Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

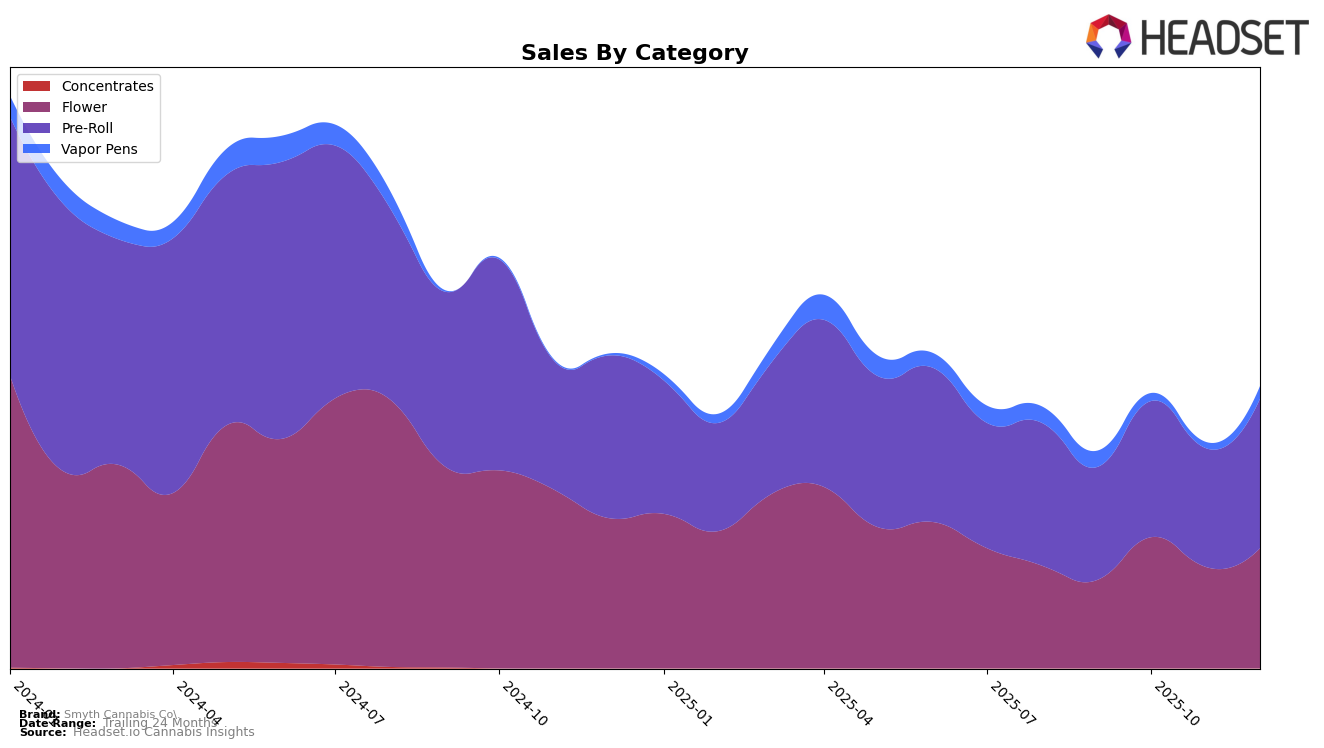

Smyth Cannabis Co. has shown varying performance across different product categories in Massachusetts. In the Flower category, the brand experienced fluctuations in its rankings, moving from 75th in September 2025 to 60th by December 2025. This indicates a positive trend despite a dip in November. The sales figures reflect this upward trajectory, with a notable increase from September to October. However, the Vapor Pens category presents a different story, where Smyth Cannabis Co. was ranked 92nd in September but did not make it into the top 30 for October or November, before reappearing at 100th in December. This suggests challenges in maintaining a strong presence in the Vapor Pens market.

The Pre-Roll category stands out as a strong performer for Smyth Cannabis Co. in Massachusetts, with consistent improvement in rankings from 41st in September to 28th in December. This steady climb indicates growing consumer preference for Smyth's Pre-Roll products, supported by a significant increase in sales from October to December. The consistent presence and improvement in this category suggest that Pre-Rolls could be a strategic focus area for the brand moving forward. Overall, while there are areas of concern, particularly in Vapor Pens, the brand's performance in Pre-Rolls and its recovery in the Flower category highlight potential growth opportunities within the Massachusetts market.

Competitive Landscape

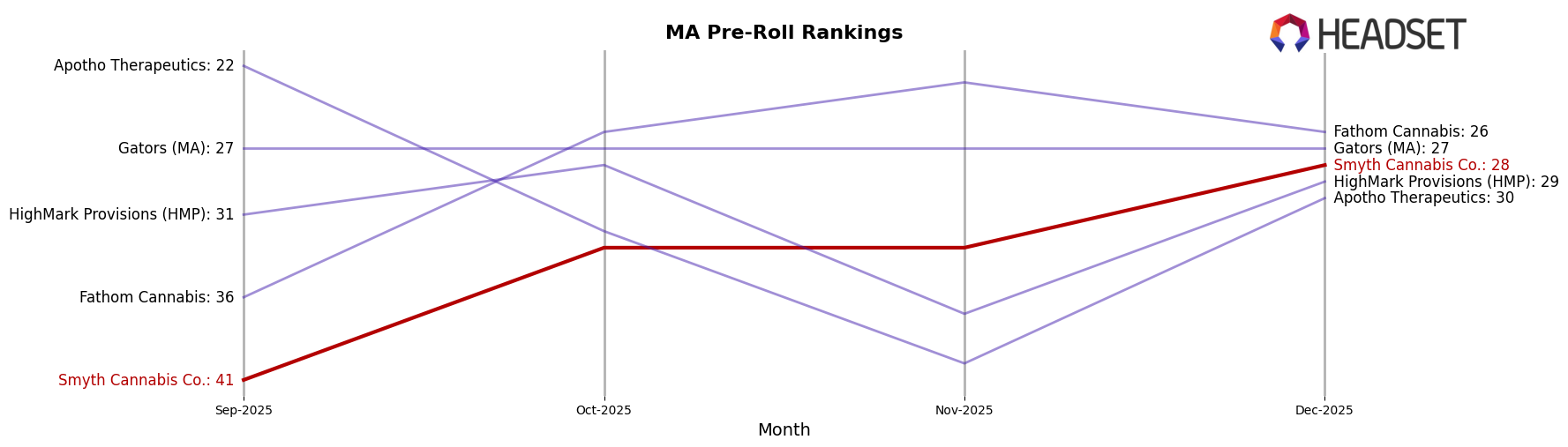

In the competitive landscape of the Massachusetts pre-roll category, Smyth Cannabis Co. has shown a promising upward trajectory in the rankings from September to December 2025. Starting at rank 41 in September, Smyth Cannabis Co. improved to rank 28 by December, indicating a positive trend in market presence. This advancement is noteworthy, especially when compared to competitors like Fathom Cannabis, which maintained a stronger position throughout the period, peaking at rank 23 in November. Meanwhile, HighMark Provisions (HMP) experienced fluctuations, ending December at rank 29, just behind Smyth Cannabis Co. Despite Gators (MA) maintaining a consistent rank of 27, their sales were notably higher, suggesting a stable customer base. The dynamic shifts in rankings and sales among these brands highlight the competitive nature of the Massachusetts pre-roll market and underscore the importance for Smyth Cannabis Co. to continue its momentum to capture a larger market share.

Notable Products

In December 2025, Pinky's Advice Pre-Roll (0.8g) emerged as the top-performing product for Smyth Cannabis Co., climbing to the first rank with impressive sales of 6349 units. Ghost Train Haze Pre-Roll (1g) maintained a strong position, ranking second, although it dropped from its top position in November. Soap Pre-Roll (1g) saw a slight decline, moving to third place from its previous first-place ranking in October. Miracle Mints Pre-Roll (1g) experienced a significant drop to fourth place, despite having been second in November. Fortissimo Pre-Roll (1g) entered the rankings in December, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.