Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

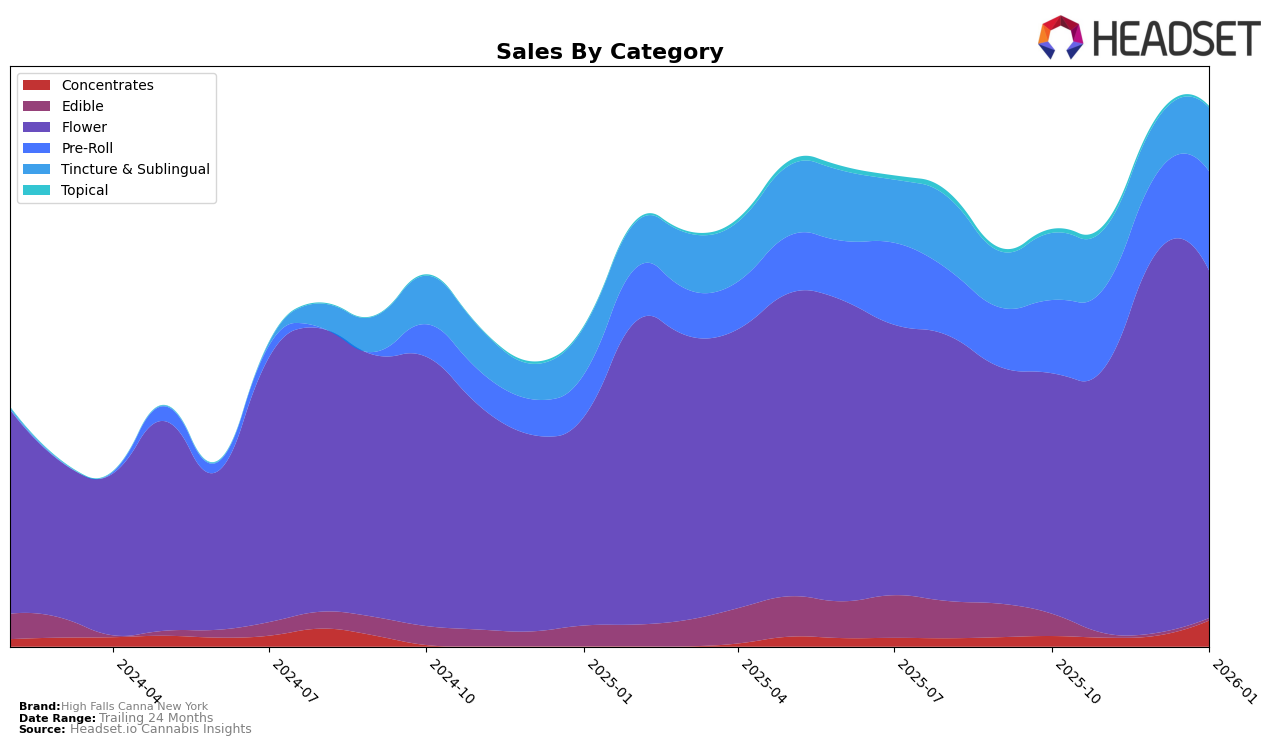

High Falls Canna New York has shown varied performance across different product categories in the New York market. In the Flower category, the brand maintained a relatively stable presence, ranking 50th in October 2025, improving to 47th in November, and reaching 41st in December, before dropping back to 50th in January 2026. This fluctuation suggests a competitive landscape where High Falls Canna New York is striving to maintain its position. In contrast, the Tincture & Sublingual category has been a stronghold for the brand, consistently maintaining a top 10 ranking throughout the months, indicating a solid consumer base and possibly a strong product offering in this category.

However, the brand's performance in other categories such as Concentrates and Edibles shows room for improvement. Notably, High Falls Canna New York did not make it into the top 30 for Concentrates during the last quarter, which could be seen as a challenge in gaining traction in this segment. Similarly, in the Edible category, their absence from the top ranks suggests a need to enhance their market strategy or product appeal. Meanwhile, the Pre-Roll category witnessed a positive trend with a rise from 85th in October to 73rd in January, indicating potential growth opportunities. These insights reveal a mixed performance that highlights both strengths and areas for potential strategic focus in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in New York, High Falls Canna New York has shown a fluctuating performance from October 2025 to January 2026. During this period, the brand's rank improved from 50th in October to 41st in December, before slipping back to 50th in January. This volatility in rank suggests a competitive pressure from brands like Heady Tree, which consistently maintained a higher rank, peaking at 32nd in December. Despite this, High Falls Canna New York outperformed UMAMII, which remained outside the top 50 for most of the period, and Flav, which saw a decline from 37th to 52nd. Notably, Kings & Queens entered the rankings in January at 48th, indicating a potential new competitor. High Falls Canna New York's sales trajectory showed a significant increase in December, aligning with its peak rank, but the subsequent drop in January highlights the need for strategic adjustments to maintain competitive positioning.

Notable Products

In January 2026, High Falls Canna New York's top-performing product was Blissful Blaze Kief Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking since October 2025 with sales of 1204 units. Frosted Mango (3.5g) emerged as the second top product in the Flower category, marking its first appearance in the rankings. Tanghulu (3.5g) improved its position, climbing from fifth in December 2025 to third in January 2026, with consistent sales growth. The Sativa Blend Pre-Roll 2-Pack (1g) entered the rankings at fourth place, while Bliss Drops Tincture (500mg THC, 15ml) debuted at fifth place. Notably, the rankings indicate a dynamic shift in consumer preferences towards new and diverse product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.