Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

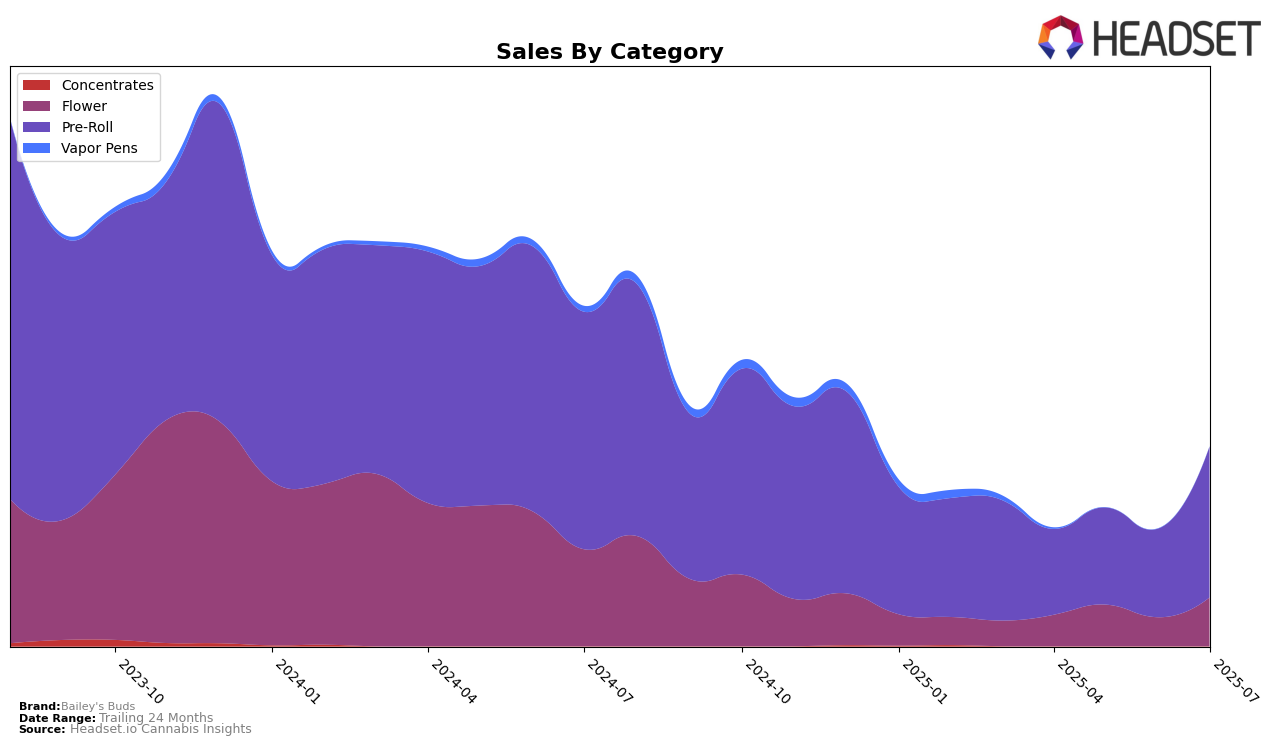

Bailey's Buds has shown distinct performance trends across different categories in Massachusetts. In the Flower category, the brand has not made it into the top 30 rankings from April to July 2025, which suggests either a competitive market or a potential area for growth. In contrast, the Pre-Roll category has seen more dynamic movements. Starting at rank 42 in April 2025, Bailey's Buds experienced a slight dip in May and June, reaching ranks 46 and 52, respectively, before a significant improvement in July, climbing to rank 27. This upward trajectory in the Pre-Roll category indicates a strengthening position, possibly due to strategic adjustments or increased consumer preference for their products.

The absence of Bailey's Buds from the top 30 in the Flower category throughout the observed months highlights a key area where the brand could enhance its market presence. Meanwhile, the Pre-Roll category's performance suggests a positive trend, with sales in July 2025 reaching 276,901, the highest in the observed period. This growth in the Pre-Roll segment could be a result of targeted marketing efforts or product innovations that resonate well with consumers in Massachusetts. Monitoring these categories closely could provide further insights into the brand's overall market strategy and potential areas for expansion or improvement.

Competitive Landscape

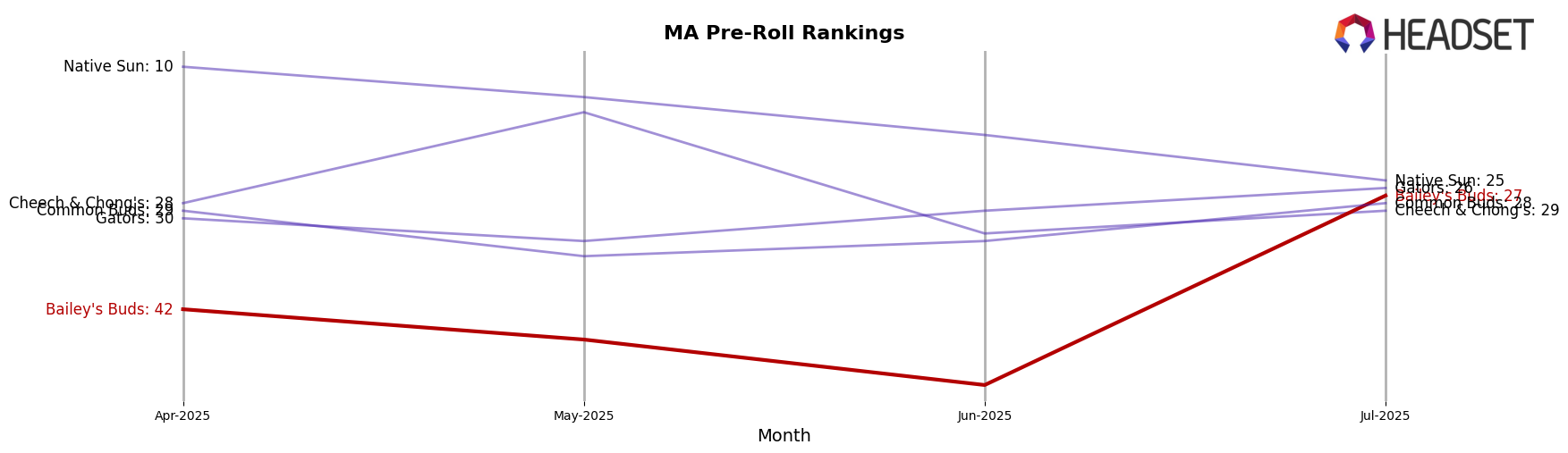

In the Massachusetts pre-roll category, Bailey's Buds has shown a significant upward trajectory in recent months, moving from a rank of 52 in June 2025 to 27 in July 2025. This improvement in rank suggests a notable increase in market presence, likely driven by a substantial rise in sales during this period. In comparison, Cheech & Chong's experienced fluctuating ranks, peaking at 16 in May before dropping to 29 in July, indicating volatility in their market performance. Meanwhile, Native Sun has seen a decline from a rank of 10 in April to 25 in July, reflecting a downward trend in sales. Common Buds and Gators have maintained relatively stable positions, with Gators slightly outperforming Common Buds by July. The competitive landscape suggests that Bailey's Buds is gaining momentum, potentially capitalizing on the declining trends of some competitors and the stability of others, positioning itself as a rising contender in the Massachusetts pre-roll market.

Notable Products

In July 2025, the Blue Dream x Sour Jack Pre-Roll 5-Pack (2.5g) reclaimed its top position in Bailey's Buds product lineup with a sales figure of 2554 units, marking a significant recovery from its third-place rank in June. The Blue Dream x Sour Jack Pre-Roll (0.5g) slipped to second place after leading in May, with consistent sales performance. Liberty Haze Pre-Roll 5-Pack (2.5g) made a notable entry into the rankings, securing the third spot, indicating a strong market reception. Waiting Game Pre-Roll 5-Pack (2.5g) debuted at fourth, showcasing potential growth in the Pre-Roll category. Finally, Blue Dream x Sour Jack (3.5g) entered the rankings at fifth, suggesting increasing interest in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.