Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

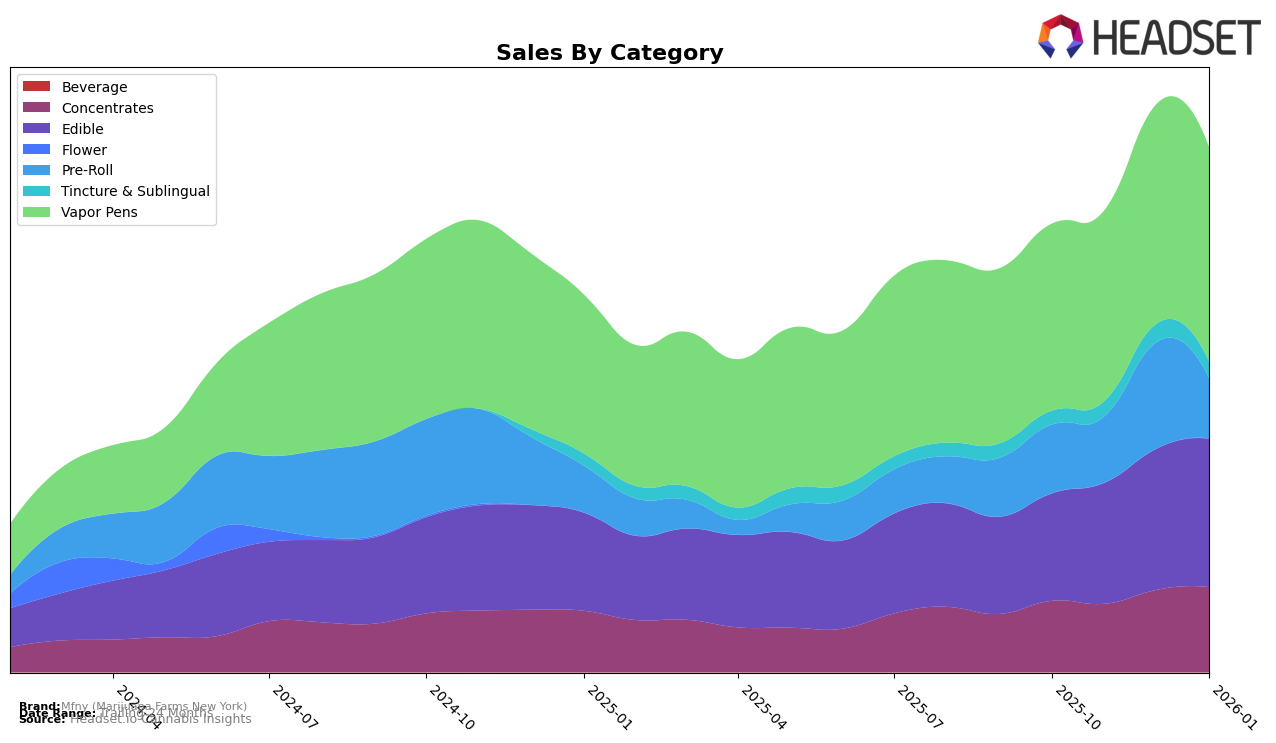

Mfny (Marijuana Farms New York) has shown consistent dominance in the New York concentrates market, maintaining the top position across several months from October 2025 to January 2026. This sustained leadership indicates a strong brand presence and consumer preference in this category. In the Edibles category, Mfny has also demonstrated impressive performance, consistently improving from sixth place in October 2025 to securing the fifth spot by January 2026. This upward movement in rankings suggests a growing recognition and possibly an expanding consumer base for their edible products. Meanwhile, their presence in the Pre-Roll category has been more volatile; despite a significant leap to sixth place in December 2025, they dropped back to twelfth by January 2026, indicating potential challenges or increased competition in this segment.

In the Tincture & Sublingual category, Mfny has maintained a steady third place from October 2025 through January 2026, showcasing stability and consistent consumer demand for these products. The Vapor Pens category also reflects a similar trend of stability, with Mfny holding a solid fourth place over the same period. This consistency in ranking suggests that their vapor pen offerings are well-received in the market. However, it's noteworthy that Mfny's presence is limited to New York, and they do not appear in the top 30 brands in any other states or provinces, which could either point to a strategic focus on their home state or a potential area for growth and expansion in the future.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Mfny (Marijuana Farms New York) consistently held the 4th rank from October 2025 to January 2026, indicating a stable position amidst strong competition. Notably, Ayrloom and Fernway maintained their 2nd and 3rd positions respectively, with Ayrloom showing a slight dip in sales from December to January, while Fernway experienced a sales increase in the same period. This suggests that while Mfny's sales grew notably from October to December, the brand needs to strategize to close the gap with these leading competitors. Meanwhile, Rove and Florist Farms swapped ranks between 5th and 6th, with Florist Farms overtaking Rove in January 2026. This dynamic shift highlights the competitive volatility below Mfny's position, emphasizing the importance for Mfny to innovate and maintain its market share in the New York vapor pen category.

Notable Products

In January 2026, Mfny (Marijuana Farms New York) saw the Blueberry x Turbo Blueberry Live Resin Gummies 8-Pack (80mg) rise to the top as the best-performing product, securing the number 1 rank with a notable sales figure of 7122. The Watermelon Lemonade x Candy Rain Live Resin Gummies 10-Pack (100mg) maintained a strong presence, climbing to the second position with increased sales compared to previous months. The Strawberry Mango x Honey Banana Gummies 10-Pack (100mg) made a significant entry, securing the third spot in its debut month. Meanwhile, the Pina Colada x Strawpaya Live Resin Gummies 10-Pack (100mg) held steady at fourth place, showing a slight decrease in sales. Lastly, the Pink Lemonade x Lemon Cane Live Resin Gummies 10-Pack (100mg) dropped to fifth place, experiencing a decline from its previous second-place position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.