Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

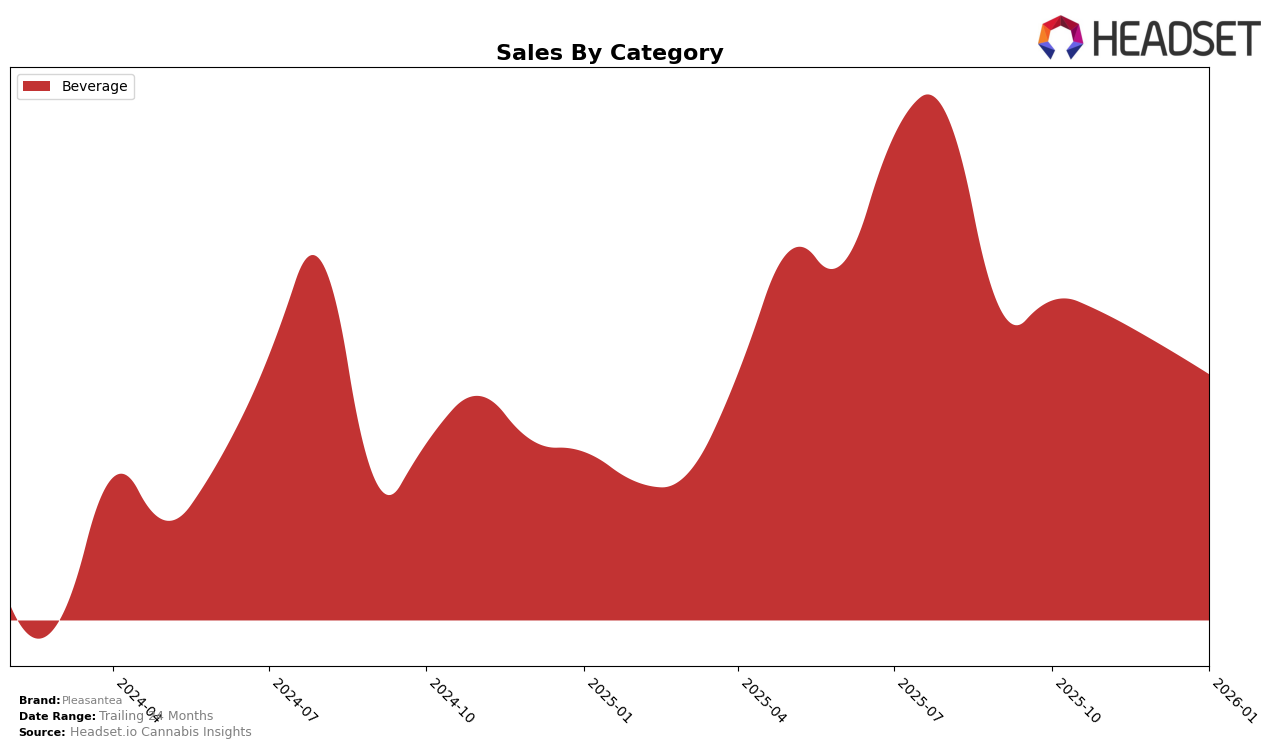

Pleasantea has shown a consistent performance in the Michigan market within the Beverage category. Over the four-month period from October 2025 to January 2026, Pleasantea maintained a steady presence, oscillating between the 6th and 7th ranks. This stability indicates a strong foothold in Michigan's competitive beverage segment, despite a gradual decline in sales figures from $93,066 in October to $83,076 in January. The brand's ability to remain within the top 10 highlights its resilience and potential customer loyalty in this state.

However, Pleasantea's absence from the top 30 rankings in other states or provinces during this period suggests either a limited market penetration or competitive challenges outside of Michigan. This lack of presence in additional markets could be seen as a potential area for growth or a strategic focus on maintaining and strengthening its position within Michigan. The brand's performance in Michigan is commendable, but the opportunity to expand and replicate this success in other regions remains a significant consideration for future growth strategies.

Competitive Landscape

In the competitive landscape of the Michigan cannabis beverage market, Pleasantea has experienced a fluctuating yet stable presence, maintaining a rank between 6th and 7th place from October 2025 to January 2026. Despite a slight decline in sales over this period, Pleasantea's position remains competitive, especially when compared to brands like CQ (Cannabis Quencher) and Highly Casual, which consistently rank higher and show stronger sales growth. Notably, tonic experienced a drop in rank from 4th to 7th, indicating potential volatility that Pleasantea could capitalize on. Meanwhile, Armada Cannabis Co. remains in the lower ranks, suggesting that Pleasantea's mid-tier positioning is relatively secure. As Pleasantea navigates this competitive field, focusing on strategies to boost sales and improve rank could enhance its market presence against these key competitors.

Notable Products

In January 2026, Raspberry Iced Tea (30mg) maintained its position as the top-performing product for Pleasantea, continuing its streak from the previous months with sales of 5,587 units. Peach Iced Tea (30mg) rose to the second spot, overtaking Lemon Iced Tea (10mg), which dropped to third place. Raspberry Iced Tea (10mg) held steady in fourth, while Peach Iced Tea (10mg) remained in fifth place. Notably, Raspberry Iced Tea (30mg) has consistently been the best-seller since October 2025. The notable shift was Peach Iced Tea (30mg) climbing from fourth to second place from November to January, indicating a growing preference among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.