Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

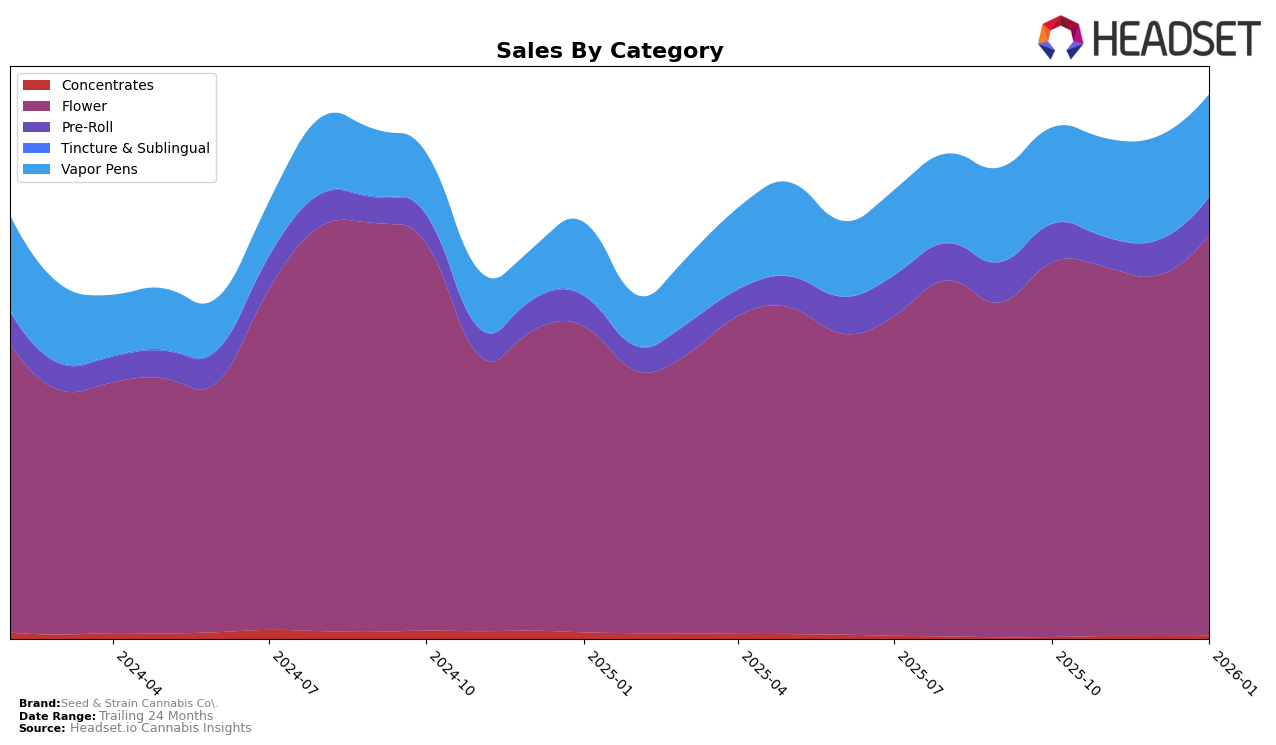

Seed & Strain Cannabis Co. has demonstrated a strong performance in the Colorado market, particularly in the Flower category where it consistently held the top rank from October 2025 to January 2026. This sustained leadership position is indicative of their robust market presence and consumer preference in this category. In the Pre-Roll category, the brand showed improvement, moving from 6th to 4th place by December 2025 and maintaining that position into January 2026. However, their performance in Vapor Pens has been stable, holding the 9th position from November 2025 onwards. This stability across categories in Colorado highlights a well-rounded product portfolio, though there may be room for growth in the Vapor Pens category.

In contrast, the performance of Seed & Strain Cannabis Co. in other states shows a mixed picture. In Illinois, the brand's ranking in the Flower category has slipped slightly from 31st to 35th by January 2026, indicating challenges in maintaining market share. Meanwhile, in New Jersey, the brand experienced a decline in the Flower category, dropping from 8th to 12th place, though their Vapor Pens saw modest improvement, climbing from 20th to 18th place. In Ohio, the brand has shown impressive growth in the Flower category, moving up to 2nd place by January 2026, while also improving their rank in Vapor Pens from 11th to 9th. The absence of rankings in Maryland since December 2025 suggests a withdrawal or a significant drop in market presence, which could be a point of concern.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Seed & Strain Cannabis Co. has consistently maintained its top position from October 2025 through January 2026. This steady leadership is noteworthy, especially when compared to its closest competitors. Good Chemistry Nurseries has held the second rank throughout the same period, while Triple Seven (777) fluctuated slightly, dropping to fourth place in December 2025 before recovering to third in January 2026. Despite these fluctuations, Seed & Strain Cannabis Co. has not only retained its number one ranking but also demonstrated a robust upward trend in sales, peaking significantly in January 2026. This indicates a strong market presence and consumer preference, positioning Seed & Strain Cannabis Co. as a dominant force in the Colorado flower market.

Notable Products

In January 2026, the top-performing product from Seed & Strain Cannabis Co. was the Kiwi Berry Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from the previous two months with impressive sales of 8,280 units. The Cannalope Haze Distillate Cartridge (1g) also held steady at the second position, showing consistent performance with sales increasing to 7,575 units. Cherry Pie Distillate Cartridge (1g) remained in third place, while the Ghost Train Distillate Disposable (1g) emerged as a new entry at the fourth rank. The Peking Duck Pre-Roll (1g) debuted in the rankings at fifth place, indicating a strong market entrance. Overall, the Vapor Pens category continued to dominate the rankings, reflecting a sustained consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.