Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

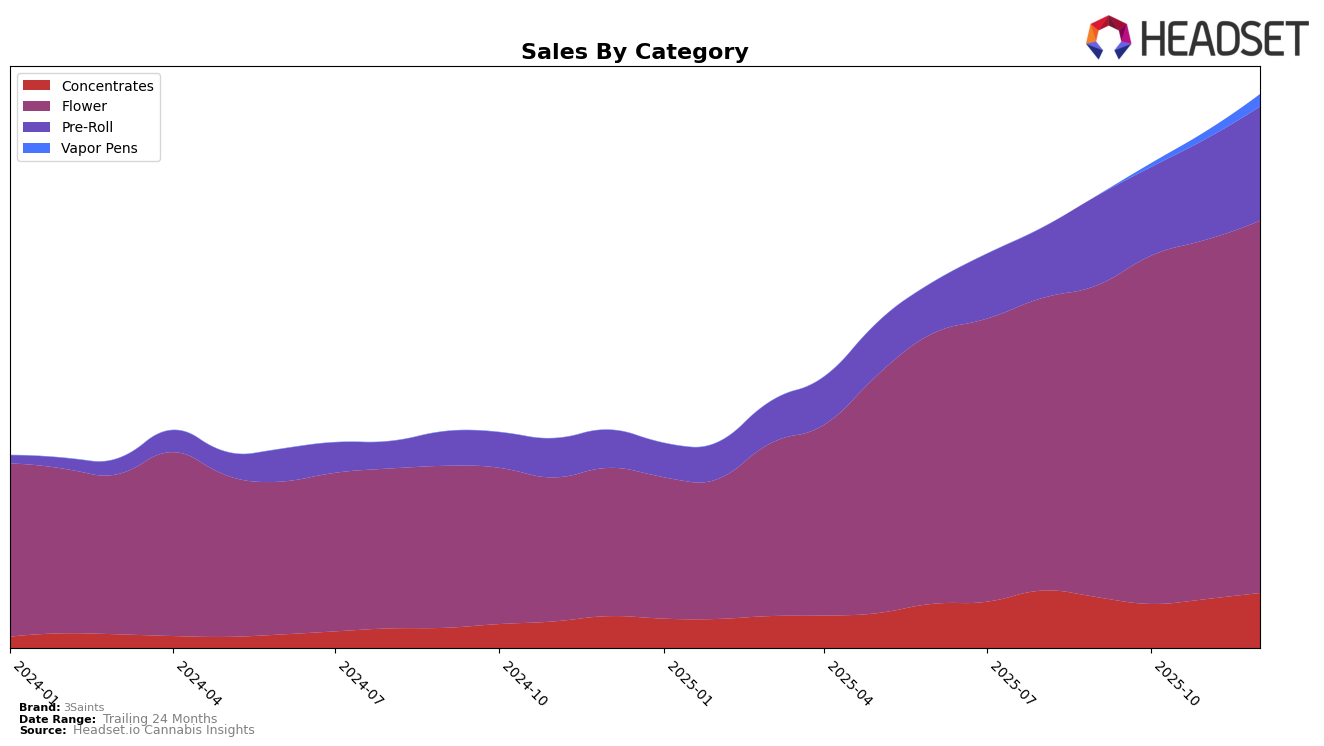

3Saints has demonstrated a stable performance in the Alberta concentrates market, consistently maintaining a rank of 5th from September to December 2025. This consistency is complemented by an upward trend in sales, culminating in a notable increase from September to December. In the flower category within the same province, 3Saints showed a slight fluctuation, moving from 9th to 8th and back to 9th by December, yet their sales figures reveal a robust growth trajectory, indicating a strengthening market presence. Interestingly, in the pre-roll category, the brand made a significant leap into the top 50 by December, suggesting a growing consumer interest in their pre-roll offerings.

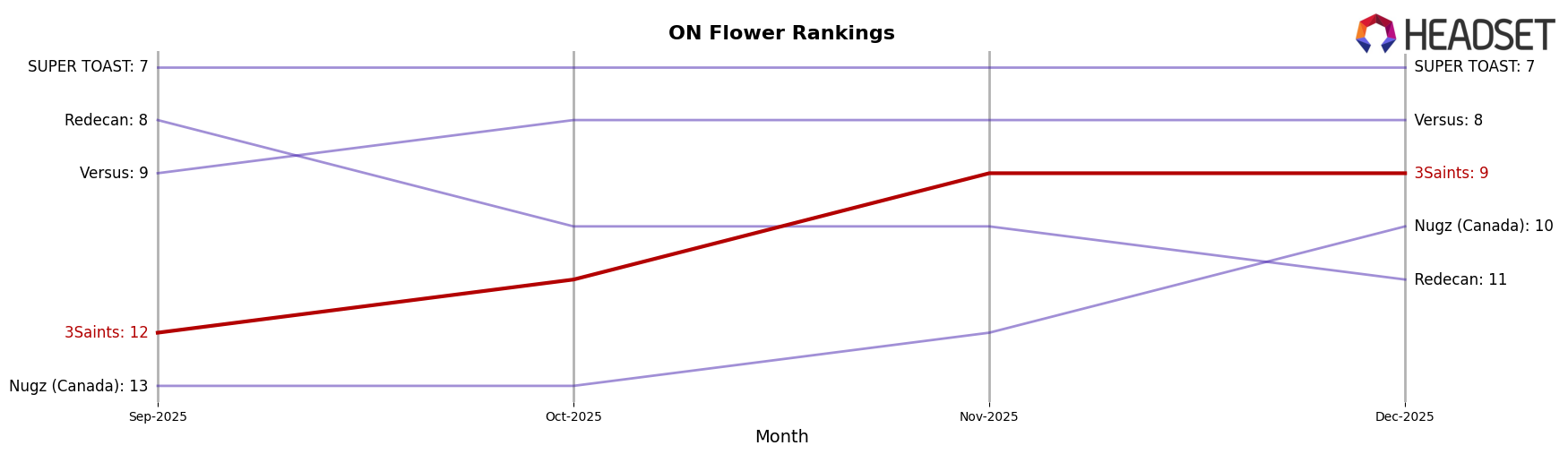

In Ontario, 3Saints has shown a positive trajectory in the flower category, improving its rank from 12th in September to 9th by November and maintaining that position through December. This upward movement is mirrored in their sales figures, which showed a steady increase. The concentrates category in Ontario also saw some fluctuation, with the brand moving from 12th to 16th and then back up to 13th by December, indicating a competitive landscape. Meanwhile, in British Columbia, 3Saints experienced a brief absence from the top 30 flower brands in October but rebounded to 29th place by November and December, reflecting a recovery in market engagement. In Saskatchewan, 3Saints was notably absent from the top 30 flower brands in September and November, but their re-entry at 22nd place in December suggests a potential for future growth.

Competitive Landscape

In the competitive Ontario flower market, 3Saints has shown a promising upward trajectory, moving from the 12th position in September 2025 to a consistent 9th place by November and December 2025. This improvement in rank is indicative of a positive trend in sales, with December figures surpassing those of September, suggesting a growing consumer preference for 3Saints products. In contrast, Redecan experienced a decline, dropping from 8th in September to 11th by December, reflecting a decrease in sales over the same period. Meanwhile, Nugz (Canada) saw a slight improvement, climbing from 13th to 10th, though still trailing behind 3Saints. Versus maintained a steady 8th position, while SUPER TOAST consistently held the 7th spot throughout these months. The data highlights 3Saints' successful strategy in gaining market share, positioning it as a rising contender in the Ontario flower category.

Notable Products

In December 2025, the top-performing product for 3Saints was Kush Cookies (3.5g) in the Flower category, maintaining its position as the number one seller since September, with sales reaching 26,996 units. Crumbled Lime Pre-Roll (0.5g) rose to second place, overtaking Kush Cookies Pre-Roll (0.5g), which dropped to third. Black Afghan Hash (2g) consistently held the fourth position across all months reviewed. Strawberry Cheezequake Pre-Roll 4-Pack (2g) remained fifth, showing a steady increase in sales but not enough to change its rank. The rankings indicate a stable preference for these products, with minor shifts in the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.