Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

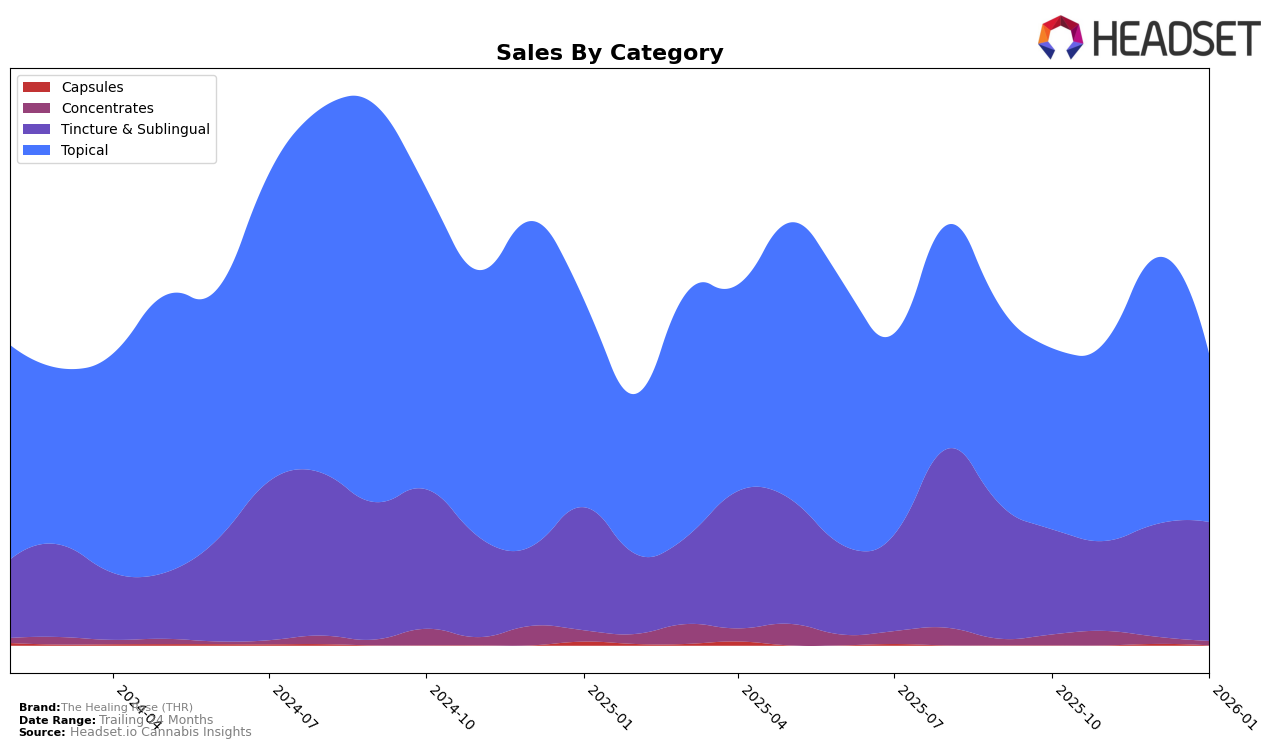

The Healing Rose (THR) has demonstrated notable progress in the topical category within the state of Massachusetts. In October 2025, THR was not ranked among the top 30 brands, which indicates that their presence in the market was relatively under the radar at that time. However, by November 2025, THR had climbed to the 6th position, and further improved to the 5th position by December 2025. This upward trajectory highlights a significant gain in market share and consumer interest over a short period. The absence of a ranking in January 2026 suggests a potential drop out of the top 30, which could be a point of concern if the trend continues without strategic adjustments.

Sales data from Massachusetts reveals an interesting pattern for The Healing Rose (THR). In November 2025, the brand's sales were recorded at $13,063, which marks a substantial increase from the previous month's sales. This surge in sales likely contributed to their improved ranking during that period. However, the lack of sales data for December 2025 and January 2026 leaves some questions unanswered about the brand's ongoing performance and market strategies. Observing these trends, it becomes crucial to keep an eye on how THR navigates potential challenges and capitalizes on opportunities to maintain or improve their standing in the competitive topical category.

Competitive Landscape

In the Massachusetts topical cannabis market, The Healing Rose (THR) has shown a notable upward trajectory in its rankings, moving from outside the top 20 in October 2025 to securing the 6th position by November and climbing further to 5th by December. This positive trend indicates a growing consumer preference for THR's offerings, potentially driven by increased brand recognition or product efficacy. In contrast, Doctor Solomon's experienced a decline from 3rd in October to 5th in November, before slightly recovering to 4th in December, suggesting potential volatility in consumer loyalty or competitive pressures. Meanwhile, Nordic Goddess maintained a relatively stable presence, fluctuating between 4th and 6th place over the same period. These dynamics highlight a competitive landscape where THR's strategic initiatives could be effectively capturing market share, positioning it as a formidable contender against established brands like Doctor Solomon's and Nordic Goddess.

Notable Products

In January 2026, The Healing Rose (THR) saw the CBD Mini 2X Orange Lavender With Chamomile Salve (50mg CBD, 0.25oz) regain the top spot as the best-selling product, with sales reaching 52 units. Following closely was the CBD Goddess Revival Bath Soak (100mg CBD, 4oz), which dropped to the second position after leading in December 2025. The CBD Grapefruit Eucalyptus Lip Balm (25mg CBD) debuted in third place, marking its first appearance in the rankings. The CBD Coconut Lip Balm (25mg CBD) maintained its position at fourth, consistent with its performance in previous months. Rounding out the top five, the CBD Goddess Revival Bath Soak (300mg CBD, 12oz) slipped to fourth place from its steady third position in the last quarter of 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.