Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

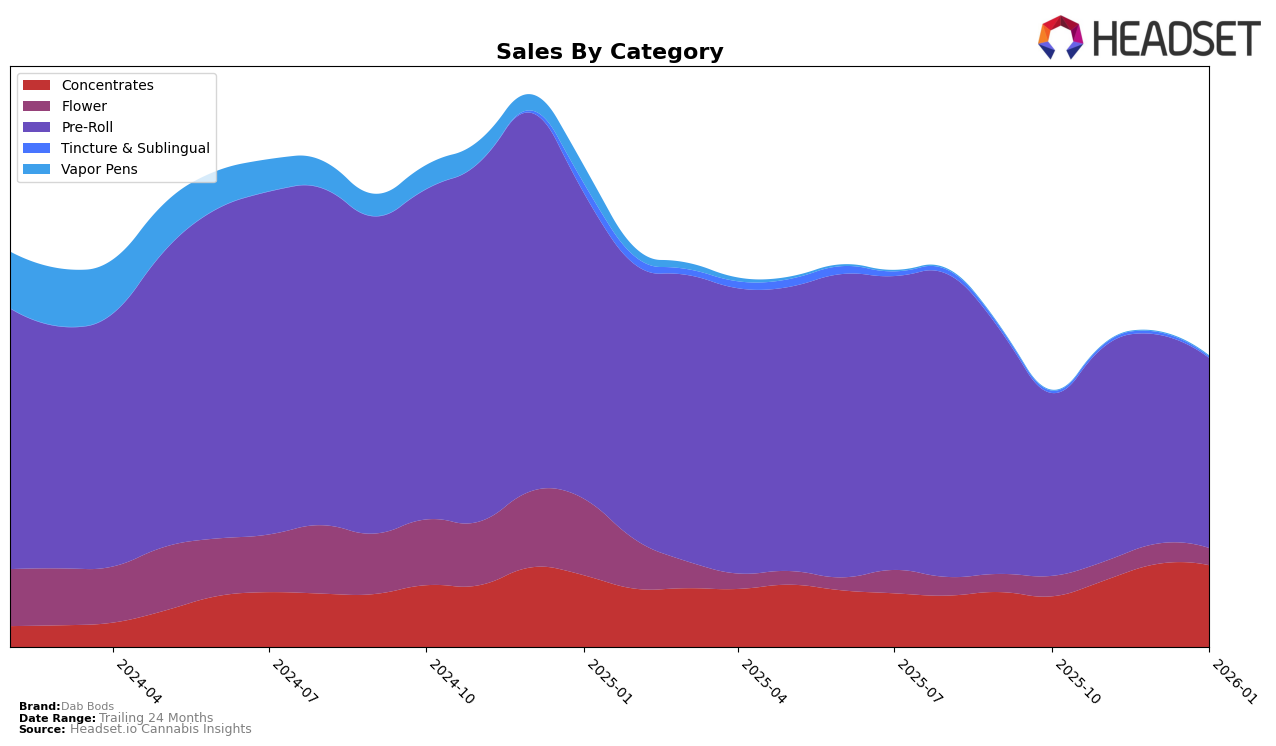

Dab Bods has shown a strong performance in the Concentrates category, particularly in Alberta, where they consistently held the second position in the rankings from December 2025 to January 2026. This upward momentum is notable, especially considering the significant increase in sales from November to December 2025. In contrast, their presence in the Concentrates category in British Columbia has been less dominant, as they were not even in the top 30 in October 2025, only breaking into the rankings at the tenth position in November 2025 and eventually reaching ninth by January 2026. This progression highlights a positive trend, though there's still room for growth to match their performance in Alberta.

In the Pre-Roll category, Dab Bods has experienced varied success across provinces. In Alberta, they have maintained a steady presence within the top 15, fluctuating slightly but showing resilience by moving from the eleventh to the tenth position by January 2026. Meanwhile, in British Columbia, the brand made a significant leap from being outside the top 30 in October 2025 to consistently holding the seventeenth and eighteenth ranks in the subsequent months. In Ontario, however, the brand's performance in Pre-Rolls has been relatively stable, hovering around the 28th and 29th positions, indicating a need for strategic adjustments to enhance their competitive edge in this region.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Dab Bods has experienced notable fluctuations in its ranking over the past few months. Starting at 9th place in October 2025, Dab Bods saw a dip to 11th in both November and December, before slightly recovering to 10th in January 2026. This movement indicates a competitive pressure from brands like Weed Me, which maintained a consistent presence in the top 10, and Good Supply, which held a steady 8th position throughout the period. Despite these challenges, Dab Bods' ability to reclaim a spot in the top 10 by January suggests resilience and potential for growth. However, the brand must strategize effectively to counteract the sales decline observed from October to January, as competitors like 1964 Supply Co and Shred continue to vie for market share in this dynamic sector.

Notable Products

In January 2026, the top-performing product from Dab Bods was Fuzzy Peach 2.0 Shatter (1g) in the Concentrates category, maintaining its number one rank from the previous two months with sales reaching 6125 units. The 60s- Blue Lobster Double Infused Pre-Roll 3-Pack (1.5g) climbed to the second position, improving from third place in the previous month with sales of 5483 units. Electric Dartz - Pineapple Express Pre-Roll 10-Pack (4g) secured the third spot, showing a consistent upward trend from fifth place in December 2025. The 50's - Pink GOAT Infused Pre-Roll 3-Pack (1.5g) dropped to fourth place from its second-place ranking in December. Widows Blood Distillate Infused Pre-Roll 3-Pack (1.5g) emerged in the rankings for the first time, taking the fifth position with notable sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.