Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

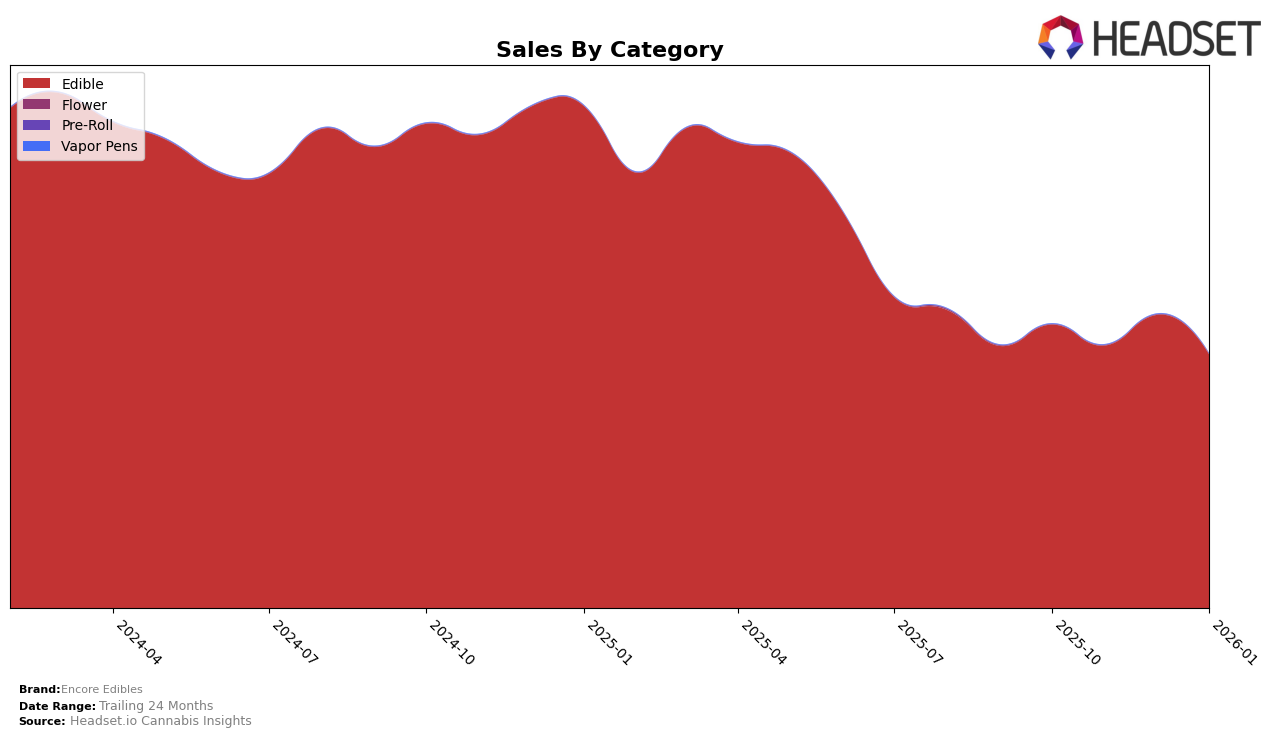

Encore Edibles has shown a consistent performance in the Connecticut market, maintaining the top position in the edibles category from October 2025 through January 2026. This stability is indicative of strong consumer loyalty and effective market strategies. In contrast, their performance in Illinois has been more volatile, with rankings fluctuating between 7th and 11th place over the same period. Such movement suggests a competitive landscape in Illinois, where Encore Edibles faces challenges in maintaining a consistent market position.

In Maryland, Encore Edibles experienced a gradual decline in rankings, moving from 4th place in October 2025 to 8th place by January 2026. This downward trend may point to increasing competition or shifts in consumer preferences. Meanwhile, their presence in New Jersey has been inconsistent, with rankings varying significantly, indicating potential volatility in market demand or brand positioning. On a positive note, Encore Edibles has maintained a relatively stable position in Ohio, consistently ranking within the top 6, which suggests a strong foothold in the state's edibles market. However, the absence of a ranking in some markets indicates areas where the brand is not among the top 30, highlighting opportunities for growth or strategic realignment.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Connecticut, Encore Edibles has consistently maintained its position as the leading brand from October 2025 through January 2026. Despite facing strong competition, Encore Edibles has managed to hold the top rank, showcasing its dominance in the market. Notably, Soundview has been a persistent contender, consistently ranking second during this period, with sales figures closely trailing those of Encore Edibles. Meanwhile, Camino has shown a steady performance, maintaining the third position from November 2025 onwards. The consistent top ranking of Encore Edibles highlights its strong brand presence and customer loyalty in Connecticut's edible category, despite the competitive pressure from other well-performing brands.

Notable Products

In January 2026, Encore Edibles saw the Sativa Tropical Mango RSO Gummies 10-Pack (100mg) rise to the top spot, achieving first place with sales of 10,646 units. The Hybrid Sour Black Cherry RSO Gummies 10-Pack (100mg) maintained a strong second position, slightly declining from its peak sales in December. The Indica Concord Grape RSO Gummies 10-Pack (110mg), previously holding the number one spot for three consecutive months, slipped to third place. Sativa Sour Watermelon Gummies 10-Pack (100mg) and Indica Sweet Berry Burst Gummies 10-Pack (100mg) consistently held the fourth and fifth positions, respectively, showing stable performance over the months. The shift in rankings highlights a notable increase in preference for Sativa Tropical Mango RSO Gummies, which overtook the previously dominant Indica Concord Grape variant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.