Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

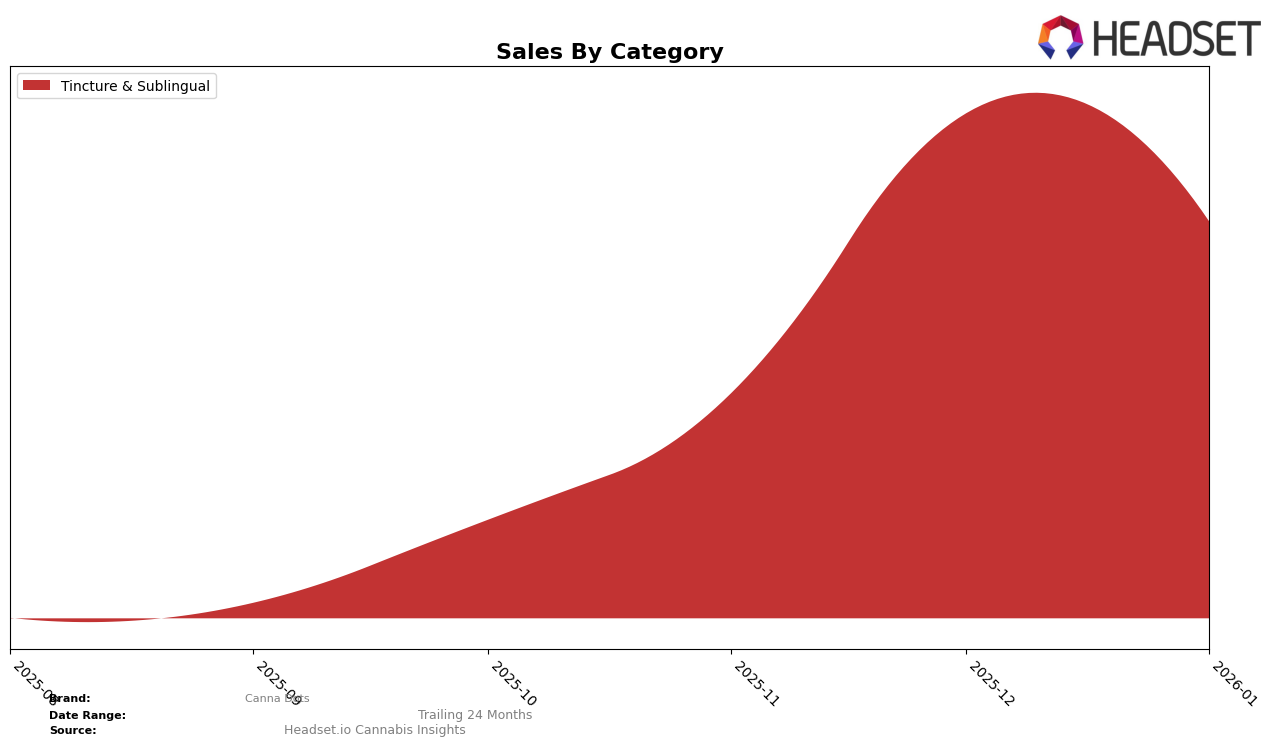

Canna Dots has shown a notable performance in the Tincture & Sublingual category in New York. While the brand did not make it to the top 30 rankings in October and November 2025, it made a significant leap by December 2025, securing the 12th position. This upward trajectory indicates a growing recognition and acceptance of their products in the state, suggesting successful marketing strategies or an increase in consumer demand. The absence from the rankings in the earlier months could have been due to increased competition or limited market penetration at that time.

The movement into the top 15 by December 2025 is a positive indicator of Canna Dots' potential in the New York market. The fact that they were not in the top 30 in October and November highlights the competitive nature of the category, but their eventual breakthrough suggests a strategic advantage or a shift in consumer preferences. This kind of performance in a major market is crucial for understanding how the brand might expand its footprint in other states or categories in the future. Observing how Canna Dots manages to maintain or improve this ranking in the coming months will be key to assessing its long-term success.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in New York, Canna Dots has shown a notable improvement by entering the rankings in December 2025 at 12th place, a position it maintained into January 2026. This marks a significant rise for Canna Dots, as it was absent from the top 20 in the preceding months. Meanwhile, Jumbodose experienced a decline, dropping from 11th place in October 2025 to falling out of the top 20 by December 2025. Chime & Chill maintained a steady presence, hovering around the 12th to 13th positions throughout the same period. This shift in rankings suggests that Canna Dots is gaining traction and potentially capturing market share from its competitors, particularly as Jumbodose's sales have decreased significantly since October 2025. These dynamics indicate a positive trend for Canna Dots, positioning it as an emerging player in the New York market.

Notable Products

In January 2026, the top-performing product from Canna Dots was Blueberry Sublinguals Dots 20-Pack (100mg), which rose to the number one rank with sales reaching 135 units. Cherry Sublinguals Dots 20-Pack (100mg) maintained a strong position, holding steady at rank two, though its sales decreased from December 2025. Orange Sublingual Dots 20-Pack (100mg), previously the top performer for three consecutive months, dropped to the third position. Unflavored Sublinguals 40-Pack (100mg) saw a decline in its ranking from third to fourth place, reflecting a decrease in sales performance. Overall, January witnessed a reshuffling in product rankings, highlighting a shift in consumer preferences within the Tincture & Sublingual category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.