Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

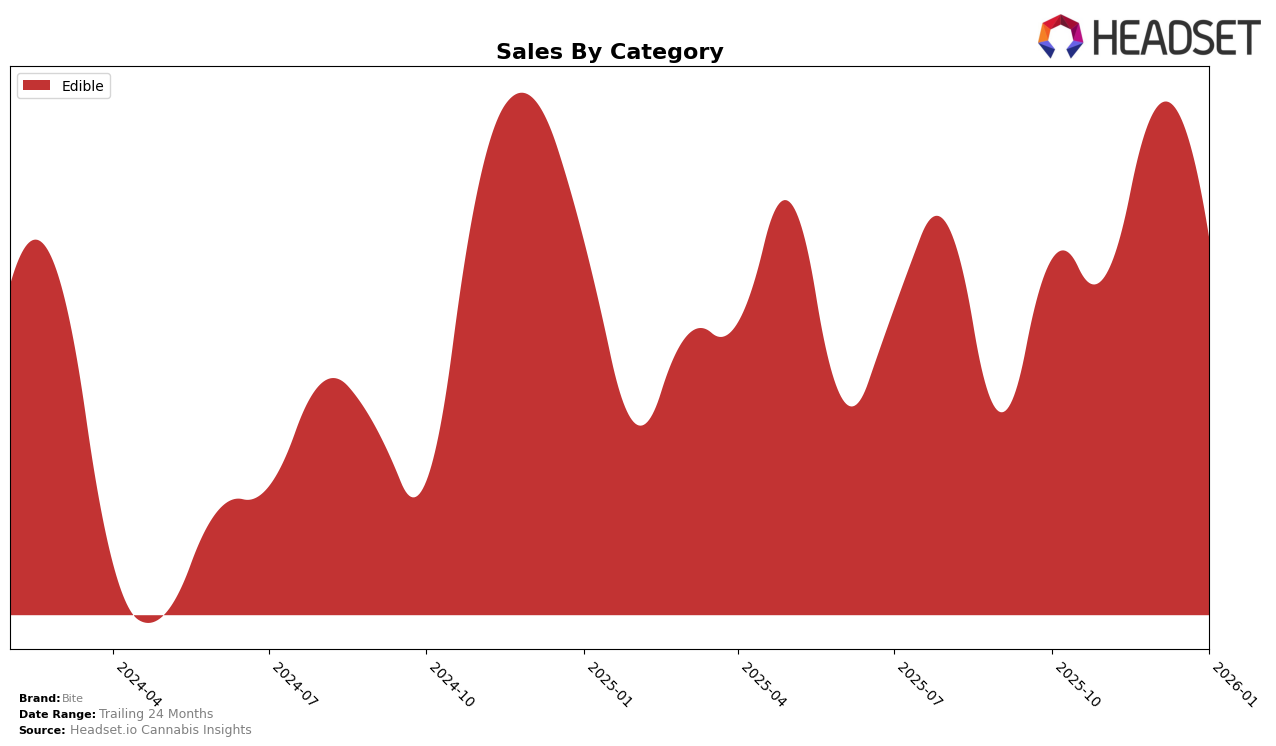

Bite has shown a consistent presence in the Massachusetts edible category, maintaining a steady 16th rank from November 2025 through January 2026. This stability in ranking indicates a solid foothold in the market, even as the brand experienced a noticeable increase in sales during December 2025, reaching $222,969. Such a trend suggests that Bite may have capitalized on seasonal demand or marketing strategies during the holiday season, although the brand's rank did not change. This consistency in ranking, despite fluctuations in sales, could indicate strong competition within the Massachusetts edible category.

While Bite's performance in Massachusetts is noteworthy, the absence of rankings in other states and categories suggests that the brand might not have achieved significant penetration beyond this specific market and category. Not appearing in the top 30 brands elsewhere could point to either a strategic focus on the Massachusetts edibles market or challenges in expanding their market presence. Understanding the reasons behind this limited geographic and categorical reach could provide valuable insights into Bite's overall market strategy and potential areas for growth.

Competitive Landscape

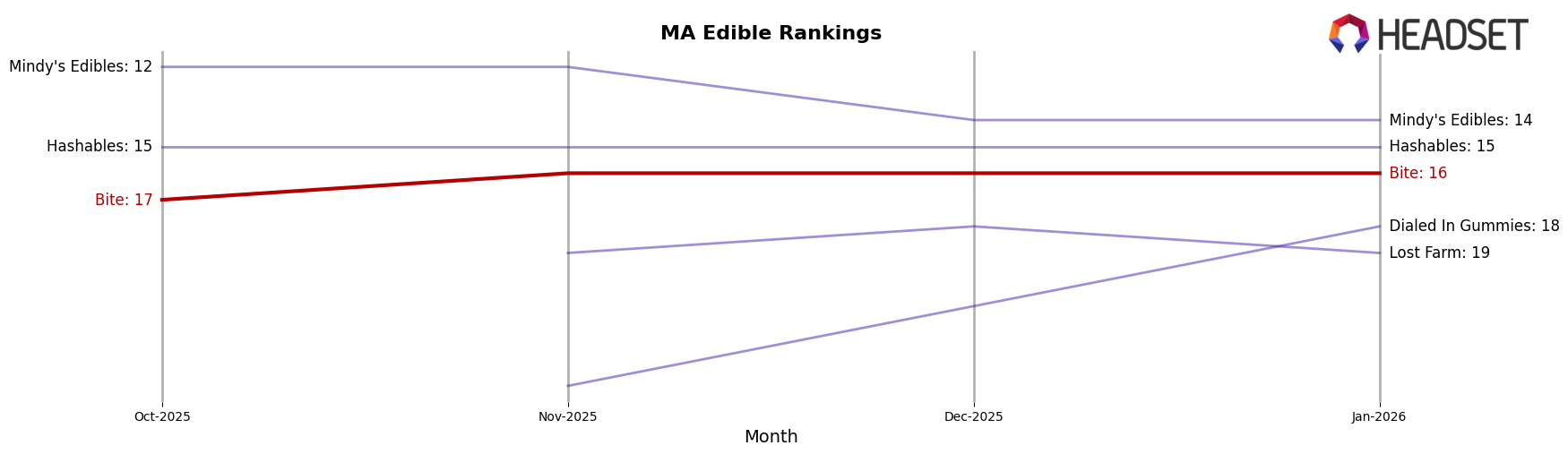

In the Massachusetts edible market, Bite has shown a consistent performance, maintaining its rank at 16th place from November 2025 through January 2026. This stability is noteworthy, especially in comparison to competitors like Mindy's Edibles, which saw a slight decline from 12th to 14th place over the same period. Meanwhile, Dialed In Gummies demonstrated a positive trend, climbing from 24th in November to 18th in January, indicating a potential threat to Bite's position if this upward trajectory continues. Hashables remained steady at 15th, just one spot above Bite, suggesting a close competition. Although Bite's sales figures have fluctuated, the brand has managed to maintain its rank, highlighting its resilience in a competitive landscape where others like Lost Farm have experienced more volatility, dropping from 18th to 19th in January. This analysis underscores Bite's stable presence in the market, but also signals the need for strategic initiatives to fend off rising competitors and improve its standing.

Notable Products

In January 2026, Bite's top-performing product was the Social Watermelon Gummies 20-Pack, maintaining its leading position from December 2025 with sales of 3114 units. The Mellow Meyer Lemon Gummies 20-Pack secured the second rank, showing a consistent upward trend from fourth in October 2025. Sleepy Blue Raspberry Gummies 20-Pack, which held the top spot in October and November 2025, ranked third, indicating a slight decline in its position over the months. UP Peach Mango Gummies 20-Pack remained stable at fourth place since December 2025 after entering the rankings in November. Golf Grape Transfusion Gummies 20-Pack consistently held the fifth position, except for November, demonstrating steady but lower sales figures compared to the top four products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.