Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

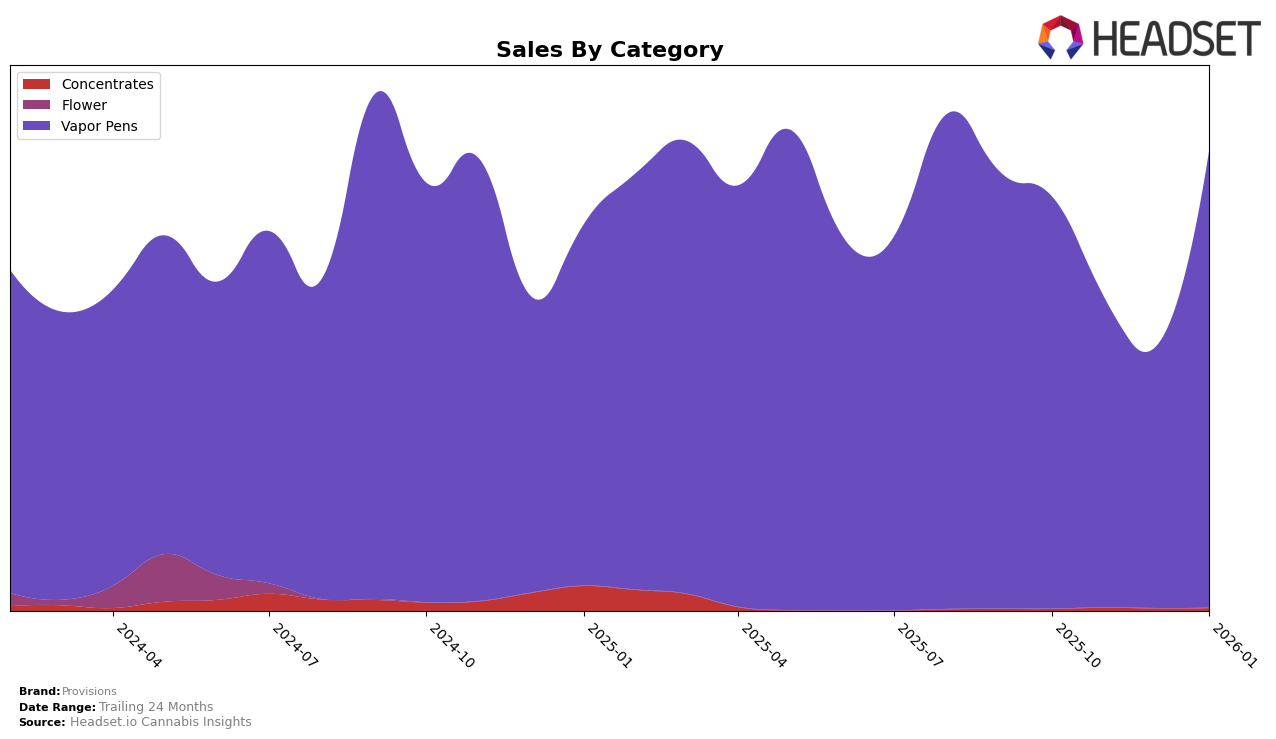

Provisions has demonstrated notable performance shifts across different categories and states, particularly in the Vapor Pens category within Nevada. Over the past few months, the brand has shown a fluctuating trend in rankings, starting at 11th place in October 2025 and experiencing a slight drop to 14th in December. However, by January 2026, Provisions made a significant leap to 7th place, indicating a strong recovery and potential growth in popularity or market strategy effectiveness. This upward movement in ranking suggests a positive reception or strategic improvement in their product offerings or marketing efforts within the state.

It is important to note that Provisions was consistently within the top 30 brands in the Vapor Pens category in Nevada, which highlights their sustained presence in a competitive market. The absence of ranking data in other states or categories suggests that Provisions may not be as prominent outside of this specific market segment or geographical area. This could point to a focused market approach or a need for expansion strategies to improve brand visibility and performance in other regions. Understanding these dynamics can offer insights into the brand's strategic priorities and areas for potential growth.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Provisions has shown a noteworthy trajectory over the past few months. While starting at the 11th rank in October 2025, Provisions experienced a dip, falling to 14th place by December. However, a significant rebound occurred in January 2026, where it climbed to 7th place, indicating a strong recovery and potential growth in market presence. This upward movement is particularly impressive when compared to competitors like Brass Knuckles, which fluctuated between 7th and 11th place, and Medizin, which improved from 14th to 9th place. Meanwhile, Select and AiroPro maintained more stable positions, consistently ranking higher than Provisions. This suggests that while Provisions is gaining momentum, there is still a competitive gap to close with the top-tier brands. The fluctuation in ranks and the recent surge in sales for Provisions highlight an opportunity for strategic marketing efforts to sustain and enhance this growth trajectory.

Notable Products

In January 2026, the top-performing product for Provisions was the Purple Dolato Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank from November 2025, with notable sales of 939 units. Following closely, the Durban Poison Distillate Cartridge (1g) debuted in second place, indicating a strong market entry. The Ghost Train Haze Distillate Cartridge (1g) secured the third position, and Master Kush Distillate Cartridge (1g) followed in fourth, both making their first appearances in the rankings. The Sour Tangie Distillate Cartridge (1g) rounded out the top five, also appearing for the first time. These rankings highlight a competitive market shift with new entries taking prominent positions compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.