Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

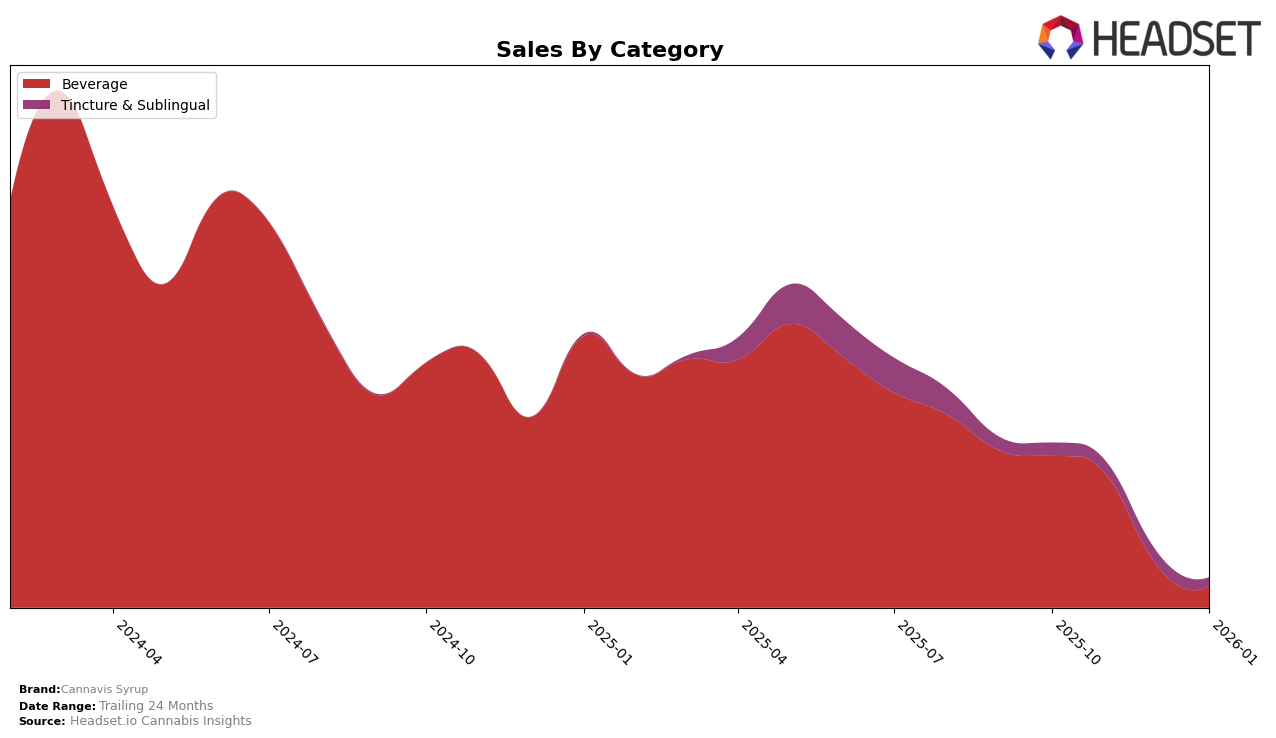

Over the last few months, Cannavis Syrup has experienced fluctuating performance across different categories and states, particularly in the Beverage category. In California, Cannavis Syrup maintained a steady position at rank 13 in both October and November of 2025. However, by December, the brand's ranking dropped to 22, and it fell out of the top 30 by January 2026. This decline in ranking correlates with a noticeable drop in sales from October to December, indicating potential challenges in maintaining market presence in California's competitive beverage category.

The absence of Cannavis Syrup in the top 30 rankings by January 2026 in California's beverage market could be seen as a point of concern, suggesting that the brand may need to reassess its strategies to regain traction. The significant drop in sales from November to December, where sales plummeted to just over $11,000, highlights the volatility and competitive nature of the market. This trend underscores the importance of strategic planning and market adaptation for brands like Cannavis Syrup to sustain and improve their standings across key states and categories.

Competitive Landscape

In the competitive landscape of the California beverage category, Cannavis Syrup has experienced notable fluctuations in its market position, reflecting broader trends and competitive pressures. As of October 2025, Cannavis Syrup held a solid 13th rank, maintaining this position into November. However, by December, it dropped to 22nd, and by January 2026, it was no longer in the top 20, indicating a significant decline in market presence. This downward trend contrasts with competitors like Cannalean, which entered the top 20 in December and maintained its position in January, and Hundo, which showed consistent performance around the 21st and 22nd ranks throughout the same period. Meanwhile, High Power also demonstrated resilience, re-entering the top 20 by January. These shifts suggest that while Cannavis Syrup initially held a competitive edge, its decline in rank and sales highlights the dynamic nature of the market and the need for strategic adjustments to regain its footing against rising competitors.

Notable Products

In January 2026, Cherry Extra Strength Syrup (500mg THC) emerged as the top-performing product for Cannavis Syrup, climbing from the fourth position in December 2025 to first, with sales reaching 149 units. Pineapple Extra Strength Syrup 2-Pack (1000mg) maintained its second-place ranking, showing consistent performance since November 2025. Watermelon Extra Strength Syrup 2-Pack (1000mg THC, 6.7oz) fell to third place from its initial top position in October 2025, indicating a decline in its sales momentum. Blue Raspberry Tincture 2-Pack (1000mg) entered the rankings in fourth place, marking its debut in the top products list. Pineapple Extra Strength Syrup (500mg THC, 2oz) also appeared in the rankings for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.