Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

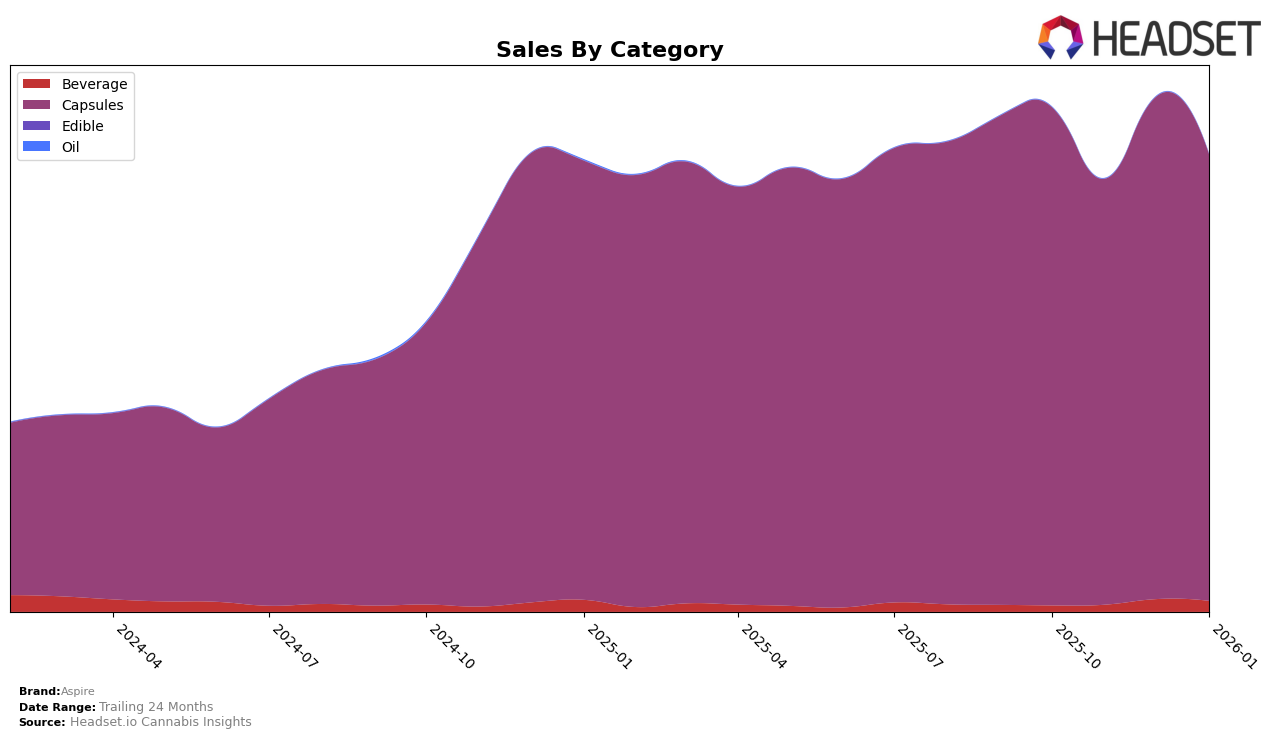

In the Ontario market, Aspire has shown a consistent performance in the Capsules category. Over the months from October 2025 to January 2026, Aspire has maintained its top position, ranking number 1 consistently. This stability indicates a strong brand presence and consumer loyalty in this category. On the other hand, the Beverage category tells a different story. Aspire was not in the top 30 brands in October and November 2025 but made a noticeable entry in December at rank 24, improving slightly to rank 23 by January 2026. This upward movement suggests a growing interest or strategic push in the Beverage category, although it still has a long way to go to match its success in Capsules.

The sales figures also reflect interesting trends. While exact numbers are not disclosed here, it's noteworthy that Aspire's sales in Capsules have shown some fluctuation, with a dip in November 2025 but a recovery by December. This could be indicative of seasonal trends or competitive dynamics in the market. Meanwhile, in the Beverage category, Aspire's entry into the rankings in December coincided with a moderate sales figure, which slightly decreased by January. The brand's performance in Ontario highlights the potential for growth in the Beverage category while solidifying its dominance in Capsules.

Competitive Landscape

In the Ontario cannabis capsules market, Aspire has consistently maintained its top position from October 2025 to January 2026, showcasing its strong brand presence and customer loyalty. Despite a slight dip in sales in November 2025, Aspire rebounded in December, reinforcing its dominance over competitors. Notably, Redecan has held steady at the second rank throughout this period, with sales figures significantly lower than Aspire's, indicating a clear market leader. Meanwhile, Glacial Gold improved its rank from fourth to third in January 2026, suggesting a positive growth trajectory, albeit still trailing behind Aspire's commanding lead. This competitive landscape highlights Aspire's robust market strategy and its ability to outperform other brands in the Ontario capsules category.

Notable Products

In January 2026, the top-performing product for Aspire was the Spark THC Moonrocks Capsules 50-Pack (500mg), maintaining its first-place ranking consistently from October 2025 through January 2026, with sales of 5783 units. Following closely, the SPARK THC Moonrocks Tablets 15-Pack (150mg) held steady in the second position throughout the same period. The Spark THC Moonrocks Live Rosin Reserve Capsules 30-Pack (300mg) also retained its third-place ranking, indicating stable consumer demand. The Spark THC Moonshot beverage remained in fourth place since November 2025, showing a slight decline in sales compared to December 2025. The CBD 100 Halo Capsules 30-Pack made a re-entry into the rankings at fifth place in January 2026, after not being ranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.