Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

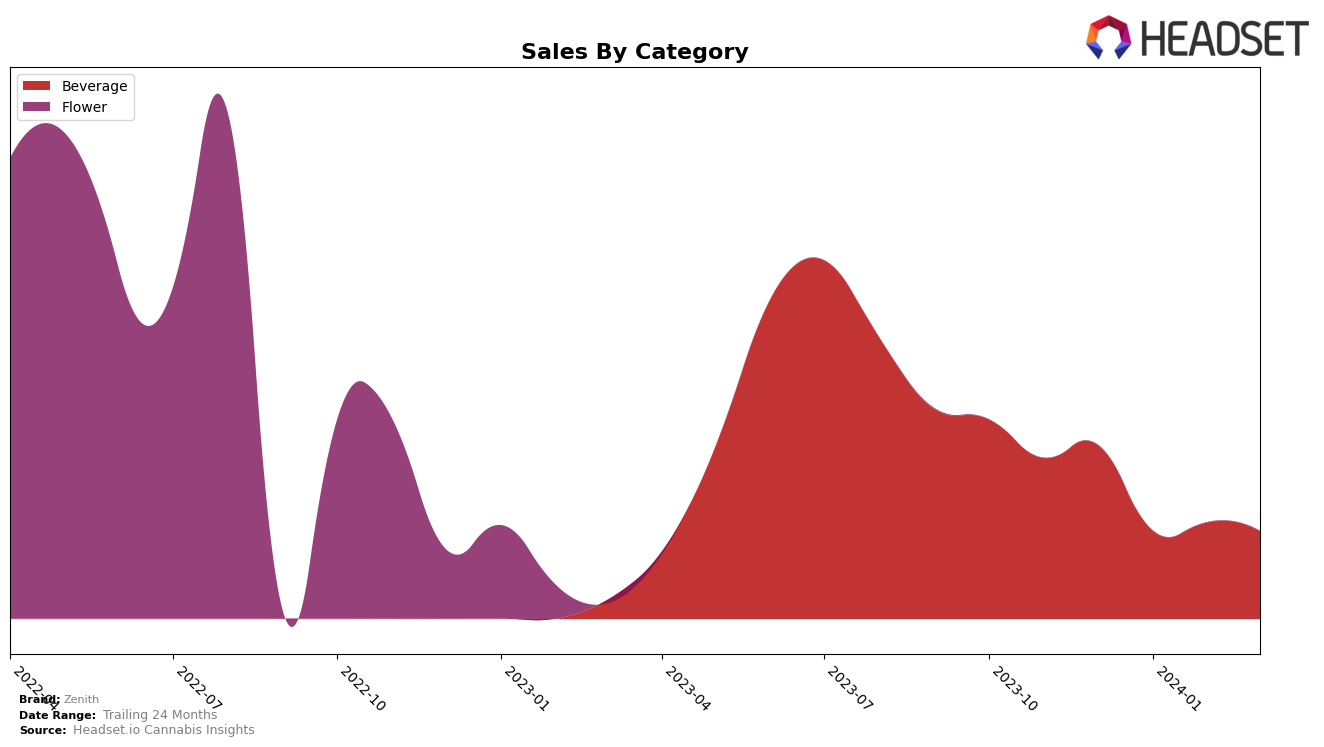

In Massachusetts, the cannabis brand Zenith has shown a consistent performance within the Beverage category, maintaining a presence within the top 30 brands over the last four months. Starting from December 2023, Zenith ranked 21st and saw a slight dip in January 2024, moving down to 23rd place. However, the brand managed to regain some ground in the following months, inching back up to 21st in February and then to 20th in March 2024. This upward trajectory, albeit modest, indicates a positive reception and growing consumer interest in Zenith's beverage offerings within the state. Notably, despite fluctuations in rankings, Zenith's ability to stay within the competitive landscape of the top 30 brands highlights its resilience and potential for growth in the Massachusetts market.

While specific sales figures for each month show variations, with a notable decrease from December 2023's sales of $9606 to a lower figure in January 2024, it's essential to focus on the broader picture of Zenith's market performance. The fluctuation in sales and rankings suggests that while Zenith faces challenges, it also has opportunities to capitalize on its market position. The brand's slight improvement in rankings from February to March 2024, moving from 21st to 20th place, could indicate a strategic response to market demands or successful marketing efforts. However, the absence of Zenith in the top rankings for other states or provinces, as well as other categories, may suggest a focused or limited market presence. This concentrated effort in Massachusetts’ Beverage category could be a strategic choice, aiming to solidify its position before expanding further.

Competitive Landscape

In the competitive landscape of the Beverage category in Massachusetts, Zenith has experienced fluctuations in its ranking, moving from not being in the top 20 in December 2023 to 20th place by March 2024. This indicates a struggle to maintain a stable position within a highly competitive market. Notably, Bubby's Baked has shown a similar pattern but managed to secure a higher rank than Zenith in March 2024, indicating stronger performance despite a drop in sales. Meanwhile, Cantrip, which was ahead of Zenith in December 2023 and January 2024, fell behind Zenith by March 2024, showcasing Zenith's ability to outperform certain competitors despite overall challenges. Sip displayed remarkable growth, moving from not being in the top 20 to overtaking Zenith by March 2024, highlighting the dynamic nature of the market and the potential for rapid changes in rank. Upstate Elevator Operators remained relatively stable but still fell behind Zenith in the rankings, suggesting that while Zenith faces significant competition, it has managed to maintain an edge over certain brands. This competitive analysis underscores the importance of strategic marketing and product quality improvements for Zenith to enhance its market position in the face of fluctuating sales and rankings.

Notable Products

In March 2024, Zenith's top-performing product remained the Pumpkin Cold Brew Coffee (5mg THC, 12oz) within the Beverage category, maintaining its number one rank consistently from December 2023 through to March 2024. This product achieved notable sales figures, selling 788 units in March. No other product details or sales figures were provided for comparison. Without additional data, insights on ranking changes for other products or categories cannot be determined. However, the consistent performance of the Pumpkin Cold Brew Coffee suggests a steady consumer demand for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.