Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

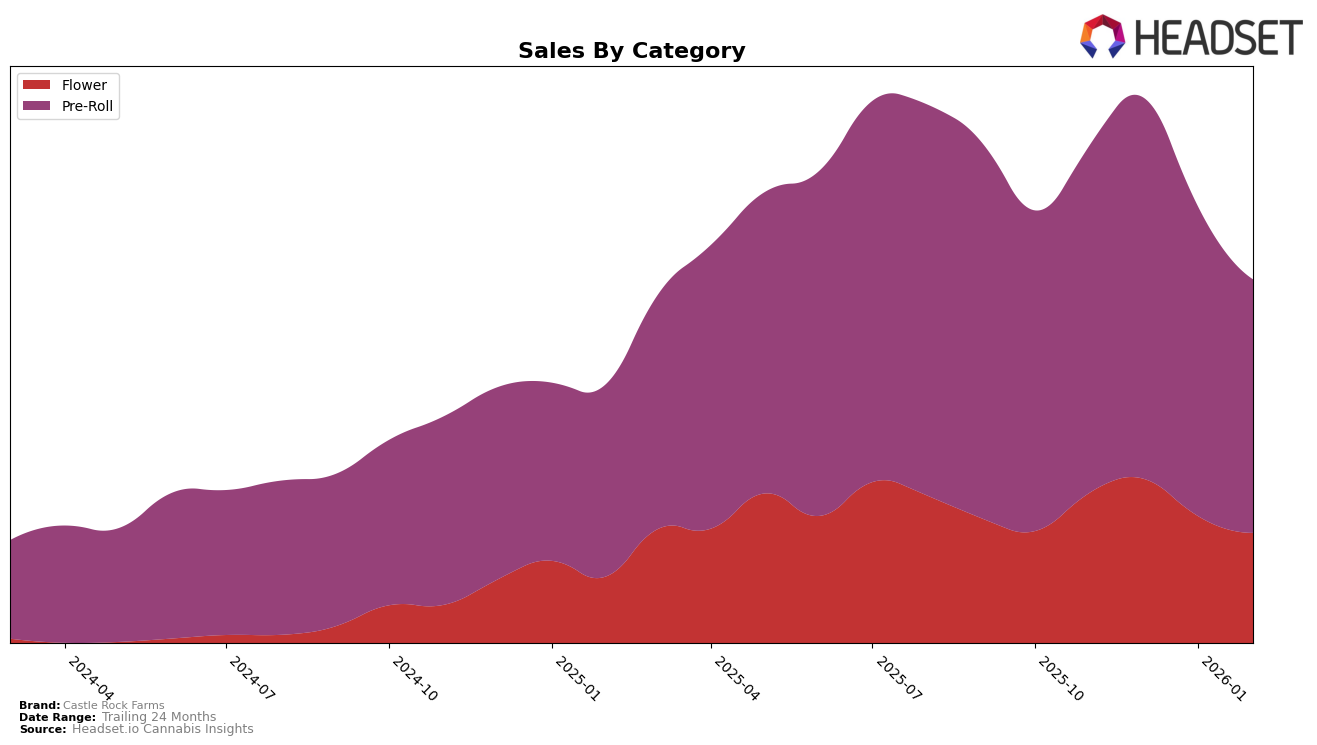

Castle Rock Farms has demonstrated varied performance across different categories and regions. In Alberta, their standing in the Flower category remained stable from November to February, maintaining a rank of 9th in the first two months before slipping to 11th. This drop coincides with a decrease in sales, indicating potential challenges in maintaining market share. However, their performance in the Pre-Roll category remains robust, holding a strong position among the top 4 brands consistently, despite a notable dip in sales from December to February. This suggests that while Flower sales have softened, the Pre-Roll segment remains a key strength for Castle Rock Farms in this province.

In British Columbia, Castle Rock Farms' performance in the Flower category has been less consistent, with rankings fluctuating from 72nd to 39th and back to 61st by February. This indicates a volatile presence in the Flower market, potentially influenced by competitive pressures or changes in consumer preferences. Conversely, their Pre-Roll category rankings have shown more stability, improving from 24th to 16th before a slight dip to 17th. In Ontario, the brand has seen a gradual improvement in the Flower category, climbing from 59th to 41st, suggesting a strengthening foothold. However, the Pre-Roll category tells a different story, where they have not broken into the top 30, which might indicate an area for potential growth or strategic focus.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Castle Rock Farms has experienced notable shifts in its market position over recent months. Starting from a strong 2nd place in November 2025, the brand saw a gradual decline, settling at 4th place by February 2026. This downward trend coincides with a decrease in sales, suggesting potential challenges in maintaining its earlier momentum. Meanwhile, Claybourne Co. has consistently held a top position, maintaining 2nd place from December 2025 through February 2026, indicating robust brand strength and consumer loyalty. Back Forty / Back 40 Cannabis also remains a strong competitor, consistently ranking 3rd, while Good Supply has improved its position from 8th to 6th place over the same period. These shifts highlight the dynamic nature of the market and suggest that Castle Rock Farms may need to strategize effectively to regain its earlier standing and counteract the competitive pressures from these prominent brands.

Notable Products

In February 2026, Castle Rock Farms' top-performing product was the Pick Me Up Pre-Roll 10-Pack (5g), maintaining its number one rank from previous months despite a decline in sales to 6832. The Watermelon Waterfall Infused Pre-Roll 5-Pack (2.5g) also held steady in the second position. Notably, the Lemon Cherry Diamond Infused Pre-Roll 3-Pack (1.5g) regained its third-place standing after dropping out of the ranks in January. The Pink Grapes Pre-Roll 20-Pack (10g) consistently ranked fourth, showing stable performance. A new entry, the Gastropop Live Resin & Diamond Infused Blunt (1g), debuted in fifth place, indicating a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.