Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

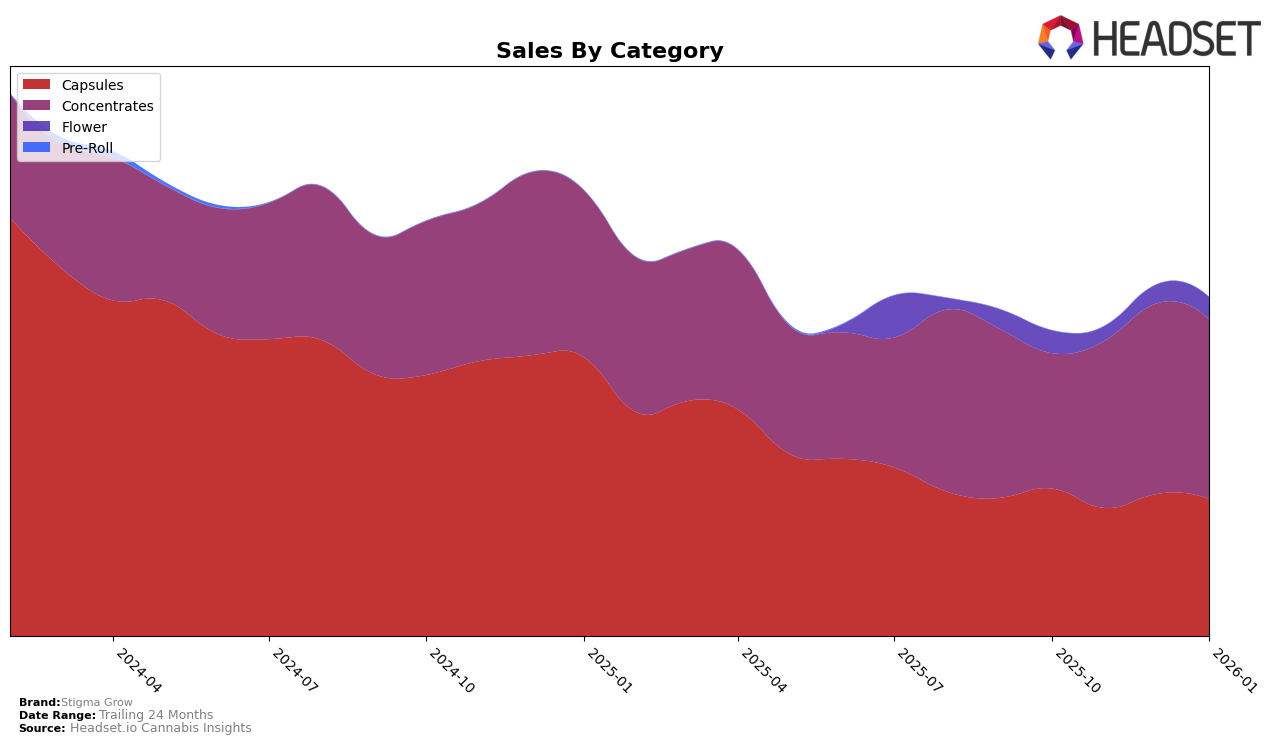

Stigma Grow has demonstrated varied performance across different categories and provinces. In Alberta, the brand has maintained a consistent fourth-place ranking in the Capsules category from October 2025 through January 2026, despite a gradual decline in sales. Meanwhile, the Concentrates category has shown a promising upward trajectory, with the brand climbing from 15th place in October 2025 to 7th place by January 2026. However, their presence in the Flower category has been less stable, with rankings outside the top 30 in November 2025, indicating a need for strategic adjustments in that segment.

In British Columbia, Stigma Grow made a notable entry into the Capsules category by December 2025, securing the 7th position and maintaining it into January 2026. This suggests a positive reception in this new market segment. The Concentrates category also witnessed a significant improvement, moving from 31st place in October 2025 to 16th place in December before slightly dropping to 18th in January 2026. In Ontario, the brand has consistently held a position within the top 11 for Capsules, reflecting a steady market presence. These movements highlight Stigma Grow's strategic focus on expanding and solidifying its market share across different regions and categories.

Competitive Landscape

In the Alberta concentrates market, Stigma Grow has demonstrated a notable upward trajectory in brand ranking from October 2025 to January 2026, moving from 15th to 7th place. This steady climb in rank suggests a positive reception and growing consumer preference for their products. In contrast, 3Saints maintained a consistent 5th place ranking throughout the same period, indicating a stable market presence but not showing the same upward momentum as Stigma Grow. Meanwhile, Nugz (Canada) held a steady 6th position from November 2025 to January 2026, suggesting a strong but static performance. Astro Lab experienced fluctuations, dropping to 20th in December 2025 before rebounding to 8th in January 2026, which might indicate volatility in their market strategy or consumer demand. The Goo! also showed some variability, peaking at 7th in December 2025 but falling to 9th by January 2026. Stigma Grow's consistent rise in rank, coupled with increasing sales figures, positions it as a brand to watch, potentially challenging the more established players in the Alberta concentrates market.

Notable Products

In January 2026, Stigma Grow's top-performing product was Phoenix Tears RSO (1g) in the Concentrates category, maintaining its first-place ranking for four consecutive months with sales of 3649 units. Indica RSO Capsules 25-Pack (250mg) continued to hold the second position, showing consistent performance across the months. CBD Softgels 15-Pack (750mg CBD) remained in third place, demonstrating stability in the Capsules category. Phoenix Tears Honey Oil (1g) improved its ranking from fifth in December 2025 to fourth in January 2026, indicating a positive trend in sales. Rippin Razz 2.0 Shatter (4g) held steady at fifth place, despite a slight decrease in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.