Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

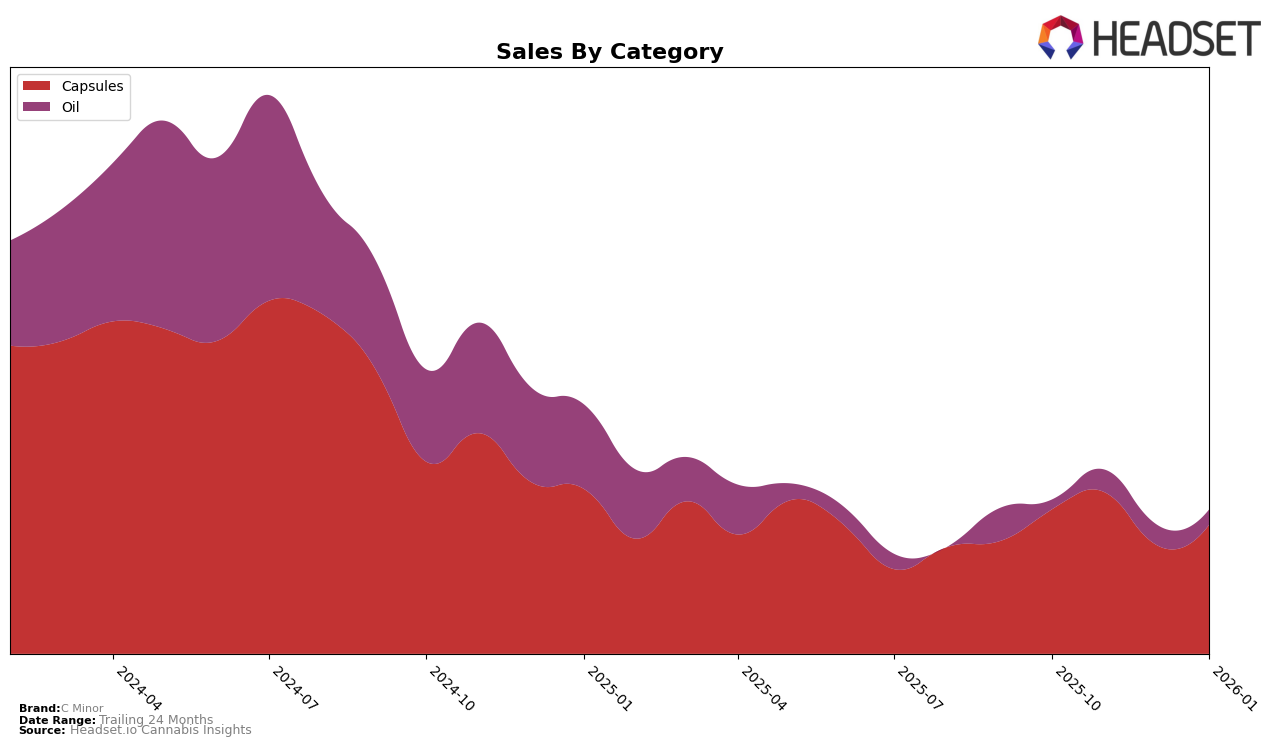

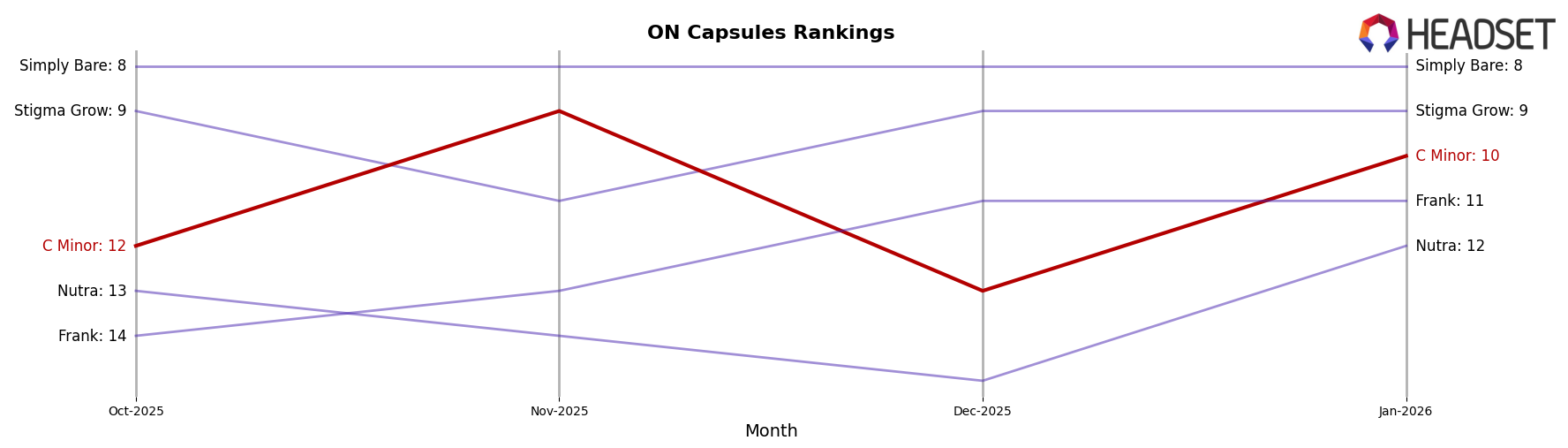

C Minor has shown a dynamic performance across different categories and states, particularly in the capsules segment in Ontario. Over the span from October 2025 to January 2026, C Minor experienced fluctuations in its rankings, starting at 12th place in October, climbing to 9th in November, dropping to 13th in December, and then rebounding to 10th in January. This movement indicates a volatile but resilient presence in the Ontario market, suggesting that while C Minor faces competition, it manages to maintain a strong position among the top brands in the capsules category. The sales figures, peaking in November, reflect this competitive edge and the brand's ability to capture consumer interest during that period.

The absence of C Minor from the top 30 rankings in other states or provinces highlights a potential area for growth or a strategic decision to focus on specific markets like Ontario. This concentrated presence could be a double-edged sword, offering dominance in one area while limiting exposure elsewhere. The brand's ability to rebound in rankings within Ontario suggests a robust local strategy, but the lack of presence in other regions might pose challenges for broader market penetration. Such insights into C Minor's performance can guide future strategic decisions, whether to consolidate its position in Ontario or to expand its reach into other promising markets.

```Competitive Landscape

In the competitive landscape of the capsules category in Ontario, C Minor has shown a fluctuating performance in terms of rank and sales over the past few months. Starting from October 2025, C Minor was ranked 12th, improved to 9th in November, dropped to 13th in December, and slightly recovered to 10th by January 2026. This volatility contrasts with the stable performance of Simply Bare, which consistently held the 8th position throughout the same period. Meanwhile, Stigma Grow maintained a competitive edge, closely trailing Simply Bare, with ranks fluctuating between 9th and 11th. Despite C Minor's rank improvements in November and January, its sales figures reveal a downward trend from November to December, suggesting challenges in maintaining market momentum. In contrast, Frank and Nutra have shown more stability, with Frank improving its rank from 14th to 11th by December, and Nutra recovering to 12th in January. These dynamics highlight the competitive pressure C Minor faces, necessitating strategic adjustments to enhance its market position and sales performance.

Notable Products

In January 2026, C Minor's top-performing product was CBD Fast Acting 50 Max Softgels 30-Pack (1500mg CBD) in the Capsules category, maintaining its number one rank for four consecutive months with sales of $793. The CBD Isolate 100 Max 3000 Oil (30ml) held steady at the second position, showing consistent performance since October 2025. CBD 50 Max 3000 Oil Drops (60ml) improved its rank from fourth in December 2025 to third in January 2026, indicating a positive shift in consumer preference. CBG:CBD 1:2 Max 2250 Ultra Formula Oil (30ml) remained consistent at the third rank from October 2025 through January 2026. Notably, the Fast Acting Max Softgels 30-Pack (300mg) was not ranked in January 2026, suggesting a potential decline or discontinuation in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.