Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

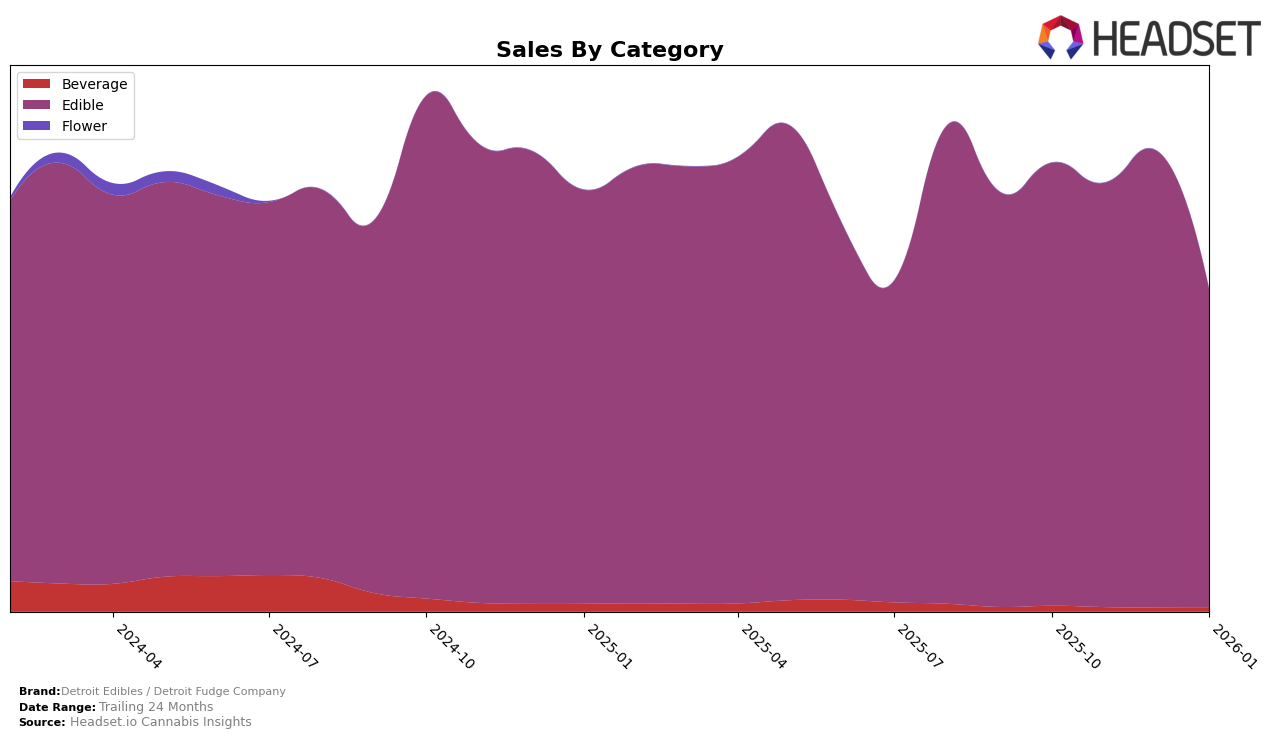

Detroit Edibles / Detroit Fudge Company has demonstrated a consistent performance in the Michigan market within the Edible category. Over the observed months, the brand maintained a steady presence, ranking 9th in October 2025 and slightly dropping to 11th by January 2026. While the brand experienced a dip in sales from October to November, there was a notable recovery in December, suggesting a potential seasonal influence on consumer purchasing behavior. However, the decline in January sales might indicate a post-holiday slowdown or increased competition. The brand's ability to remain within the top 11 is commendable, though the slight downtrend in rank suggests room for strategic adjustments to regain momentum.

It's important to note that outside of Michigan, Detroit Edibles / Detroit Fudge Company did not appear in the top 30 brands in other states or provinces within the Edible category during this period. This absence could be interpreted as a challenge in expanding their market presence beyond Michigan or a strategic focus on their home state. The brand's steady performance in Michigan could provide a solid foundation for growth if they choose to explore opportunities in other regions. Understanding the regional preferences and competitive landscape will be crucial for Detroit Edibles / Detroit Fudge Company as they navigate potential expansion strategies.

Competitive Landscape

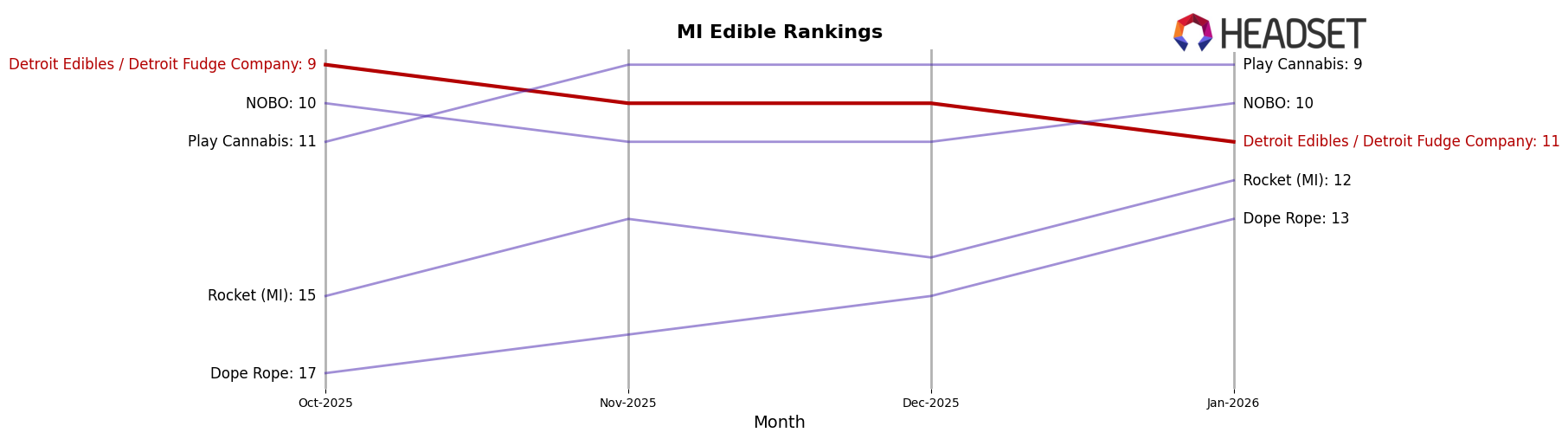

In the competitive landscape of the Michigan edible cannabis market, Detroit Edibles / Detroit Fudge Company has experienced a slight decline in its ranking, moving from 9th place in October 2025 to 11th place by January 2026. This shift is notable as it indicates a downward trend in their market position, despite a temporary sales boost in December 2025. In contrast, Play Cannabis has shown resilience, consistently improving its rank to secure the 9th position by January 2026, suggesting a competitive edge in consumer preference. Meanwhile, NOBO has maintained a stable presence, closely trailing Detroit Edibles / Detroit Fudge Company, and even surpassing them in January 2026. Additionally, Rocket (MI) and Dope Rope have been climbing the ranks, with Rocket (MI) reaching 12th place and Dope Rope improving to 13th by January 2026. These dynamics highlight the competitive pressures faced by Detroit Edibles / Detroit Fudge Company, emphasizing the need for strategic initiatives to regain and strengthen their market position.

Notable Products

In January 2026, the Barracuda Crispy Milk Chocolate Bar 20-Pack (200mg) emerged as the top-performing product for Detroit Edibles / Detroit Fudge Company, climbing from its consistent second-place ranking in the previous months. Despite lower sales of 6041 units compared to December 2025, it surpassed the Peanut Butter Milk High Dose Barracuda Chocolate Bar 20-Pack (200mg), which fell to second place. The CBD/THC 1:1 High Dose Barracuda Milk Chocolate Bar 20-Pack (200mg CBD, 200mg THC) maintained its third-place position, showing stable demand. Notably, the Barracuda Milk Chocolate Bar (200mg) entered the rankings in January 2026, securing the fourth spot. The Barracuda Death By Milk Chocolate Cup 8-Pack (200mg) experienced a slight decline, moving from fourth to fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.