Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

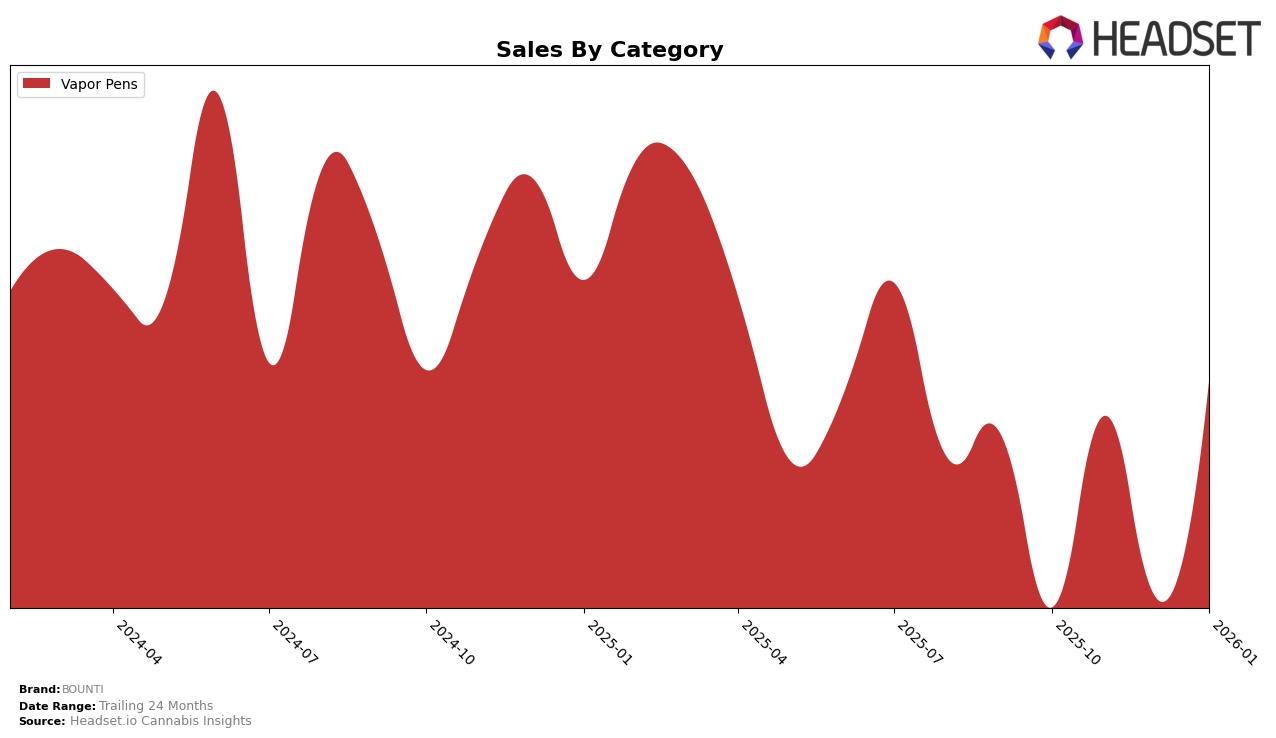

BOUNTI has shown a dynamic performance across different categories and states, with notable movements in the Vapor Pens category in Nevada. After not making it into the top 30 in October 2025, BOUNTI climbed to 18th place by November, indicating a significant upward trend. Although there was a slight dip in December, where they ranked 29th, the brand quickly regained its position, returning to 18th place by January 2026. This fluctuation suggests a volatile but ultimately positive trajectory in Nevada's Vapor Pens market, highlighting BOUNTI's potential to maintain competitive standing amidst changing market conditions.

Interestingly, the sales figures for BOUNTI in Nevada's Vapor Pens category reflect this upward momentum, with a notable increase from $64,625 in October 2025 to $178,553 by January 2026. This growth underscores the brand's ability to capture market share despite the competitive landscape. However, it is important to note that BOUNTI's absence from the top 30 in October could be viewed as a challenge that they successfully overcame in subsequent months. This indicates a potentially strategic adjustment or an increase in consumer demand that BOUNTI was able to capitalize on effectively. Such insights provide a glimpse into BOUNTI's market adaptability and resilience.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, BOUNTI has shown a notable fluctuation in its market position from October 2025 to January 2026. Initially ranked 33rd in October, BOUNTI made a significant leap to 18th place by November, although it experienced a dip to 29th in December before rebounding to 18th again in January. This volatility in rank is mirrored by its sales performance, which saw a substantial increase from October to November, followed by a decline in December, and a strong recovery in January. In contrast, competitors like Panna Extracts and Dabwoods Premium Cannabis maintained more stable rankings, consistently staying within the top 20, which suggests a steadier market presence. Meanwhile, Hustler's Ambition demonstrated a dynamic trajectory, similar to BOUNTI, but with a stronger finish in January. These insights highlight BOUNTI's potential for growth and the competitive pressure it faces from more consistently ranked brands in the Nevada vapor pen market.

Notable Products

In January 2026, BOUNTI's top-performing product was the Blue Dream Distillate Disposable (0.5g) in the Vapor Pens category, maintaining its first-place rank with $518 in sales. The Creamsicle Distillate Cartridge (0.85g) climbed to the second position from fourth in December 2025, showing a significant improvement in its ranking. Blue Dream Distillate Cartridge (0.85g) secured the third spot, marking its first appearance in the top three since October 2025. Bubba Kush Distillate Cartridge (0.85g) saw a drop to fourth place after previously ranking first in December 2025. Overall, the Vapor Pens category dominated the top rankings for BOUNTI in January 2026, with notable shifts in product performance compared to the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.