Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

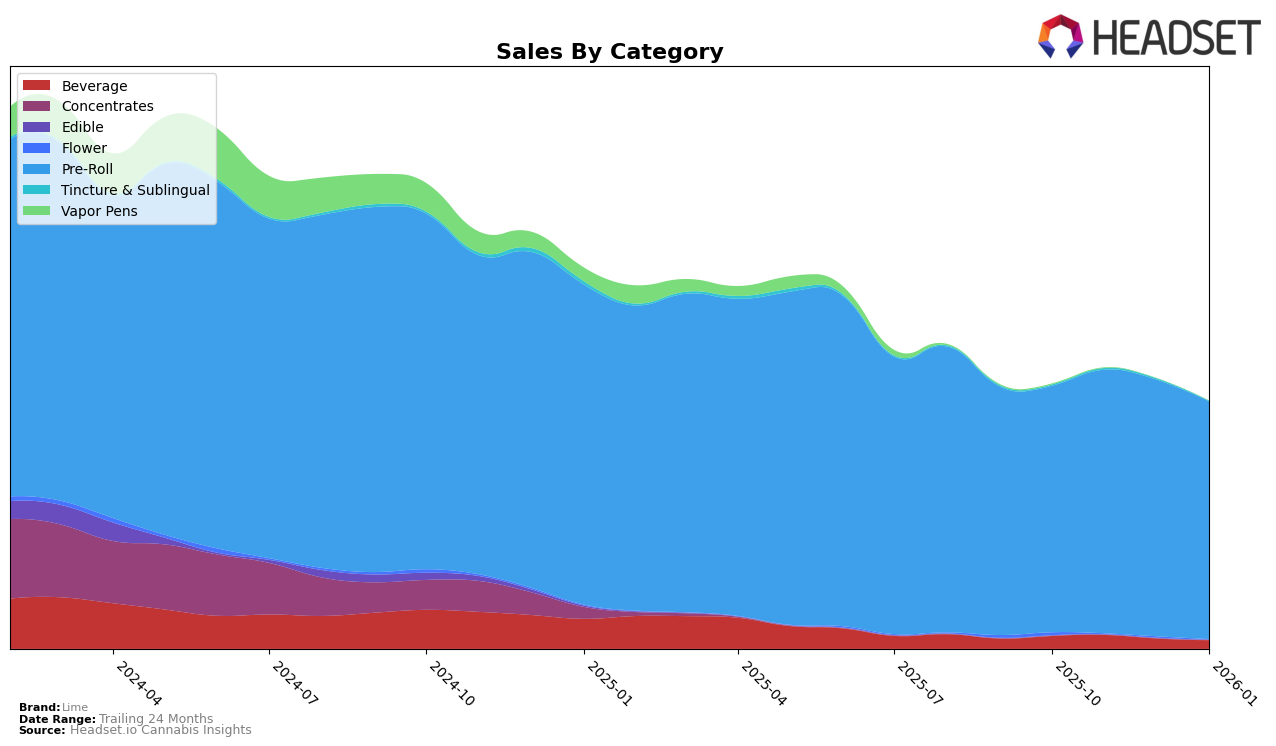

In the state of California, Lime has shown consistent performance across its product categories. In the Beverage category, Lime maintained its position, ranking at 11th for October, December, and January, with a slight improvement to 10th place in November. This stability in ranking, despite a decrease in sales from November to January, suggests a resilient market presence. On the other hand, in the Pre-Roll category, Lime consistently held the 13th position in October and November, before slipping slightly to 14th in December and January. The brand's ability to remain within the top 15 in both categories indicates a solid foothold in the competitive California market.

Notably, Lime's performance did not place it within the top 30 brands in other states or provinces across these categories during the same period, which could be seen as a limitation to their market reach beyond California. This absence from the rankings in other regions highlights potential areas for growth and expansion. The brand's concentrated success in California suggests that while they have a strong presence locally, there is significant room for Lime to explore and penetrate new markets. These insights could be pivotal for stakeholders looking to understand Lime's market dynamics and potential growth strategies.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Lime has experienced a slight decline in its ranking, moving from 13th place in October and November 2025 to 14th place in December 2025 and January 2026. This downward trend in rank is accompanied by a decrease in sales from November 2025 to January 2026. In contrast, Caviar Gold maintained a steady 12th rank until January 2026, when it slipped to 13th, while Heavy Hitters consistently held the 10th position through December 2025 before dropping to 12th in January 2026. Notably, Birdies showed a significant upward trajectory, climbing from 32nd in October 2025 to 15th by January 2026, indicating a strong growth trend that could pose a competitive threat to Lime. Meanwhile, Sparkiez experienced a slight fluctuation in its ranking, ending at 16th in January 2026. These dynamics suggest that while Lime faces challenges in maintaining its rank and sales, emerging competitors like Birdies are gaining momentum in the market.

Notable Products

In January 2026, Lime's top-performing product was the Gushers Infused Pre-Roll (1.75g) in the Pre-Roll category, which ascended to the first rank with sales of $4,496. The Lil' Lime - Purple Zaza Diamond And Hash Infused Pre-Roll (0.6g) debuted strongly at the second position. The Lil' Limes - Gushers Live Resin Hash Infused Mini Pre-Roll 5-Pack (3g) maintained its third place from December 2025. Meanwhile, the Lil' Limes - Alien Gas Live Resin Hash Infused Pre-Roll 5-Pack (3g) experienced a slight drop, moving from third in November to fourth in January. Notably, the King Louis XIII Live Resin Hash Infused Pre-Roll (1.75g) saw a significant decline, falling from first in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.