Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

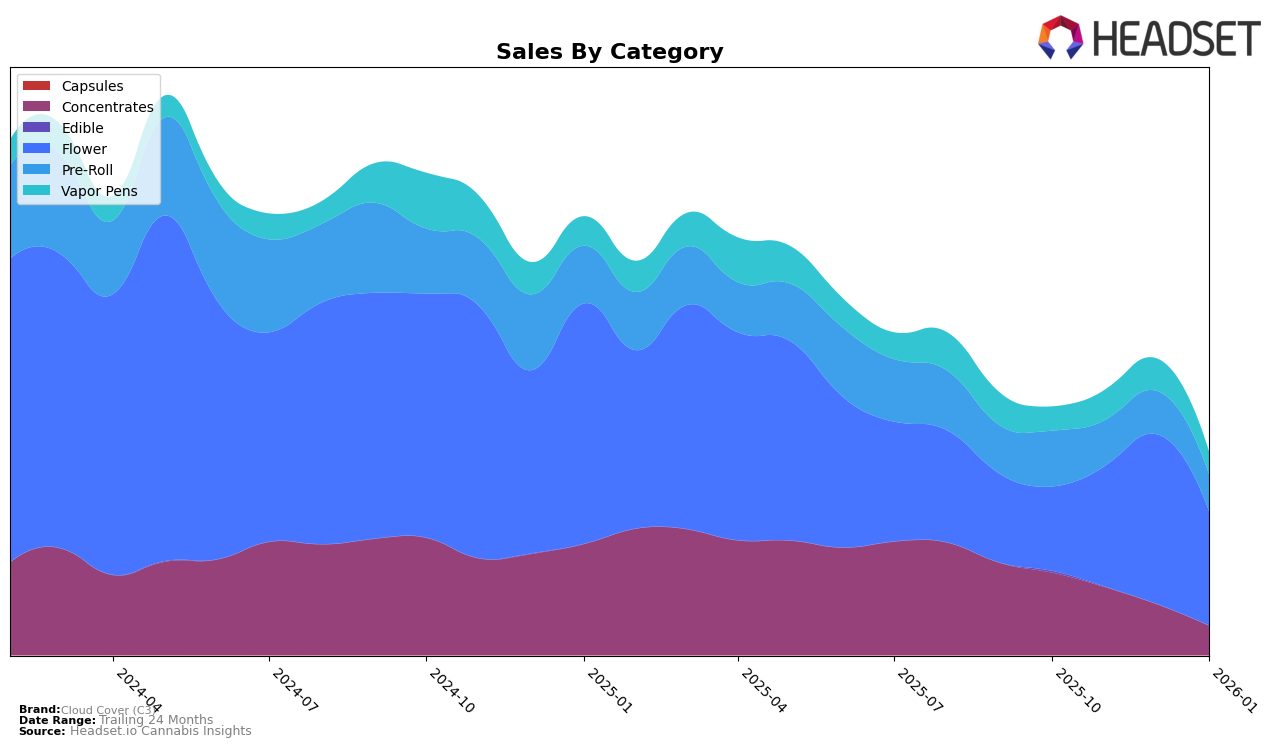

Cloud Cover (C3) has demonstrated a varied performance across different states and product categories. In Massachusetts, the brand has shown resilience in the Concentrates category, maintaining a steady position within the top 30, despite a decline in sales from October to January. The Flower category, however, tells a different story, where C3's ranking fluctuated significantly, peaking at 54th in November before falling to 65th by January. This inconsistency in performance could indicate challenges in maintaining a competitive edge in a saturated market. Meanwhile, in the Vapor Pens category, C3 was absent from the top 30 in October, but managed to gain a foothold by November, suggesting a positive trajectory in consumer interest.

In Michigan, Cloud Cover (C3) experienced a noteworthy rise in the Concentrates category, climbing from 56th in November to 39th by January, which aligns with a notable increase in sales. This upward movement indicates a growing consumer preference for their products in this segment. The Flower category presented a different scenario, with C3 entering the top 100 in November and achieving a high of 39th in December, only to fall again to 82nd in January. This fluctuation suggests potential volatility in market demand or supply issues. In Missouri, C3's performance in the Pre-Roll category saw a decline from 29th in October to 54th by January, reflecting a downward trend in consumer preference or market competition pressures.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Cloud Cover (C3) has shown significant fluctuations in its market position from October 2025 to January 2026. Starting outside the top 20 in October, Cloud Cover (C3) made an impressive leap to rank 98th in November, further climbing to 39th in December before dropping to 82nd in January. This volatility highlights the brand's potential for rapid growth, as evidenced by its December peak, but also underscores challenges in maintaining consistent performance. Comparatively, Zips maintained a more stable presence, consistently ranking between 55th and 62nd, which suggests a steady consumer base and potentially more predictable sales. Meanwhile, Sapphire Farms experienced a decline from 39th in November to 89th in January, indicating potential market challenges. Mitten Extracts and True Health also faced ranking variability, with Mitten Extracts missing the top 20 in October and December, and True Health entering the list in December. These dynamics suggest that while Cloud Cover (C3) has shown potential for growth, it operates in a highly competitive market where maintaining rank and sales requires strategic agility.

Notable Products

In January 2026, the top-performing product for Cloud Cover (C3) was the Premium Blue Dream Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from December 2025 with sales of 2,937 units. The Super Boof Pre-Roll (1g) climbed back to the second position after being absent from the rankings in December. Super Boof (3.5g) emerged in the third spot in the Flower category with notable sales of 2,095 units. Slurricane Terp Sugar (1g) appeared in fourth place in the Concentrates category, showing a strong debut. Lastly, Old Dirty Biker (3.5g) secured the fifth position in the Flower category, indicating a robust entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.