Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

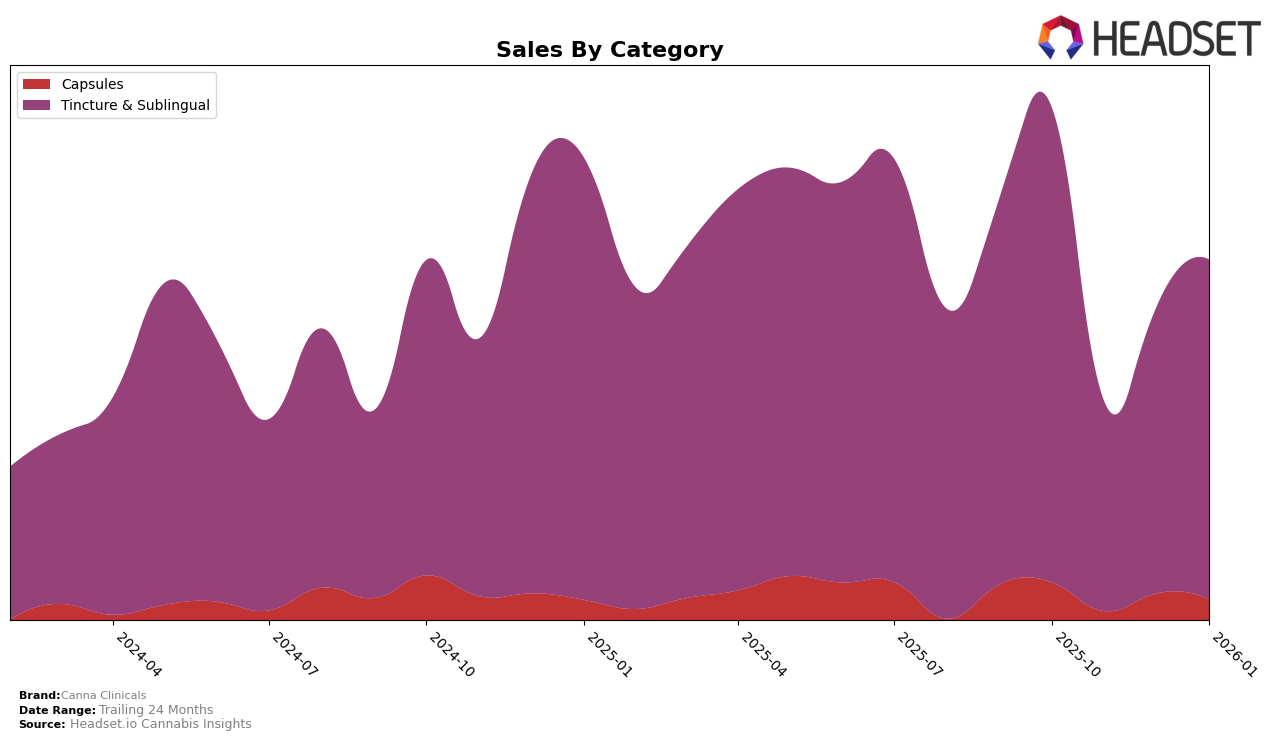

Canna Clinicals has shown a noteworthy performance in the New York market, particularly in the Tincture & Sublingual category. Over the span from October 2025 to January 2026, the brand has demonstrated consistent improvement in its ranking, moving from 9th position in October to 8th in January. This upward trend indicates a strengthening presence in the market, suggesting that Canna Clinicals' strategies might be resonating well with consumers in New York. The brand's sales figures also reflect this positive momentum, with a notable increase from November to January, hinting at a successful holiday season push or effective marketing campaigns during this period.

However, it's important to note that Canna Clinicals' absence from the top 30 brands in other states and categories could be seen as a potential area for improvement. The lack of presence in these rankings might suggest that while the brand is performing well in New York, there is room for growth and expansion in other regions. This could be an opportunity for Canna Clinicals to evaluate its strategies and consider diversifying its market presence beyond New York. Exploring new categories or enhancing distribution channels in other states could be potential avenues for growth, though the specifics of such strategies remain to be seen.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in New York, Canna Clinicals has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 9th in October, Canna Clinicals dropped to 11th in November, indicating a temporary decline in market presence. However, the brand showed resilience by climbing back to 10th in December and further improving to 8th by January 2026. This upward trajectory suggests a positive response to market dynamics or strategic adjustments. In contrast, High Falls Canna New York maintained a strong position, consistently ranking within the top 7, though it experienced a slight dip in December. Meanwhile, Ithaca Organics Cannabis Co. showed a steady performance, peaking at 6th place in November and December before slipping to 7th in January. The competitive pressure from these brands, alongside the re-emergence of FLWR CITY in January, underscores the challenges and opportunities for Canna Clinicals in maintaining and improving its market share in this dynamic sector.

Notable Products

In January 2026, the CBD/THC 1:10 Max Strength Tincture maintained its top position among Canna Clinicals products for the fourth consecutive month, with sales reaching 463 units. The CBD/CBN/THC Sleep Tincture climbed to the second position from its previous third, reflecting a growing consumer interest in sleep aids. The CBD/THC 1:1 Max Strength Capsules secured the third spot, showing consistent performance over the months. Notably, the CBD/THC/CBG 1:1:1 Relief Complex Capsules made a significant leap to fourth place, marking its first appearance in the rankings since October 2025. Meanwhile, the CBD/THC/CBN 1:1:1 Sleep Complex Capsules rounded out the top five, despite a gradual decline in sales and ranking from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.