Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

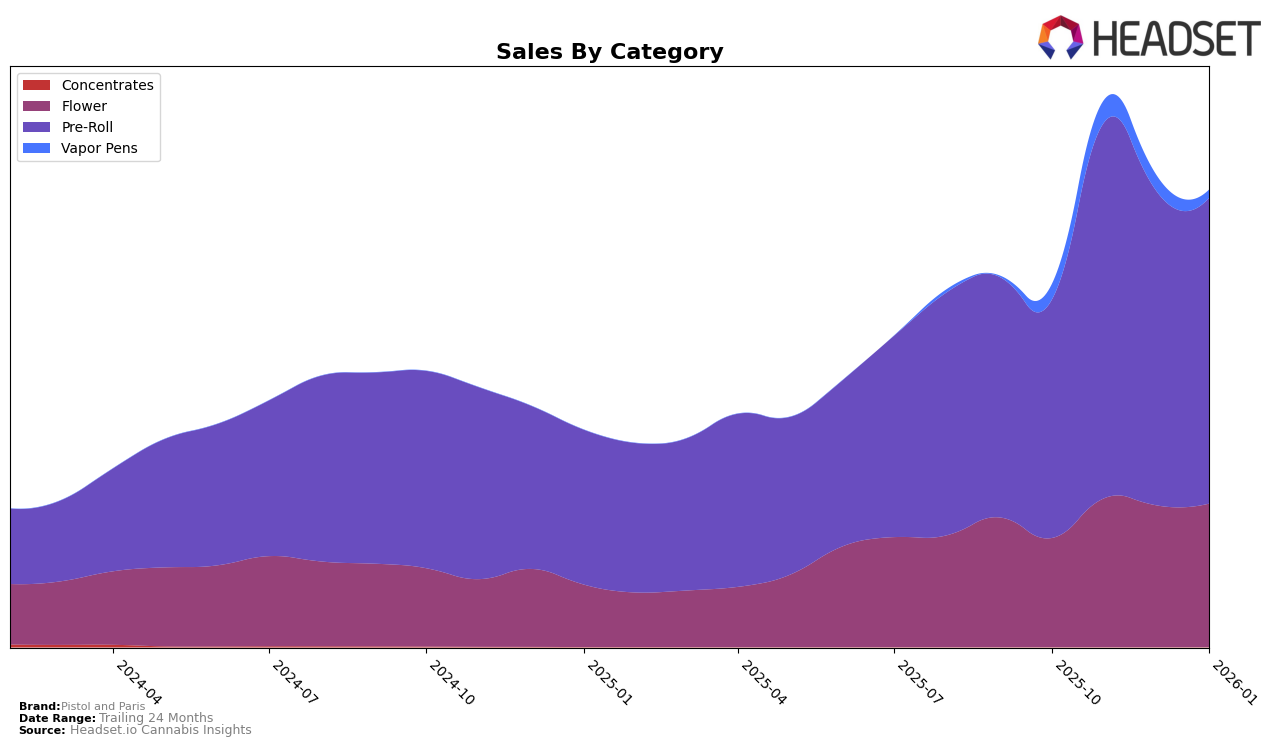

In the province of Alberta, Pistol and Paris has shown notable progress in both the Flower and Pre-Roll categories. In the Flower category, the brand improved its ranking from 47th in October 2025 to 23rd by January 2026, indicating a significant upward trend. The Pre-Roll category saw a similar pattern, with the brand moving from 32nd to 13th over the same period. The sales figures corroborate this positive trajectory, with Pre-Roll sales maintaining robust growth, despite a slight dip in January 2026. This growth in Alberta suggests a strengthening market presence for Pistol and Paris, especially in the Pre-Roll category.

Meanwhile, in British Columbia, Pistol and Paris has maintained a strong position in the Pre-Roll category, holding steady at the 2nd and 4th positions from October 2025 to January 2026. However, the Flower category saw a slight decline, with the brand dropping from 8th to 18th. The Vapor Pens category presents a mixed picture; while the brand was ranked 18th in October 2025, it fell out of the top 30 by January 2026, indicating potential challenges in this segment. In Ontario, the brand's performance has been relatively stable, with minor fluctuations in the rankings for both Flower and Pre-Roll categories, suggesting a consistent market presence without significant breakthroughs.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Pistol and Paris has experienced notable shifts in its ranking and sales performance. Despite maintaining a strong position in October and November 2025 with a consistent rank of 2, the brand saw a slight decline to rank 4 by December 2025 and January 2026. This change in rank is significant when compared to competitors like Weed Me, which climbed from rank 13 in October to a stable rank 2 by December and January, and Thumbs Up Brand, which surged from rank 23 in October to rank 3 by December and January. Meanwhile, Good Supply and Jeeter also showed competitive performance, with both brands consistently ranking within the top 7. These dynamics suggest that while Pistol and Paris remains a key player, it faces increasing competition from brands that are rapidly gaining market share, potentially impacting its sales momentum in the longer term.

Notable Products

In January 2026, Hawaiian Fanta Pre-Roll 3-Pack (1.5g) maintained its top position as the best-selling product for Pistol and Paris, with sales figures reaching 16,240 units. Pink Goo Pre-Roll 3-Pack (1.5g) climbed to the second position from third place in December 2025, showing a consistent demand. Death Bubba Pre-Roll 3-Pack (1.5g) experienced a slight drop, moving from second to third place. Pink Goo Pre-Roll (1g) held steady in fourth place, indicating stable sales performance. Notably, the Pink Goo (3.5g) product debuted in the rankings at fifth place, suggesting a positive reception in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.