Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

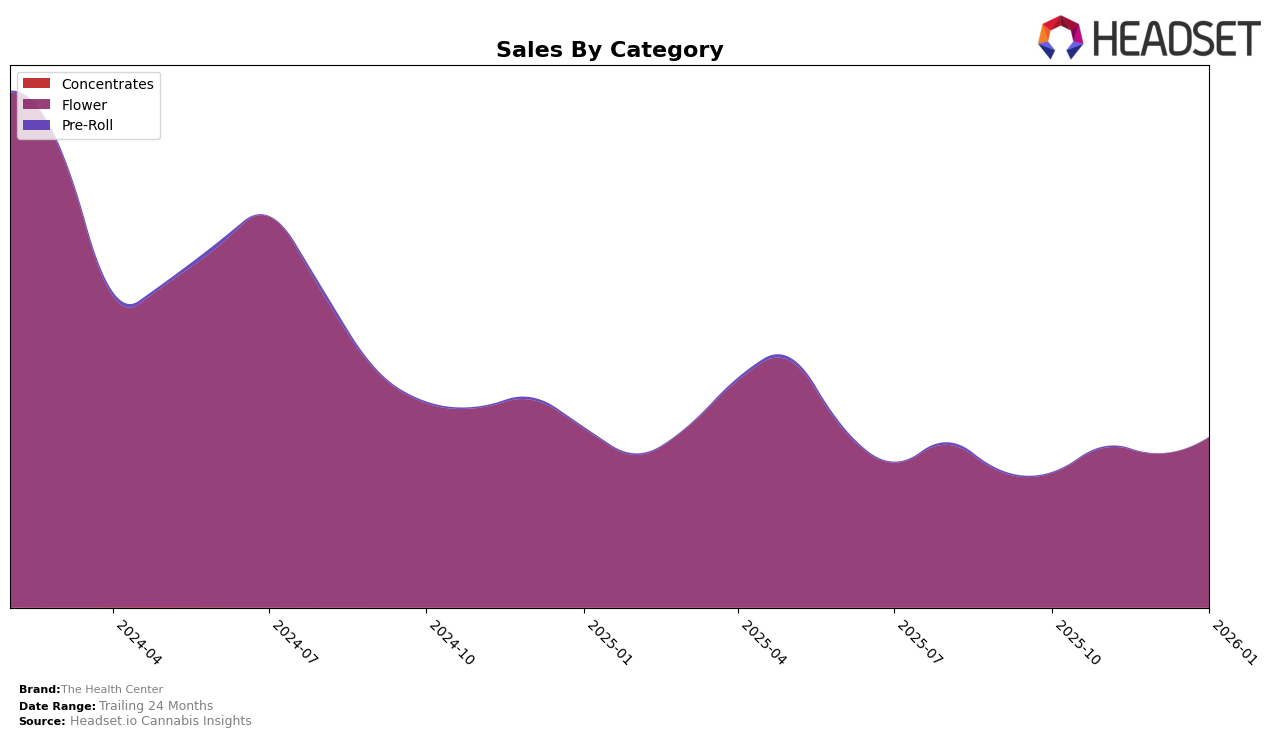

The Health Center has shown a notable upward trajectory in the Flower category within Colorado. Starting from a position outside the top 30 in October 2025, the brand made significant strides, breaking into the 28th position by January 2026. This progress is underscored by a steady increase in sales over the months, indicating a growing consumer preference and market presence. The brand's ability to climb into the top 30 is a positive indicator of its strengthening foothold in the Colorado market, suggesting effective strategies in product offerings or market engagement.

While The Health Center's performance in Colorado's Flower category is commendable, the absence of ranking data for other states or categories suggests that the brand's influence might be predominantly localized or not as robust in other markets. This could be seen as a limitation if the brand aims for broader geographical expansion or category diversification. However, the current upward trend in Colorado could serve as a model for potential growth strategies in new territories or product lines. Observing how The Health Center leverages its momentum in Colorado could provide insights into its future performance across different states and categories.

Competitive Landscape

In the competitive landscape of the Colorado flower category, The Health Center has shown a promising upward trajectory, climbing from a rank of 36 in October 2025 to 28 by January 2026. This improvement in rank is indicative of a positive trend in sales, as evidenced by a steady increase from October to January. In contrast, LoCol Love (TWG Limited) experienced fluctuations, peaking at 19 in November before dropping to 30 in January, suggesting potential volatility in their market position. Meanwhile, Summit and The Organic Alternative maintained relatively stable positions, with Summit consistently ranking higher than The Health Center but showing a downward trend from 23 to 27. Interestingly, Mischief, which was absent from the top 20 in October, made a significant leap to rank 29 by January, indicating a potential emerging competitor. These dynamics highlight The Health Center's growing presence in the market, positioning it as a brand to watch in the coming months.

Notable Products

In January 2026, Honeymoon Diesel Popcorn (7g) emerged as the top-performing product for The Health Center, regaining its first-place rank with sales reaching 3,497 units. This product swapped places with Honeymoon Diesel (7g), which moved to second place after leading in December 2025. Strawberry Nightmare Popcorn (7g) consistently held the third position across several months, while Strawberry Nightmare (7g) climbed to fourth place, showing a resurgence in popularity. Chem Lemons Popcorn (7g) re-entered the top five, ranking fifth, despite not appearing in the top rankings for the past few months. Overall, the Flower category dominated the sales landscape for The Health Center during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.