Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

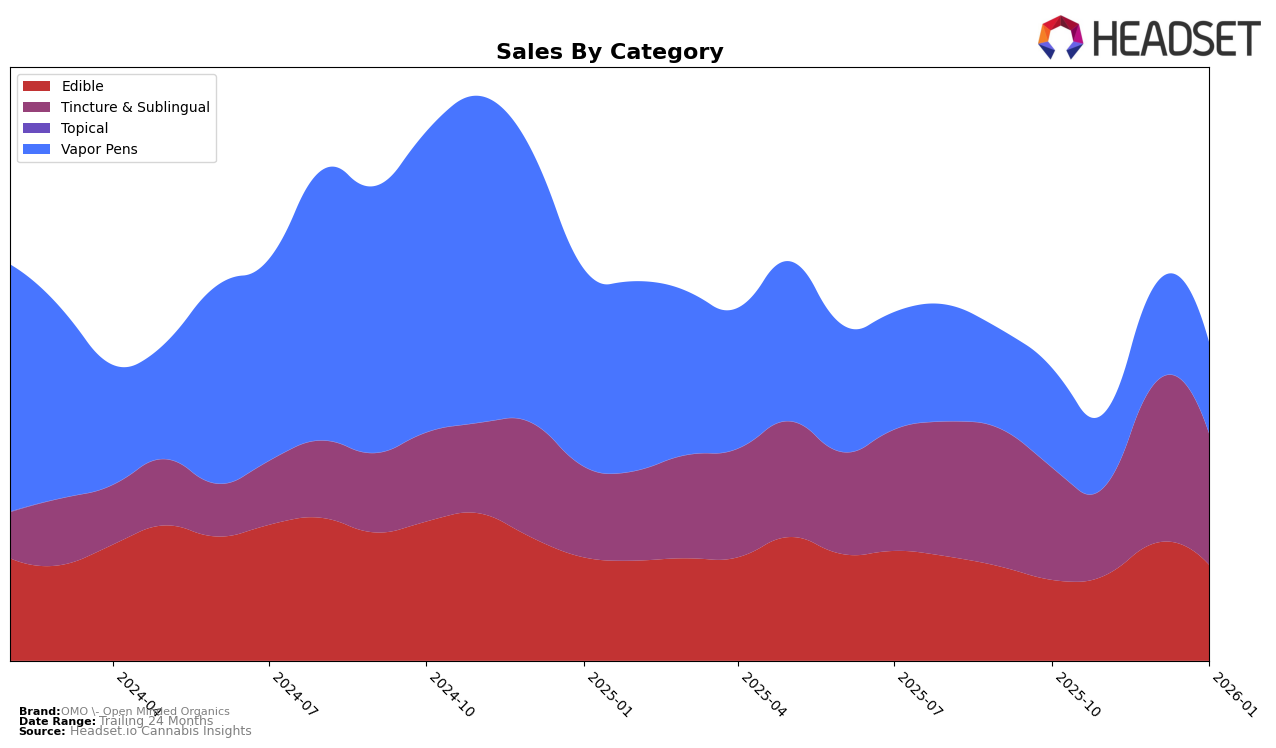

In the New York market, OMO - Open Minded Organics has shown varied performance across different product categories. Within the Edible category, the brand has struggled to break into the top 30, with rankings hovering in the 38 to 41 range over the last four months. This indicates a challenging competitive landscape in this segment, despite a notable sales bump in December. Conversely, the Tincture & Sublingual category has been a strong performer for OMO, consistently ranking within the top 7 and even reaching the 5th position in December and January. This suggests a strong consumer preference and brand presence in this category, likely contributing to robust sales figures.

The Vapor Pens category presents a different story for OMO in New York, where the brand's rankings have been outside the top 70, indicating a less dominant position. Despite this, there was a slight improvement in December and January, with rankings moving up from 80 to 74. This could suggest a gradual increase in brand acceptance or strategic adjustments in their product offerings or marketing efforts. The fluctuations in ranking and sales across these categories highlight the dynamic nature of consumer preferences and the competitive pressures within the New York cannabis market.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in New York, OMO - Open Minded Organics has experienced fluctuating rankings, reflecting a dynamic market position. Notably, OMO improved its rank from 7th in November 2025 to 5th by December 2025, maintaining this position into January 2026. This upward movement suggests a positive reception of their products during the holiday season, which could be attributed to strategic marketing or product innovation. However, OMO faces stiff competition from brands like Mfny (Marijuana Farms New York) and Veterans Choice Creations (VCC), which consistently held the 3rd and 4th ranks respectively, with sales figures significantly higher than OMO's. Meanwhile, High Falls Canna New York and Ithaca Organics Cannabis Co. have shown more volatility in their rankings, suggesting potential opportunities for OMO to capitalize on any market shifts. Overall, while OMO has demonstrated resilience and growth, maintaining and improving its market position will require strategic efforts to outpace these established competitors.

Notable Products

In January 2026, the top-performing product for OMO - Open Minded Organics was the Blueberry RSO Gummies 10-Pack (100mg) in the Edible category, maintaining its first-place rank from December 2025 with notable sales of 841 units. The Standardized DSO Infused Oil Tincture (1000mg THC, 30ml) continued to hold the second position within the Tincture & Sublingual category, showing consistent performance over the past months. Sleepy Strawberry RSO Gummies 10-Pack (100mg) ranked third, slipping from its previous top position in November 2025. Cherry Glurp RSO Distillate Cartridge (1g) improved its rank to fourth place from fifth in December 2025, indicating a positive upward trend. Notably, Maui Wowie Distillate Cartridge (1g) entered the rankings at fourth place, demonstrating strong sales potential in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.