Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

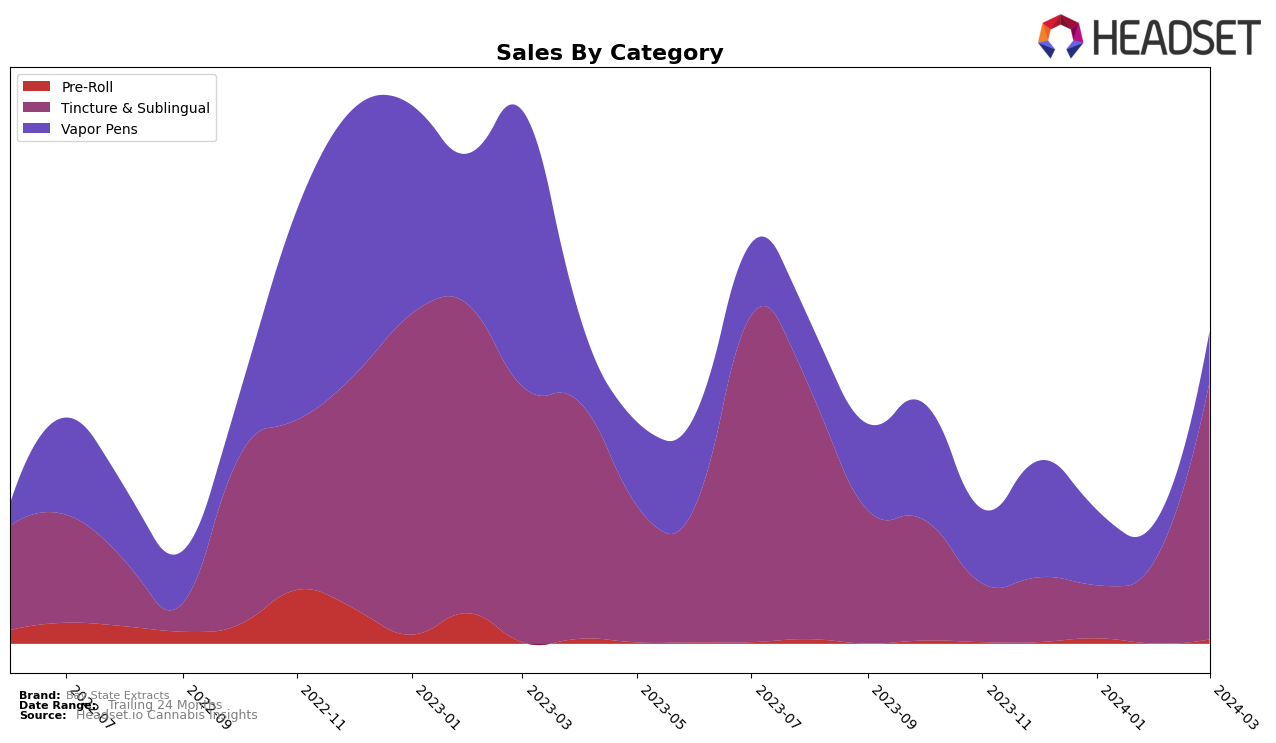

In the competitive landscape of the Massachusetts cannabis market, Bay State Extracts has shown a noteworthy performance in the Tincture & Sublingual category. Beginning in December 2023, the brand was ranked 14th, maintaining this position into January 2024 before experiencing a positive shift upwards to 12th in February and further climbing to 9th by March 2024. This upward trajectory in rankings within a short span indicates a growing consumer preference and increased market penetration for Bay State Extracts in this category. The significant sales jump from 2206 units in February to 6811 units in March underscores this trend, highlighting a robust growth in demand for their Tincture & Sublingual products in the Massachusetts market.

However, it's important to note the absence of Bay State Extracts from the top 30 brands in other categories and states or provinces, which could be viewed as an area for expansion or improvement. The consistent ranking within the top 20 for Tincture & Sublinguals in Massachusetts from December 2023 to March 2024, culminating in a top 10 position, showcases the brand's solid footing in this specific market segment. This performance could serve as a strategic foundation for Bay State Extracts to leverage for growth into other categories or geographical areas. The detailed analysis of their sales and ranking progression, particularly the impressive leap in March, suggests a focused and possibly expanding consumer base, which could be pivotal for future developments and strategies for Bay State Extracts.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category within Massachusetts, Bay State Extracts has shown a notable upward trajectory in its rank and sales from December 2023 through March 2024. Starting at 14th position in December, it climbed to 9th by March, indicating a positive reception in the market. Its competitors, such as Nira+ Medicinals, Gibby's Garden, and The Healing Rose (THR), have also experienced fluctuations in their rankings, with The Healing Rose (THR) notably moving up to the 8th position by March, surpassing Bay State Extracts. However, Good Feels Inc has consistently held a higher rank and sales volume, maintaining a strong presence in the top tier of this category. This competitive analysis highlights the dynamic nature of the market, with Bay State Extracts demonstrating growth potential amidst stiff competition. The brand's upward movement in rank and sales suggests increasing consumer acceptance and market penetration, positioning it as a brand to watch in the evolving Massachusetts cannabis market.

Notable Products

In March 2024, Bay State Extracts saw the "Trifecta - CBD/CBG/CBN 2:1:1 Relax Oil Tincture Drops" lead their sales with 73 units, marking it as the top-selling product in the Tincture & Sublingual category and overall. Following closely, the "Trifecta - CBN/CBC/CBG 2:1:1 Blackout Oil Tincture Drops" secured the second position with a notable rise from the fifth position in January to second in March. The "Trifecta - THCV/CBG/CBD 4:3:1 Focus Distillate Cartridge" was the third best-selling product, despite a slight dip in its ranking from being the top product in December and January to third in March. Noteworthy is the consistent performance of the "Trifecta - CBN/CBC/CBD 2:1:1 Blackout Distillate Cartridge," which maintained its fourth position without any sales data from December to February, indicating a strong market return in March. These shifts highlight a dynamic consumer preference within Bay State Extracts' offerings, with a particular interest in diversified cannabinoid formulations.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.