Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

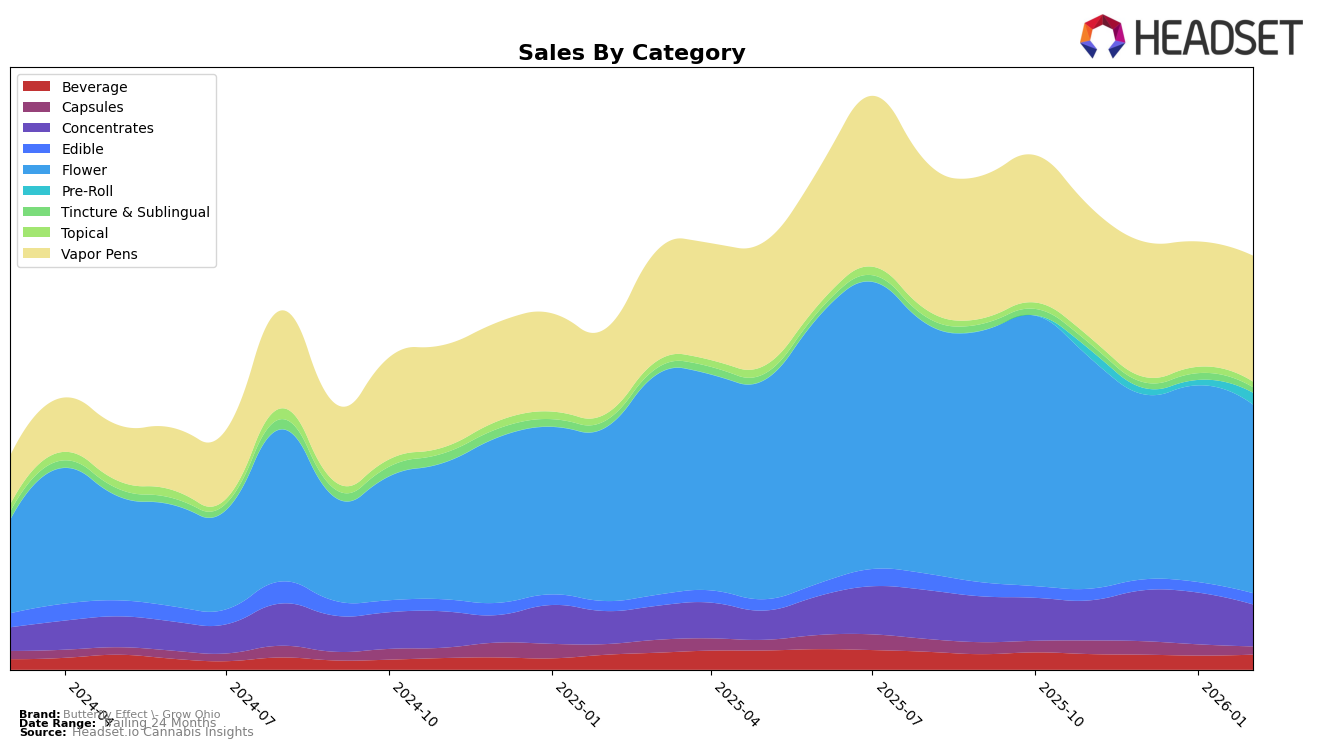

Butterfly Effect - Grow Ohio has shown a consistent performance in the Ohio market, with notable stability in several categories. In the Beverage category, the brand maintained a steady rank of 3rd in both November and December 2025, advancing to 2nd place in January and February 2026. This upward movement suggests an increasing consumer preference for their beverage offerings. Meanwhile, the Concentrates category saw Butterfly Effect consistently holding the 2nd position throughout the analyzed months, indicating a strong foothold in this segment. However, the Capsules category presented a different narrative, with the brand slipping from 2nd in November to 4th by January, and failing to secure a top 30 position in February, which could point to growing competition or shifting consumer preferences.

In the Flower category, Butterfly Effect - Grow Ohio experienced a slight decline in rank from 8th in November to 11th in December, maintaining that position through February. Despite this, the sales figures remained robust, illustrating the brand's resilience in this competitive category. The Edible category, however, showed a positive trend, with the brand improving its rank from 28th in December to 22nd by February, suggesting a potential area of growth. Interestingly, the Pre-Roll category saw Butterfly Effect entering the top 30 for the first time in February with a rank of 15th, marking a significant milestone for the brand. In Vapor Pens, the brand consistently ranked 4th from December through February, reaffirming its strong market presence in this category. Overall, Butterfly Effect - Grow Ohio demonstrates a dynamic performance across multiple categories, with both challenges and opportunities evident in their market strategy.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Butterfly Effect - Grow Ohio has experienced a notable shift in its market position over recent months. Despite maintaining a steady rank at 11th place from December 2025 to February 2026, the brand has faced challenges in climbing higher due to strong competition. Brands like Grassroots and Seed & Strain Cannabis Co. have consistently ranked higher, with the latter experiencing a significant drop from 4th to 9th place in February 2026, which could present an opportunity for Butterfly Effect - Grow Ohio to capitalize on. Meanwhile, Meigs County Grown and Buckeye Relief have shown gradual improvements in their rankings, indicating a competitive environment. Butterfly Effect - Grow Ohio's sales have seen fluctuations, with a decrease from November to December 2025, followed by a slight recovery in early 2026, suggesting the need for strategic adjustments to enhance its market position and capture a larger share of the Ohio flower market.

Notable Products

In February 2026, Butterfly Effect - Grow Ohio's top-performing product was Young Buck - Layer Cake Pre-Roll (0.5g) in the Pre-Roll category, which climbed from its previous unranked status in January to secure the number one spot, achieving an impressive sales figure of $5,921. The Layer Cake (2.83g) Flower maintained a strong presence, holding steady at the number two rank for the second consecutive month, despite a slight decrease in sales. The 91 Royale CO2 Luster Pod (0.85g) made its debut at third place in the Vapor Pens category, indicating a strong market entry. Meanwhile, the Layer Cake Co2 Luster Pod (0.85g) and Notorious CO2 Luster Pod (0.85g) occupied the fourth and fifth positions, respectively, showing consistent performance in the Vapor Pens category. Overall, this month saw a notable reshuffling in product rankings, highlighting a dynamic and competitive sales environment.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.