Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

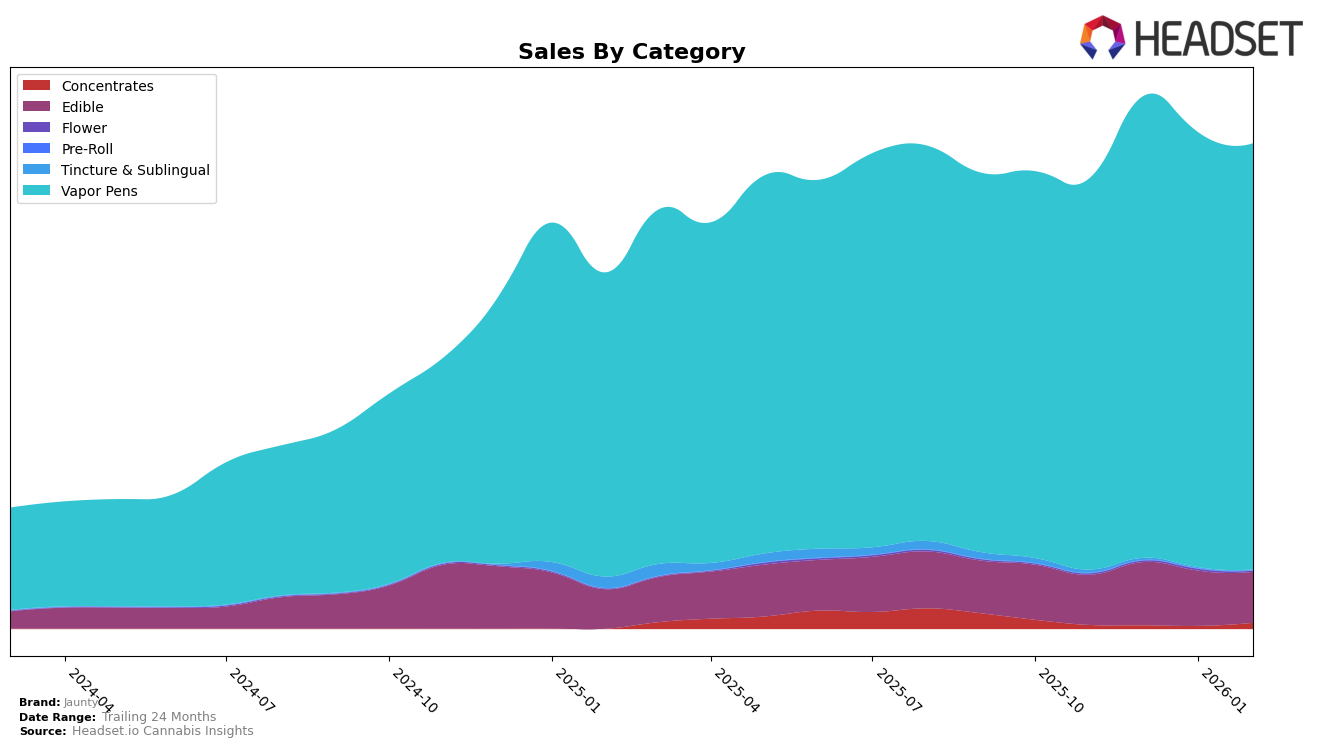

Jaunty has shown a steady presence in the New York market, particularly in the Vapor Pens category, where it has consistently held the number one position from November 2025 through February 2026. This consistent top ranking indicates a strong brand loyalty and market penetration in this category. In contrast, the Edible category tells a slightly different story. Jaunty's rank fluctuated between 9th and 11th place over the same period, peaking in December 2025 before dropping again by February 2026. This movement suggests that while Jaunty is a major player in the Edible market, there is room for growth and potential competition that could impact its future rankings.

The sales data for Jaunty in the New York market highlights an interesting trend: while the Vapor Pens category experienced a slight decrease in sales from December 2025 to February 2026, it still maintained its top ranking. This suggests that despite a dip in sales, Jaunty's dominance in Vapor Pens remains unchallenged. On the other hand, the Edible category witnessed a peak in sales in December 2025, followed by a decline in the subsequent months. This fluctuation in sales and ranking could imply seasonal demand variations or shifts in consumer preferences within the Edible category. Overall, Jaunty's performance across these categories underscores its stronghold in Vapor Pens while hinting at opportunities for growth and stabilization in Edibles.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in New York, Jaunty has consistently maintained its top position from November 2025 through February 2026, showcasing its strong market presence and consumer preference. Despite facing stiff competition from brands like Ayrloom and Fernway, which held steady ranks at second and third respectively, Jaunty's leadership in sales indicates a robust brand loyalty and effective market strategies. Ayrloom and Fernway, although close competitors, have not surpassed Jaunty, with Ayrloom consistently ranking second and Fernway third during this period. This consistent ranking suggests that while these brands are formidable, Jaunty's innovative offerings and strong customer base have helped it maintain its lead, making it a dominant force in the New York vapor pen market.

Notable Products

In February 2026, the top-performing product from Jaunty was the Classic - Sour Diesel Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank for four consecutive months with sales reaching 8,218 units. The Classic - Pineapple Express Oil Cartridge (1g) also held steady in the second position, consistent with its previous rankings. Notably, the Classic- Blueberry Kush Distillate Cartridge (1g) climbed to the third rank, improving from its fifth position in January 2026. The Classic- Wedding Cake Distillate Cartridge (1g) made its debut at rank four, while the Classic - Granddaddy Purple Distillate Cartridge (1g) re-entered the rankings at fifth place after being unranked in December and January. Overall, these shifts indicate a dynamic competitive landscape within Jaunty's Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.