Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

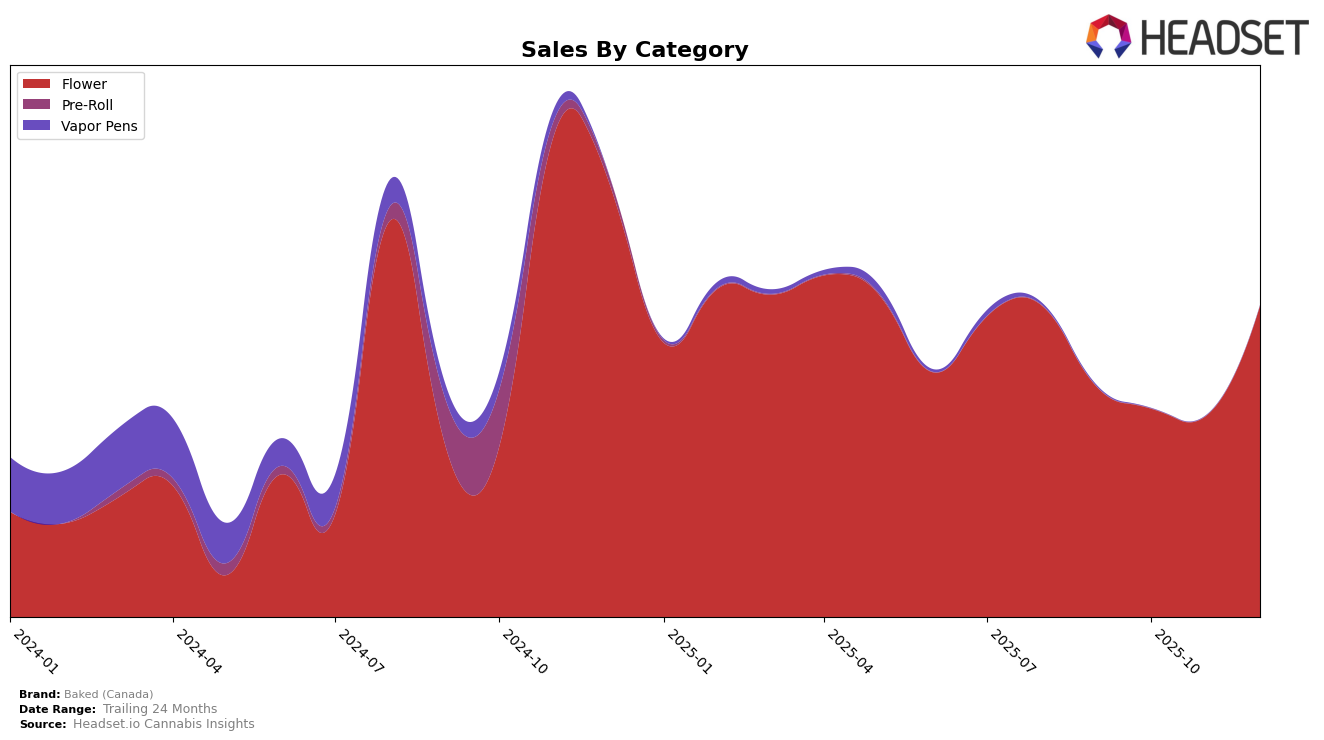

Baked (Canada) has experienced some interesting shifts in its performance across various categories and provinces. In the Flower category in Alberta, the brand demonstrated a noteworthy comeback towards the end of 2025. After slipping out of the top 30 in September, October, and November, Baked (Canada) made a significant leap back to the 27th position by December. This resurgence is underscored by a marked increase in sales, jumping from CAD 157,360 in November to CAD 243,277 in December, indicating a strong finish for the year.

However, the brand's absence from the top 30 rankings in the Flower category for three consecutive months prior to December suggests potential challenges or heightened competition in the Alberta market. This could imply either a temporary dip in popularity or strategic shifts within the company that took time to manifest positively. The fluctuations in Baked (Canada)'s ranking highlight the dynamic nature of the cannabis industry, where brands must continuously adapt to maintain or improve their market position. Observing these trends can provide valuable insights into the brand's strategy and market conditions, offering a glimpse into the competitive landscape in Alberta.

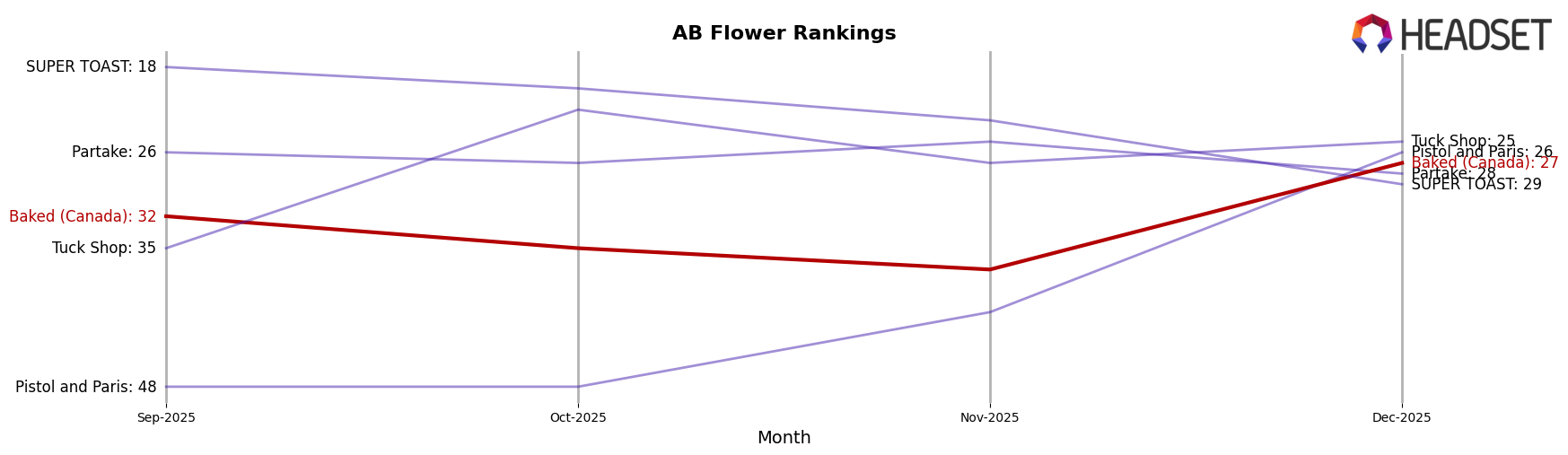

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Baked (Canada) has experienced notable fluctuations in its ranking over the last few months. Starting from a rank of 32 in September 2025, Baked (Canada) saw a decline to 37 by November, before rebounding to 27 in December. This recovery in December is significant, especially as it coincides with a substantial increase in sales, suggesting a positive reception to potential strategic changes or product offerings. In contrast, Pistol and Paris demonstrated a remarkable upward trend, climbing from a rank of 48 in September to 26 in December, indicating a strong market presence and growing consumer preference. Meanwhile, Partake and SUPER TOAST maintained relatively stable positions, with Partake hovering around the mid-20s and SUPER TOAST experiencing a slight decline from 18 to 29. Tuck Shop showed a significant rise in October but settled at 25 by December. These dynamics highlight the competitive pressures Baked (Canada) faces, emphasizing the need for strategic marketing and product differentiation to sustain and improve its market position.

Notable Products

In December 2025, the top-performing product for Baked (Canada) was PSC (28g) in the Flower category, maintaining its number one rank for four consecutive months. Notably, PSC (28g) experienced a significant sales increase, reaching 1297 units in December, compared to 848 units in November. This performance underscores its continued dominance in the market. The Pineapple Upside Down Terp Cartridge (1g) from the Vapor Pens category did not feature in the top rankings for December, indicating a shift in consumer preference or availability. Overall, the data highlights PSC (28g) as a consistently strong performer with a marked improvement in sales as the year closed.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.