (10mg THC, 12oz, 355ml) was not ranked from November to January after holding the fourth spot in October. Overall, the top three products have demonstrated stable performance with minor shifts in rankings, highlighting a strong preference for cider-based beverages.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.