Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

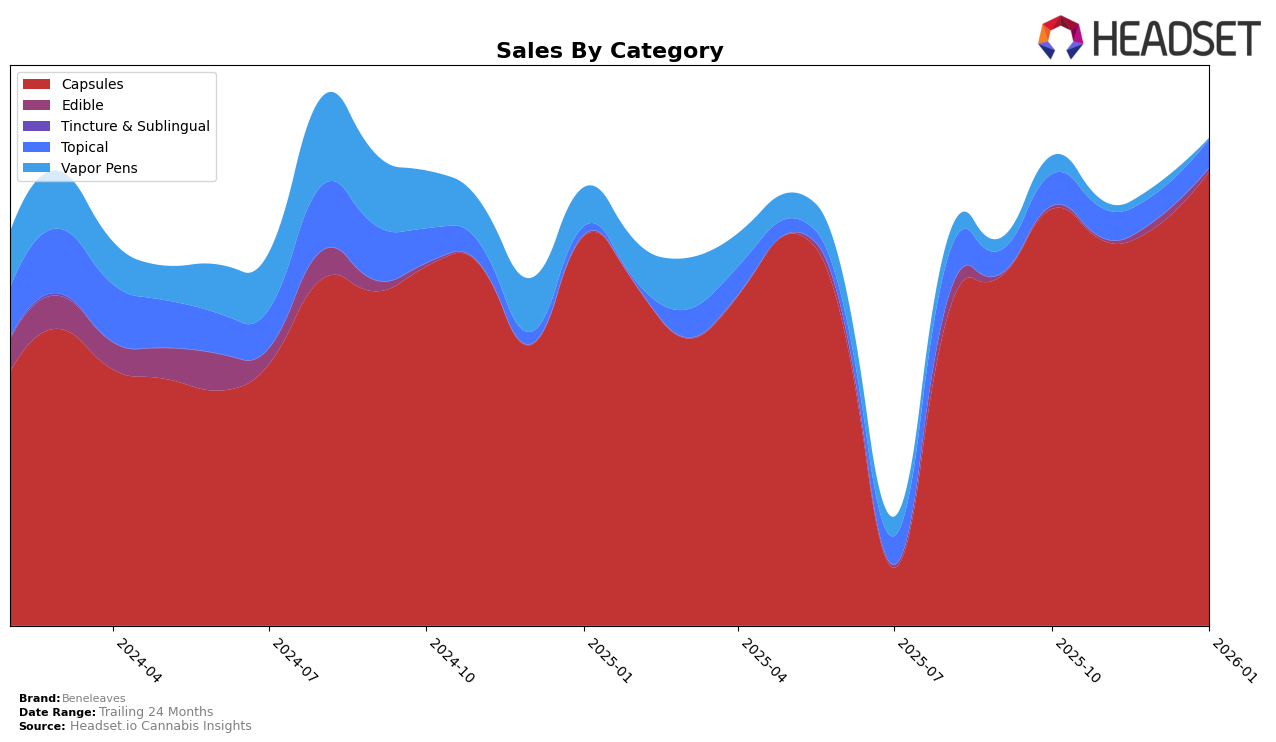

Beneleaves has consistently maintained its top position in the Capsules category in Ohio over the last four months, indicating a strong market presence and consumer preference in this segment. Despite a slight dip in sales in November 2025, the brand rebounded with notable growth by January 2026, highlighting resilience and effective market strategies. In contrast, Beneleaves' performance in the Vapor Pens category did not secure a top 30 ranking beyond October 2025, suggesting potential challenges or increased competition in this segment. This absence from the top rankings in subsequent months could indicate areas for improvement or a shift in consumer preferences.

In the Topical category, Beneleaves has consistently held the 7th position across the same period in Ohio, reflecting a stable but not leading presence. This steady ranking suggests that while the brand is a recognized player, there might be room for growth or innovation to climb higher in the rankings. The consistent sales figures in this category, despite slight fluctuations, indicate a loyal customer base. However, the lack of a top 30 presence in other states or provinces could imply a focus on the Ohio market or challenges in expanding their footprint geographically. This performance overview provides a glimpse into Beneleaves' market dynamics, with potential opportunities for strategic adjustments to enhance their competitive edge.

Competitive Landscape

In the Ohio capsules market, Beneleaves has consistently maintained its top position from October 2025 through January 2026, showcasing its strong brand presence and customer loyalty. Despite fluctuations in sales figures, with a notable dip in November 2025, Beneleaves managed to rebound with impressive sales growth by January 2026. Competitors such as Main Street Health and Butterfly Effect - Grow Ohio have shown dynamic shifts in rankings, with Main Street Health climbing from fourth to second place by January 2026, while Butterfly Effect - Grow Ohio experienced a slight drop from second to third place. These movements highlight a competitive landscape where Beneleaves' ability to sustain its leadership position is particularly noteworthy, as it suggests a robust market strategy and strong consumer preference amidst the evolving competition.

Notable Products

In January 2026, the top-performing product from Beneleaves was the RSO Capsules 22-Pack (660mg), maintaining its first-place ranking consistently from October 2025 with a notable sales figure of 3783. The Sativa Helios Capsules 11-Pack (440mg) held steady in second place, showing a slight increase in sales compared to the previous month. The CBD/THC/CBG/CBC/CBN Entourage Effect Capsules 22-Pack moved back to third place after briefly holding second place in November 2025. Hypnos Indica Capsules 11-Pack consistently remained in fourth place, although its sales have been declining since October 2025. A new entry, the CBN/THC 1:1 Hypnos + CBN Capsules 22-Pack, debuted in fifth place, indicating a growing interest in CBN-focused products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.