Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

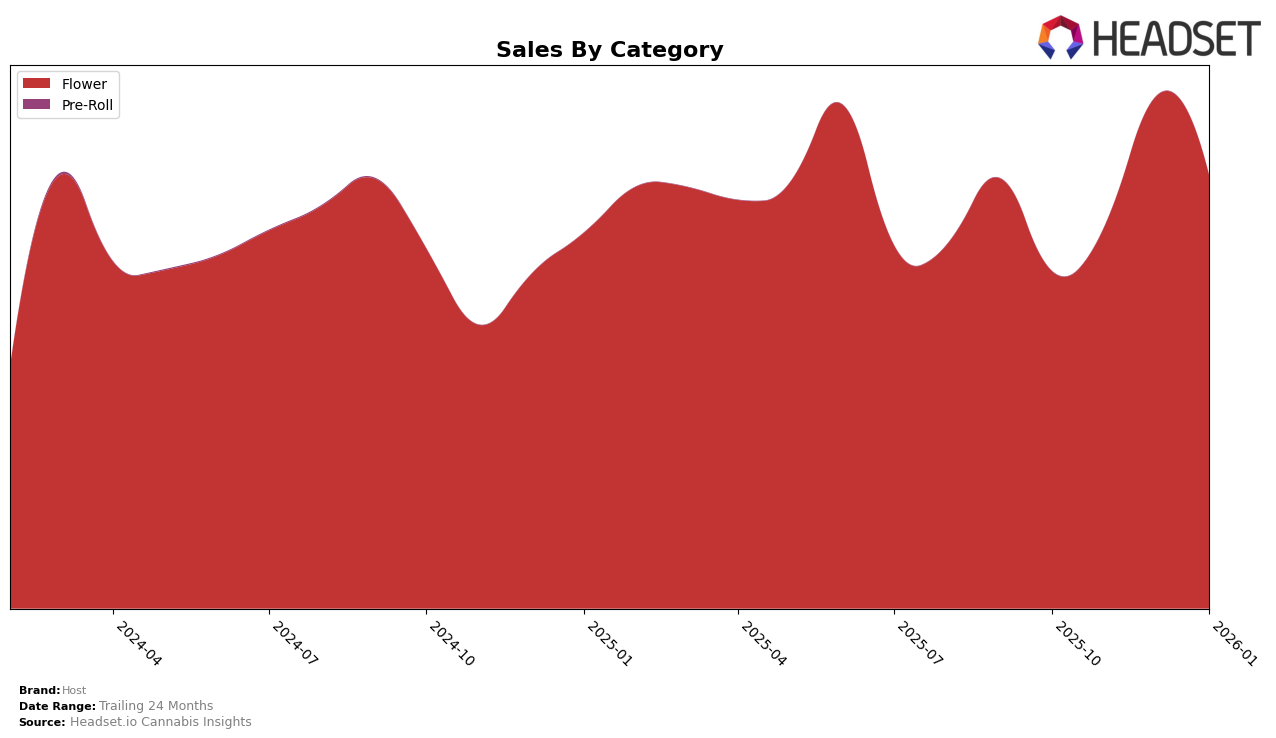

In the state of Colorado, Host has demonstrated a notable upward trajectory in the Flower category over the past few months. Starting from a rank of 30 in October 2025, the brand improved its position to 28 by November, and further climbed to 22 in December. However, there was a slight dip to 24 in January 2026. This movement indicates a strong performance in the market, particularly in December, where Host achieved its highest rank. The fluctuations in ranking suggest a competitive landscape, but Host's ability to break into the top 30 and maintain a presence highlights its growing influence in the Colorado Flower market.

Despite the positive trends in Colorado, it is worth noting that Host's absence from the top 30 rankings in other states and categories suggests areas for potential growth and expansion. The brand's concentrated success in Colorado's Flower category might indicate a strategic focus or a particular market fit that has yet to be replicated elsewhere. This presents both a challenge and an opportunity for Host to leverage its success in Colorado to explore and penetrate other markets and categories. Understanding the factors contributing to Host's performance in Colorado could provide valuable insights for replicating success in other regions.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Host has demonstrated notable resilience and growth. From October 2025 to January 2026, Host improved its rank from 30th to 24th, showcasing a steady climb in a competitive market. This upward trend in ranking is mirrored by its sales performance, which peaked in December 2025. In comparison, Pot Zero experienced a significant fluctuation, starting at 43rd in October 2025 and improving to 23rd by January 2026, indicating a volatile yet upward trajectory. Meanwhile, The Organic Alternative and Lost in Translation (LIT) both showed a slight decline in rank by January 2026, suggesting a potential opportunity for Host to capitalize on its competitors' stagnation. Notably, Grateful Grove made a remarkable leap from 67th to 22nd, which could pose a future challenge for Host if this trend continues. Overall, Host's consistent performance and strategic positioning in the market highlight its potential for sustained growth amidst dynamic competition.

Notable Products

In January 2026, Host's top-performing product was Cherry Slimeade 1g in the Flower category, securing the number one rank with sales of 1229 units. Following closely, Strawberry Jamz Bulk also in the Flower category, achieved the second position with notable sales figures. BrrBerry 3.5g, which previously held the second spot in November 2025, ranked third in January 2026, indicating a slight decline in its position over the months. Gelato Cake 3.5g, which was third in December 2025, dropped to fourth place. Cap Junky 3.5g entered the rankings in January 2026 at fifth place, showcasing a strong performance as a new entrant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.