Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

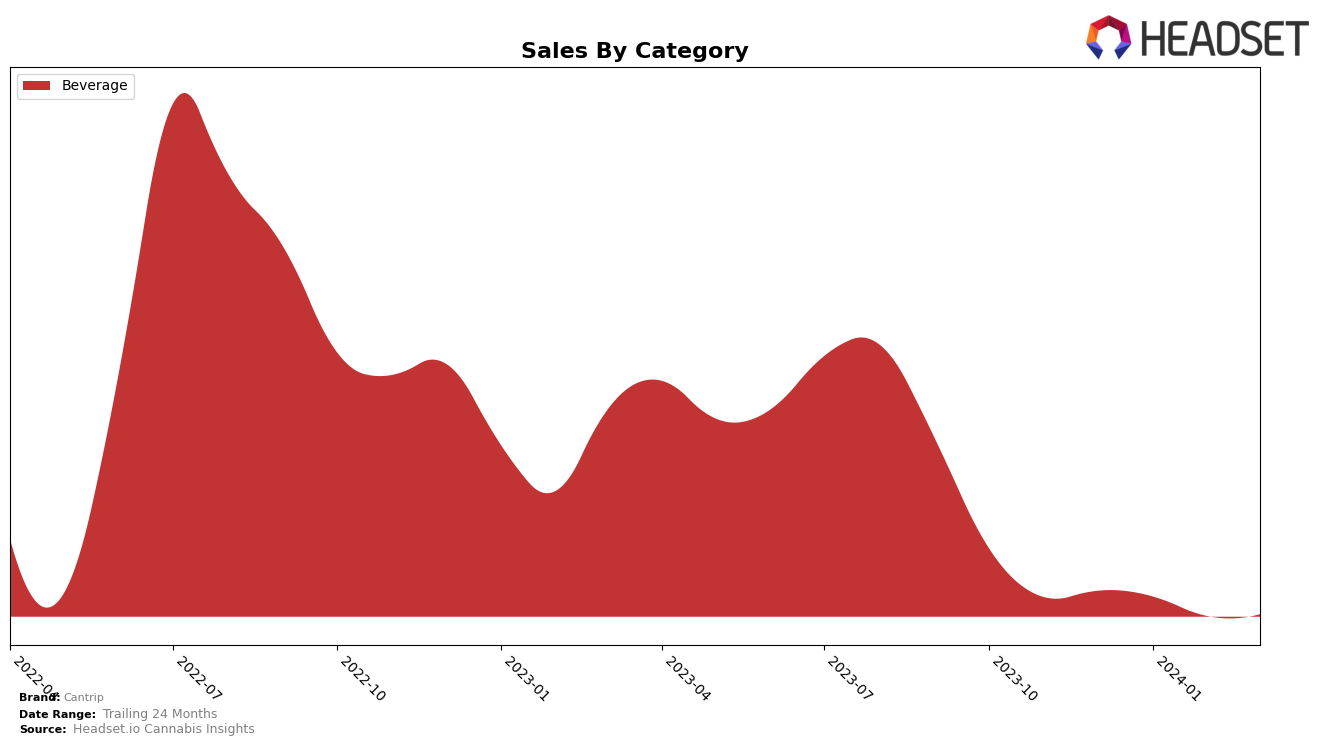

In Massachusetts, the Cantrip brand has shown a fluctuating performance in the Beverage category over the observed period. Initially holding the 18th rank in December 2023 and January 2024, it experienced a slight decline to the 23rd position in February 2024 before partially recovering to the 21st spot in March 2024. This trajectory suggests a competitive challenge in maintaining its market standing amidst the crowded Massachusetts cannabis beverage space. Notably, the sales figures reveal a significant drop in February 2024 to 3624.0, down from 11876.0 in December 2023, before a modest recovery in March. This dip and subsequent partial recovery in sales and ranking could indicate market dynamics such as seasonal demand fluctuations or changes in consumer preference impacting Cantrip's performance.

While specific details on Cantrip's performance across other states or provinces are not provided, the data from Massachusetts alone offers valuable insights into the brand's market dynamics within the Beverage category. The initial stable ranking followed by a drop and a slight recovery suggests that Cantrip may be facing stiff competition or encountering challenges in solidifying its market presence. The sales figures, with only one detailed, hint at potential volatility in consumer demand or possibly strategic adjustments by Cantrip in response to market conditions. This pattern of performance highlights the importance of strategic agility and market adaptation for brands operating in the highly competitive and rapidly evolving cannabis industry. However, without more comprehensive data across different states or categories, the broader performance of Cantrip remains partially obscured, inviting further investigation into its strategies and market positioning.

Competitive Landscape

In the competitive landscape of the beverage category in Massachusetts, Cantrip has experienced fluctuations in its market positioning from December 2023 through March 2024. Initially ranked 18th in December, Cantrip maintained its position in January but fell to 23rd in February before slightly recovering to 21st in March. This trajectory suggests a challenging period for Cantrip, particularly in February, where it saw a significant drop in rank, possibly due to a decrease in sales volume during that month. Competitors such as Bubby's Baked and Zenith have shown more stability or improvement in their rankings, with Bubby's Baked moving from 15th to 19th and Zenith entering the top 20 in March at 20th position. This indicates a highly competitive market where even small changes in sales or marketing strategies can lead to notable shifts in brand rankings. Cantrip's performance, while facing challenges, also highlights the brand's resilience and potential for recovery, as seen in its slight rank improvement in March. The presence of other competitors like Ocean Breeze and Upstate Elevator Operators, fluctuating at the lower end of the ranking, further emphasizes the competitive dynamics within this category, where brands continuously vie for consumer attention and market share.

Notable Products

In March 2024, Cantrip's top-selling product was the Orange Soda 4-Pack (20mg) in the Beverage category, with impressive sales figures reaching 638 units. Following closely behind in rankings were Root Beer (5mg THC, 355ml, 12 fl oz) and Orange Soda (5mg THC, 355ml, 12 fl oz), securing the second and third positions, respectively. Notably, the Orange Soda 4-Pack (20mg) maintained its top position from February 2024, showcasing consistent consumer preference. The Blackberry Lavender Seltzer (5mg THC, 12oz) and CBD/THC Grapefruit Hibiscus Seltzer 4-Pack (8mg CBD, 12mg THC) also made it to the list, ranking fourth and fifth, indicating a diverse interest in Cantrip's beverage offerings. This analysis underscores the popularity of Cantrip's beverage line, with a particular emphasis on flavored sodas, and reveals a stable demand for the Orange Soda 4-Pack (20mg) across consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.