Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

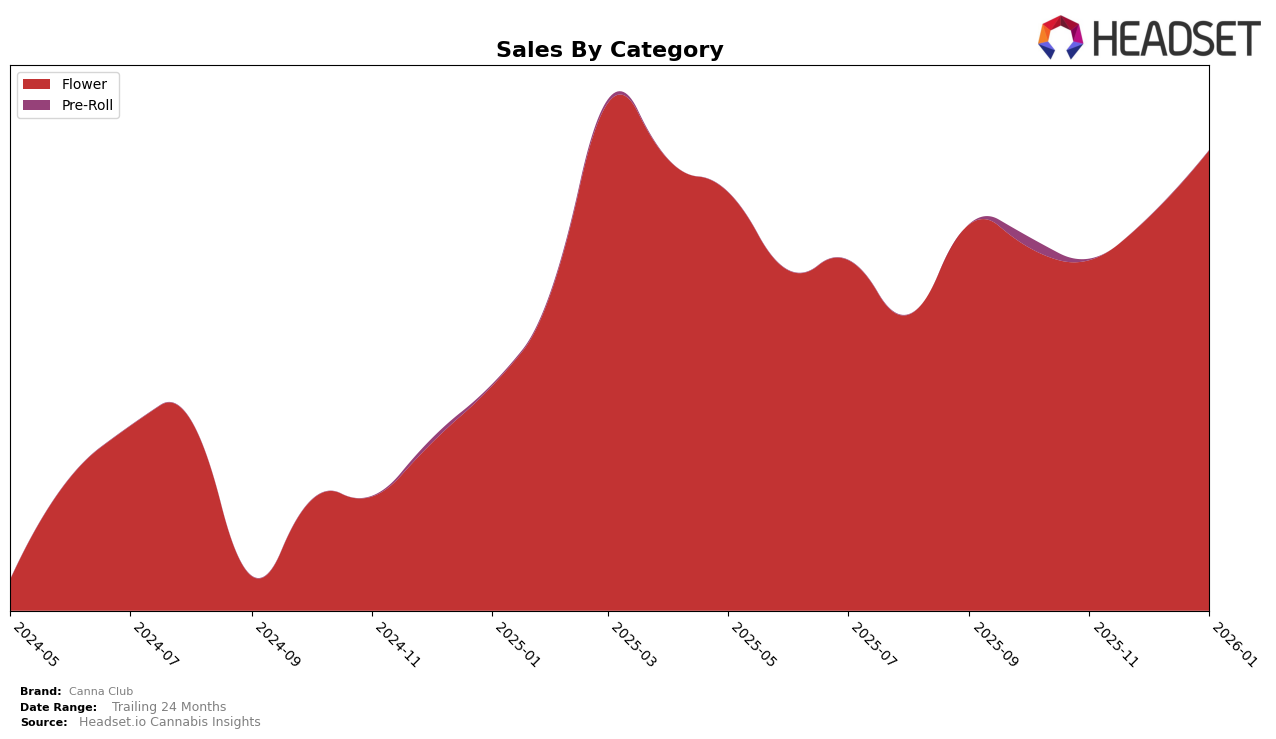

In the Colorado market, Canna Club has shown notable fluctuations in the Flower category rankings over the last few months. Starting at the 24th position in October 2025, the brand experienced a slight dip to 26th in November, only to regain its 24th position in December. By January 2026, Canna Club made a significant leap to the 17th position, reflecting a positive trend in its market performance. This upward movement suggests an increasing consumer preference or strategic market positioning by Canna Club, as evidenced by the rise in sales from approximately $305,351 in November to $401,281 in January.

The data indicates that Canna Club was not in the top 30 brands for any other category or state besides Colorado, which could be seen as a limitation in its market reach or category diversification. This absence from the top rankings in other areas might suggest either a focused strategy on the Flower category within Colorado or potential challenges in expanding its brand presence. The brand's ability to climb the rankings in Colorado's Flower category could serve as a foundation for further growth and expansion into other markets or categories in the future.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Canna Club has shown a promising upward trajectory in recent months. Starting from a rank of 24th in October 2025, Canna Club improved to 17th by January 2026, indicating a positive shift in market position. This improvement is noteworthy when compared to competitors like In The Flow, which experienced a decline from 5th to 15th place over the same period. Meanwhile, Dro maintained a relatively stable position, hovering around the 16th rank, suggesting consistent performance. Canna Club's sales growth aligns with this upward rank movement, contrasting with NOBO, which fluctuated significantly, dropping out of the top 20 in December 2025 before rebounding. This data highlights Canna Club's strengthening foothold in the market, potentially driven by strategic initiatives that resonate well with consumers, setting a foundation for continued growth amidst fluctuating competition.

Notable Products

In January 2026, Canna Club's top-performing product was Green Crack (Bulk) in the Flower category, achieving the highest rank with sales of 2729 units. Blue Dream (14g) maintained its strong performance, holding steady at the second rank from December 2025 to January 2026. Mac & Cheese (14g) entered the rankings in January 2026, tying for second place with Blue Dream (14g). Tribe Walker (7g) secured the third position, marking its first appearance in the top ranks. Headband Cookies (3.5g) slipped from second to fourth place compared to December 2025, despite an increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.