Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

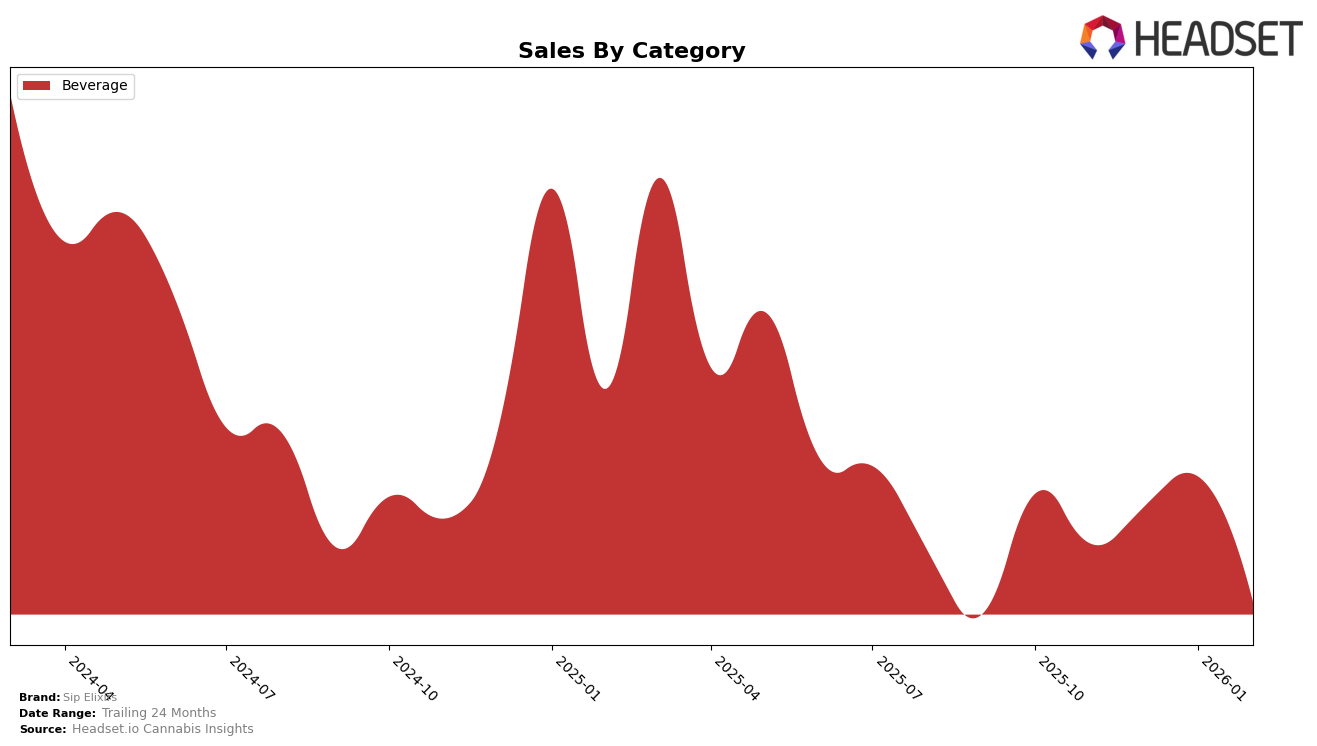

In Arizona, Sip Elixirs has demonstrated a strong performance in the beverage category, consistently holding the second position from November 2025 to February 2026, except for a brief rise to the top spot in January 2026. This stability in ranking is indicative of a robust market presence and consumer loyalty in the state. The sales figures show a slight decline from January to February, suggesting potential seasonal factors or increased competition. Meanwhile, in Nevada, Sip Elixirs has maintained its dominance as the leading brand in the beverage category, consistently ranking first throughout the same period. This sustained top position, coupled with an overall upward trend in sales from November to January before a slight dip in February, underscores the brand's strong foothold and growth potential in the Nevada market.

Conversely, the performance of Sip Elixirs in California presents a more challenging scenario. The brand has seen a decline in its ranking, dropping from 12th place in November 2025 to 15th in December, and maintaining that position in January 2026 before falling out of the top 30 in February. This downward trend in both ranking and sales may indicate increased competition or a shift in consumer preferences within the California market. The absence from the top 30 in February highlights the need for strategic adjustments to regain traction. The contrasting performances across these states highlight the dynamic nature of the cannabis beverage market and the varying consumer demands in different regions.

Competitive Landscape

In the Nevada beverage category, Sip Elixirs has maintained a dominant position, consistently ranking first from November 2025 through February 2026. This leadership is notable given the stable performance of competitors like Keef Cola and HaHa, which have both held steady at second and third positions, respectively, during the same period. Despite the consistent ranks, Sip Elixirs has demonstrated a robust upward trend in sales, peaking in January 2026 before a slight dip in February. In contrast, Keef Cola and HaHa have experienced fluctuations, with HaHa seeing a notable decline in February. This suggests that while Sip Elixirs continues to capture consumer interest and expand its market share, its competitors are struggling to keep pace, highlighting the brand's strong market positioning and potential for future growth.

Notable Products

In February 2026, the top-performing product from Sip Elixirs was Party - Hurricane Elixir (100mg), maintaining its number one rank for four consecutive months with a sales figure of 13,408. Party - Electric Lemon Elixir (100mg) consistently held the second position from December 2025 through February 2026. Sleep - Wild Berry Elixir (100mg) remained steady at third place, showing a slight increase in sales compared to January 2026. The CBN/THC 2:1 Sleep Dreamberry Elixir (100mg CBN, 50mg THC) dropped to fourth place after having reached third in January 2026. Sunset Punch Elixir (100mg) re-entered the rankings at fifth place for February 2026, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.