Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

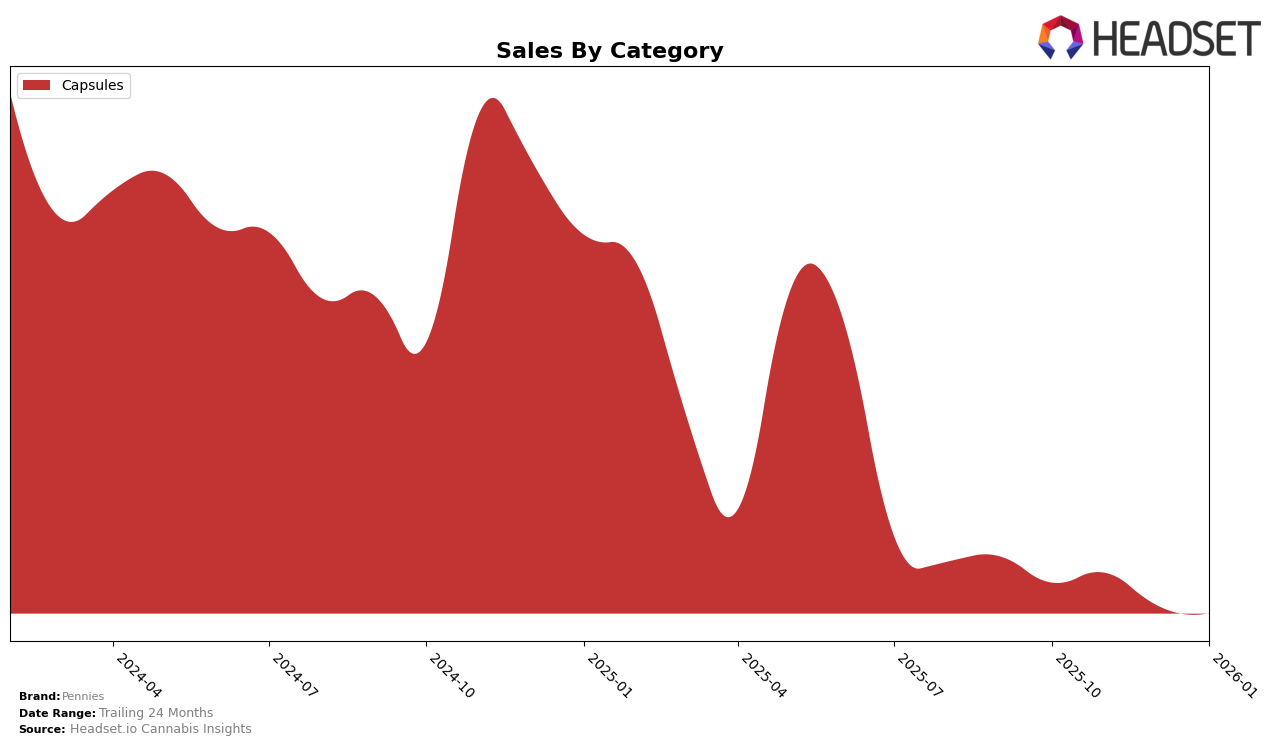

In the market of Ontario, Pennies has shown consistent performance in the Capsules category. Over the four-month period from October 2025 to January 2026, Pennies maintained a steady presence, holding the 15th rank in three out of the four months, with a slight dip to the 16th position in December 2025. This consistency indicates a stable consumer base and a solid market presence in Ontario's Capsules category. However, the slight decrease in rank during December could suggest increased competition or seasonal fluctuations affecting sales dynamics.

Despite the stable rankings, the sales figures for Pennies in Ontario's Capsules category experienced a downward trend from November 2025 to January 2026. Starting with a peak in November, sales decreased over the subsequent months, reaching the lowest point in January 2026. This decline could point to various factors, such as market saturation or shifting consumer preferences. The absence of Pennies from the top 30 brands in other categories or states during this period may indicate a more focused market strategy in Ontario, emphasizing their strength in the Capsules category.

Competitive Landscape

In the competitive landscape of the capsules category in Ontario, Pennies has shown a consistent presence, maintaining a rank within the top 20 brands from October 2025 to January 2026. Despite facing stiff competition, Pennies held steady at rank 15 in October and November, slipped to 16 in December, and rebounded back to 15 in January. This resilience is notable given the dynamic shifts among competitors. For instance, Rosin Heads experienced a significant drop from rank 10 in October to 14 in January, indicating potential volatility in their sales performance. Meanwhile, Dosecann showed a gradual decline from rank 11 to 13 over the same period. Interestingly, Mood Ring and Persy were not consistently ranked, with Mood Ring missing from the top 20 in December and January, and Persy absent in November. These fluctuations among competitors highlight Pennies' ability to maintain its market position, suggesting a stable customer base and effective market strategies in a competitive environment.

Notable Products

In January 2026, the top-performing product for Pennies was THC Softgels 5-Pack (50mg) in the Capsules category, maintaining its number one rank for four consecutive months with sales reaching 816 units. Following closely, THC Plus Softgels 20-Pack (200mg) also held its consistent second position in the same category, with sales of 392 units. Notably, both products have shown a consistent ranking pattern from October 2025 through January 2026, indicating stable consumer demand. The sales figures for THC Softgels 5-Pack saw a slight increase from December 2025, reflecting a positive trend. Overall, the Capsules category continues to dominate the product lineup for Pennies, sustaining its lead in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.