Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

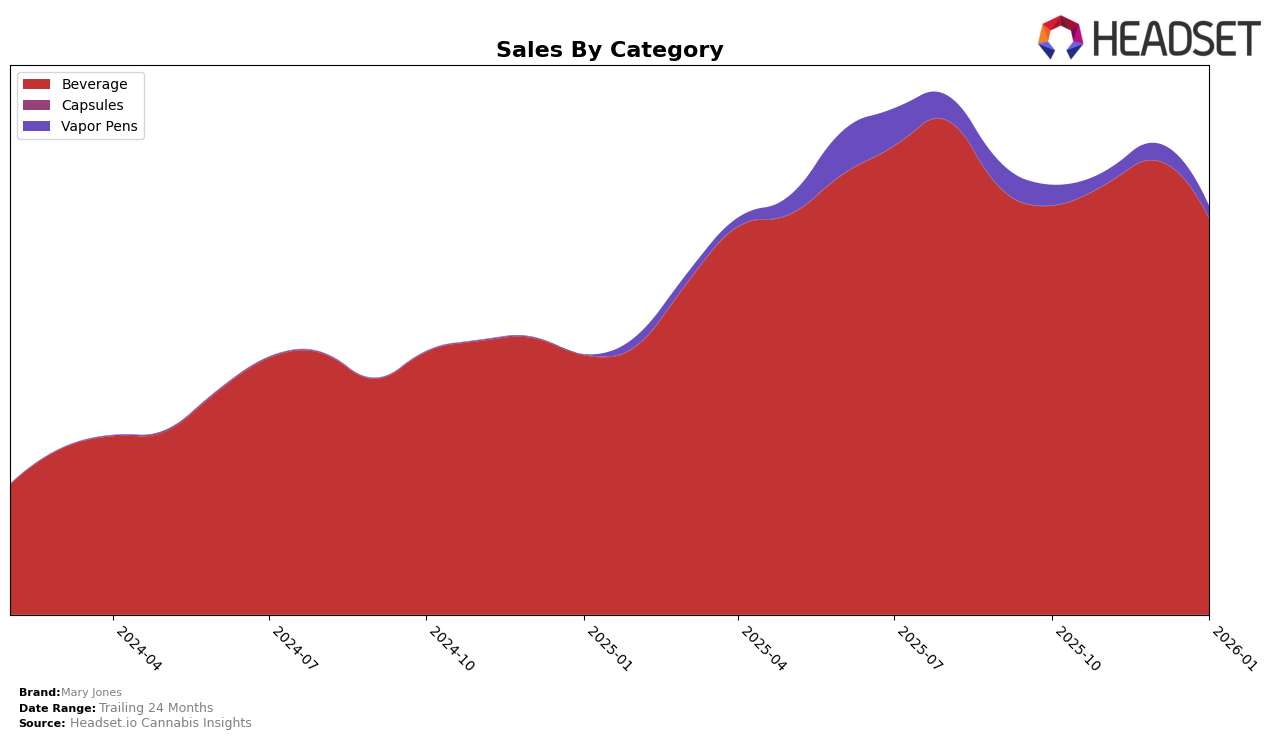

Mary Jones has demonstrated a strong and consistent performance in the beverage category across several markets, maintaining a top-tier presence. In Michigan, the brand has held the number one spot consistently from October 2025 to January 2026, showcasing its dominance and consumer preference in the region. Similarly, in Alberta, Mary Jones has consistently ranked fourth over the same period, indicating a stable market position. However, the brand's performance in Missouri has seen a decline, dropping from fifth to eighth place, which might suggest increasing competition or changing consumer preferences. Meanwhile, in British Columbia, the brand was not in the top 30 in October 2025 but managed to climb to the sixth position by November, maintaining a strong presence through January 2026.

In contrast, Mary Jones' performance in the vapor pens category in Alberta shows a different trend. The brand has not managed to break into the top 30 rankings, with positions hovering around the late 50s and early 60s from November 2025 to January 2026. This suggests that while Mary Jones has a solid foothold in beverages, it faces challenges in gaining traction within the vapor pens market. The brand's beverage category performance in Ontario has been relatively stable, with a slight dip from eighth to ninth place in January 2026, indicating a competitive landscape. Meanwhile, in Saskatchewan, Mary Jones has consistently held the second position, reflecting a strong market presence and consumer loyalty in the beverage sector.

Competitive Landscape

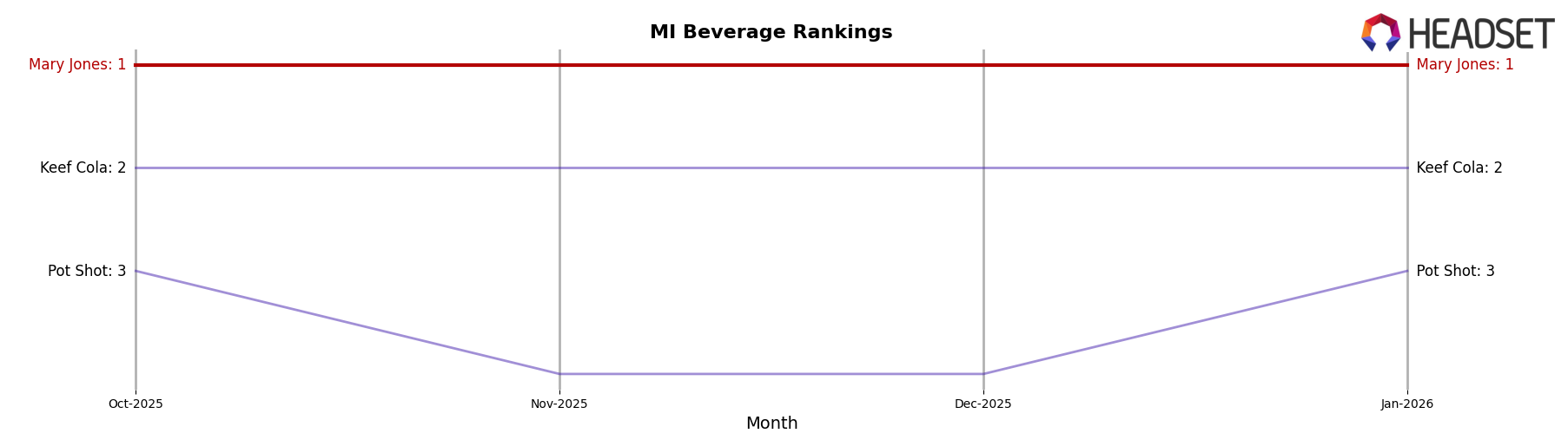

In the Michigan beverage category, Mary Jones has maintained a strong lead, consistently holding the number one rank from October 2025 through January 2026. This steady performance highlights its dominance in the market, despite a slight dip in sales from November to January. Meanwhile, Keef Cola has remained a consistent runner-up in the rankings, holding the second position throughout the same period, although its sales saw a notable decline in January 2026. Pot Shot experienced some rank fluctuations, dropping to fourth place in November and December, but rebounded to third in January with an increase in sales. These dynamics suggest that while Mary Jones continues to lead, the competition is actively vying for market share, particularly as Keef Cola and Pot Shot adjust their strategies to challenge Mary Jones' top position.

Notable Products

In January 2026, the top-performing product for Mary Jones was Zero Berry Lemonade Soda (10mg THC, 12oz, 355ml), maintaining its leading position from the previous two months, with sales reaching 18,332 units. Berry Lemonade Soda (100mg THC, 12oz, 355ml) consistently held second place, showing stable performance over the months. Green Apple Soda (100mg THC, 12oz, 355ml) remained in third place, despite a slight decrease in sales compared to previous months. MF Grape Soda (100mg THC, 12oz, 355ml) and Root Beer Soda (100mg THC, 16oz) continued to rank fourth and fifth, respectively, with MF Grape Soda experiencing a slight increase in sales over the period. Overall, the Beverage category displayed consistent rankings, with Zero Berry Lemonade Soda leading the charge for Mary Jones.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.