Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

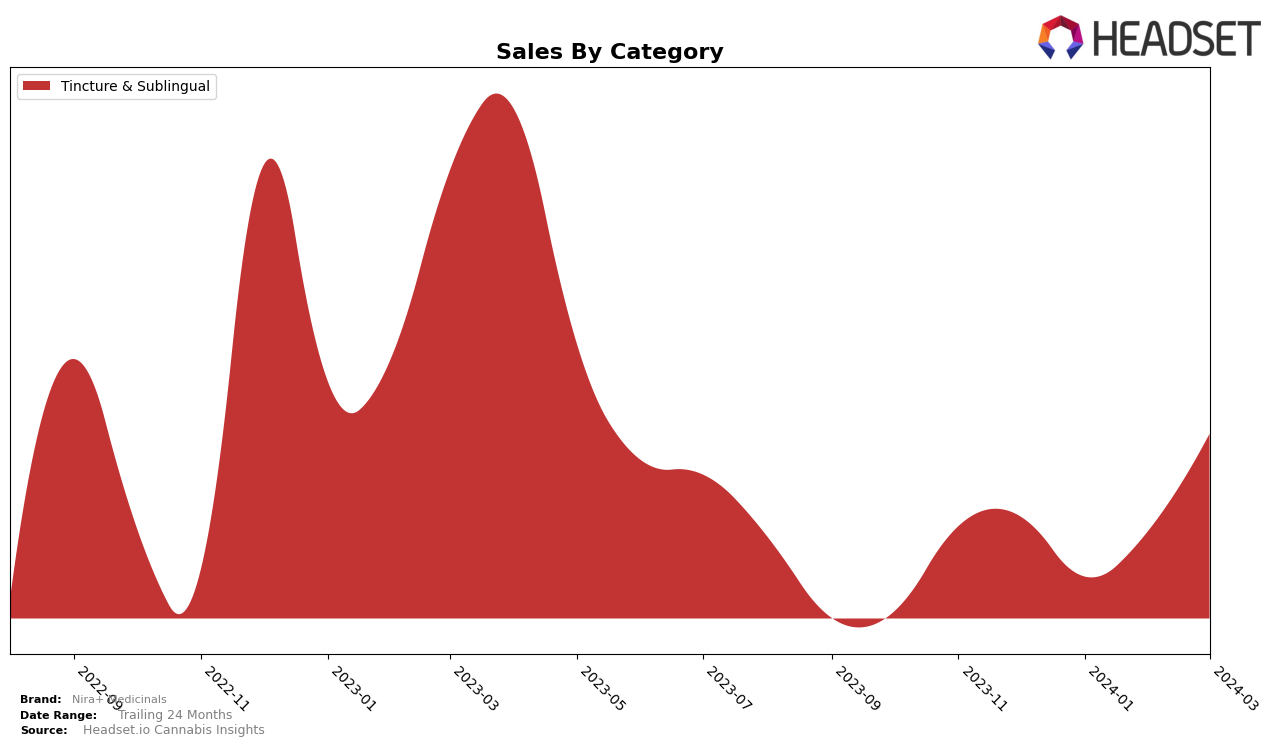

In the competitive landscape of tinctures and sublinguals within Massachusetts, Nira+ Medicinals has shown a notable performance trajectory over the recent months. Starting in December 2023 ranked 9th, the brand experienced a slight dip in January 2024, falling to the 13th position, which could be attributed to various market dynamics or internal challenges. However, it's important to note the resilience and recovery demonstrated as they climbed back up to the 11th spot in February and further improved to the 10th position by March 2024. This upward trend, especially in a highly competitive category such as Tincture & Sublingual, speaks volumes about the brand's strategic maneuvers and consumer acceptance. The sales figures, peaking in March with $5,340, underscore a successful rebound and growing consumer trust in Nira+ Medicinals' offerings in Massachusetts.

While the raw sales data and exact ranking positions provide a glimpse into the brand's performance, the movement across the months is particularly telling of Nira+ Medicinals' market dynamics in Massachusetts. The initial drop from the 9th to the 13th rank could be seen as a setback; however, the consecutive improvement in the following months highlights a positive response to possibly revised marketing strategies or product enhancements. The absence from the top 30 brands in any state or category would have been a significant concern, but Nira+ Medicinals maintained its presence within the competitive landscape, showcasing resilience and adaptability. The brand's journey through these fluctuations offers valuable insights into market strategies and consumer preferences, making it a subject of interest for industry observers and potential investors alike.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Massachusetts, Nira+ Medicinals has experienced a fluctuating position in terms of rank and sales over the recent months. Starting from December 2023, Nira+ Medicinals held the 9th position, but saw a decline to 13th in January 2024, before slightly recovering to 11th in February and improving further to 10th in March 2024. This trajectory indicates a volatile market position, with a notable rebound in sales from February to March. Competitors such as The Healing Rose (THR), which climbed from 16th to 8th place, and Bay State Extracts, moving up to 9th from 14th, demonstrate significant improvements in rank, suggesting a highly competitive environment. Gibby's Garden and INSA also show dynamic shifts in their rankings, indicating a market that is responsive to consumer preferences and brand performance. The data suggests that while Nira+ Medicinals is maintaining a presence within the top 10, the brand faces stiff competition from rising brands, which could influence its market strategy and sales performance moving forward.

Notable Products

In March 2024, Nira+ Medicinals saw Dream Tincture (300mg) leading the sales charts within its category, marking its position as the top-selling product with a significant sales figure of 73 units. Following closely behind was Uplift Tincture (300mg), securing the second spot in the rankings. Notably, both products have maintained their top positions from the previous month, although Dream Tincture (300mg) rose from second to first place, overtaking Uplift Tincture (300mg). This shift indicates a growing preference for Dream Tincture among consumers. The consistent high rankings of these products over the past few months highlight their strong presence and popularity within the Nira+ Medicinals lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.