Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

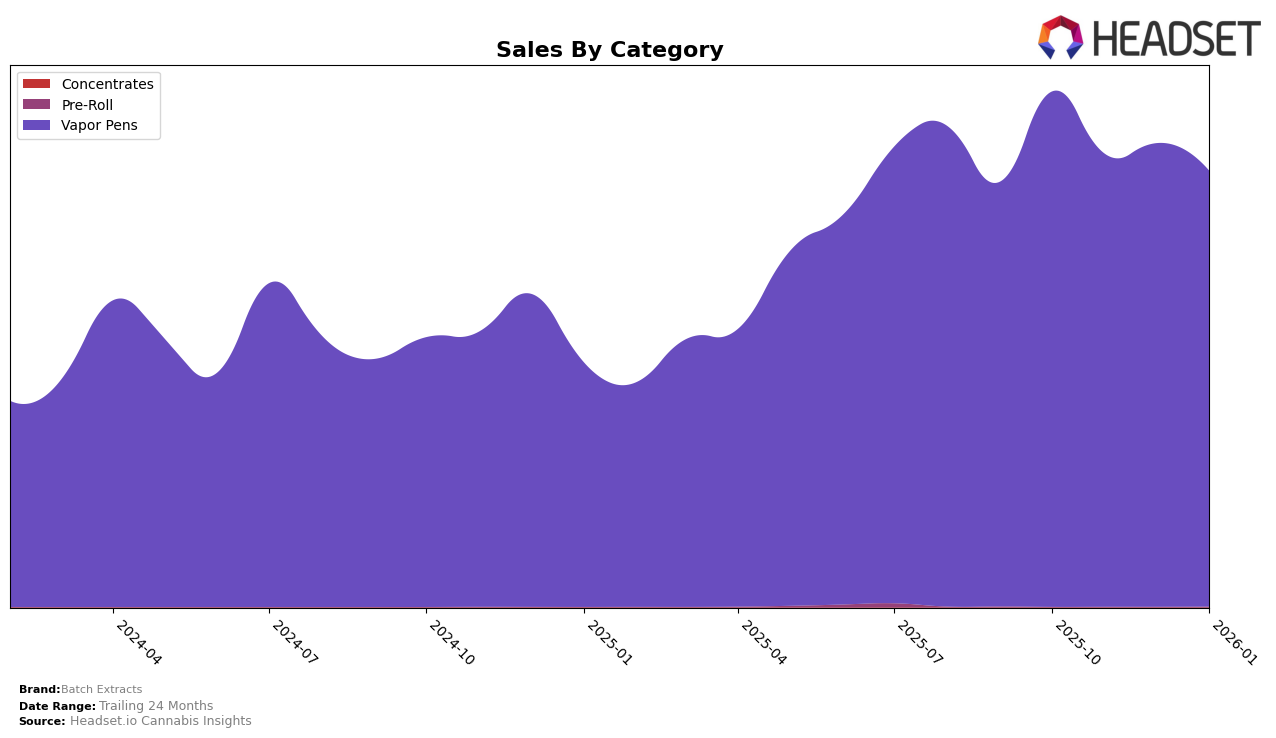

Batch Extracts has demonstrated consistent performance within the vapor pen category across several states, maintaining a strong foothold in the market. Notably, in Colorado, the brand has secured and maintained the 4th position for four consecutive months, indicating a stable demand and brand loyalty among consumers. In contrast, the brand's presence in Illinois shows a positive trajectory, as it climbed from the 54th position in October to the 38th by January, highlighting a significant improvement in market penetration. This upward movement in Illinois is particularly noteworthy given the competitive nature of the market, suggesting effective strategies in place to capture consumer interest.

Meanwhile, Batch Extracts' performance in Michigan has been less stable, with the brand dropping from 18th to 26th in the rankings over the observed period. This decline may point to increased competition or shifting consumer preferences, posing a potential challenge for the brand. On the other hand, in Missouri, the brand has shown resilience, improving its rank from 16th to 14th in January, despite a decrease in sales figures. This suggests that while sales volume may fluctuate, the brand's market position remains relatively secure. Such insights into regional performance can provide valuable perspectives for stakeholders looking to understand the dynamics of Batch Extracts' market presence.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Batch Extracts has consistently maintained its position at rank 4 from October 2025 to January 2026, indicating a stable presence in the market. Despite a dip in sales from November to January, Batch Extracts has managed to hold its ground against competitors like PAX, which has consistently ranked 3rd, and Spherex, which fluctuated between 1st and 2nd place. Notably, Jetty Extracts showed a significant upward trend, moving from 9th to 5th place, which could pose a potential threat if this momentum continues. Meanwhile, Craft / Craft 710 remained stable but saw a slight drop from 5th to 6th place in January. Batch Extracts' ability to maintain its rank amidst fluctuating sales and competitive shifts highlights its resilience and potential for strategic growth in the vapor pen category.

Notable Products

In January 2026, the top-performing product from Batch Extracts was Signature - Maui Wowie Distillate Disposable (2g) in the Vapor Pens category, maintaining its number one rank from November 2025, with a notable sales figure of 4341 units. Dazzleberry Distillate Cartridge (1g), also in the Vapor Pens category, held the second position, a slight improvement from its third-place ranking in December. Shwazzberry Distillate Cartridge (1g) ranked third, showing a consistent presence in the top three over the previous months. Goodness Grapecious Distillate Cartridge (1g) moved down to the fourth position from its third-place performance in December. The Sativa Distillate Disposable (2g) entered the rankings at fifth place, marking its debut in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.