Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

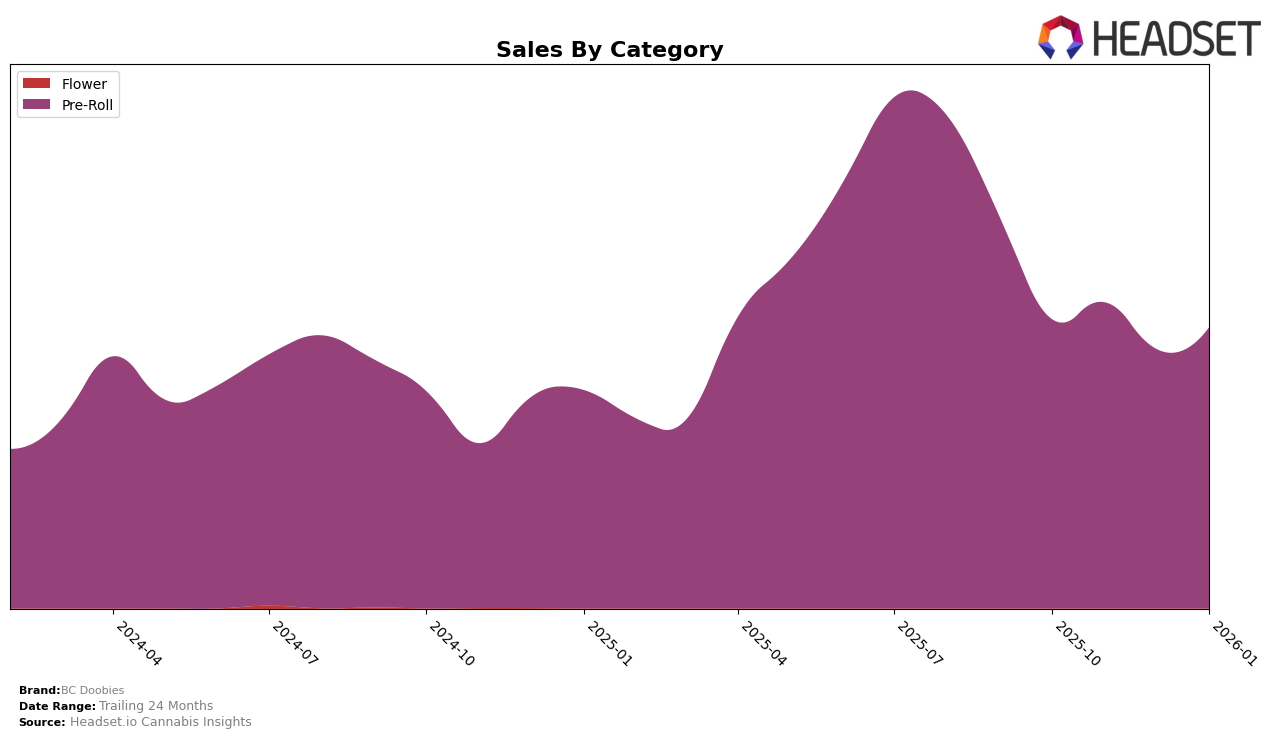

In British Columbia, BC Doobies has shown a notable performance in the Pre-Roll category. Starting from a strong position at rank 4 in October 2025, the brand experienced a decline to rank 16 by November but managed to climb back to rank 11 by January 2026. This movement indicates a resilient market presence and suggests that while there were fluctuations, the brand's strategies might be effectively addressing competitive pressures. The sales figures, which peaked in November, provide a glimpse into potential promotional activities or seasonal trends affecting consumer purchasing behavior.

Contrastingly, in Ontario, BC Doobies did not feature in the top 30 ranks for the Pre-Roll category throughout the observed months, with rankings hovering in the low 50s and 60s. This suggests a less competitive stance in this province, possibly due to stronger local competitors or differing consumer preferences. The steady decline in sales from October to January further underscores the challenges faced in this market. Understanding the factors contributing to this performance disparity between British Columbia and Ontario could be crucial for the brand's strategic adjustments moving forward.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, BC Doobies has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 4th in October 2025, BC Doobies saw a significant drop to 16th in November, before recovering to 14th in December and further improving to 11th by January 2026. This recovery is particularly noteworthy given the consistent performance of competitors like Shred, which maintained a steady climb from 11th to 9th place over the same period. Meanwhile, Valhalla Flwr experienced a decline from the top position in October to 10th by January, indicating a potential opportunity for BC Doobies to capture market share. Additionally, 1964 Supply Co showed a gradual ascent, moving from 15th to 12th, which could pose a competitive threat if BC Doobies does not continue its upward trajectory. The dynamic shifts in rankings highlight the competitive pressures in the market and underscore the importance of strategic positioning for BC Doobies to capitalize on its recent sales momentum.

Notable Products

In January 2026, the top-performing product for BC Doobies was Great White Shark Pre-Roll 3-Pack (1.5g) maintaining its leading position from the previous month. Brazilian Haze Pre-Roll 2-Pack (2g) climbed to second place, showing a significant increase in sales to 4928 units, up from its third-place ranking in December 2025. Tokyo Sunset Pre-Roll 3-Pack (1.5g) secured the third position, although it slipped from its peak in November 2025 when it was ranked first. Genghis Chron Pre-Roll 10-Pack (5g) remained consistent in the fourth spot, demonstrating stable sales over the months. Deep Fried Ice Cream Pre-Roll 2-Pack (2g) re-entered the top five, marking its presence at fifth place after missing the December 2025 rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.