Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

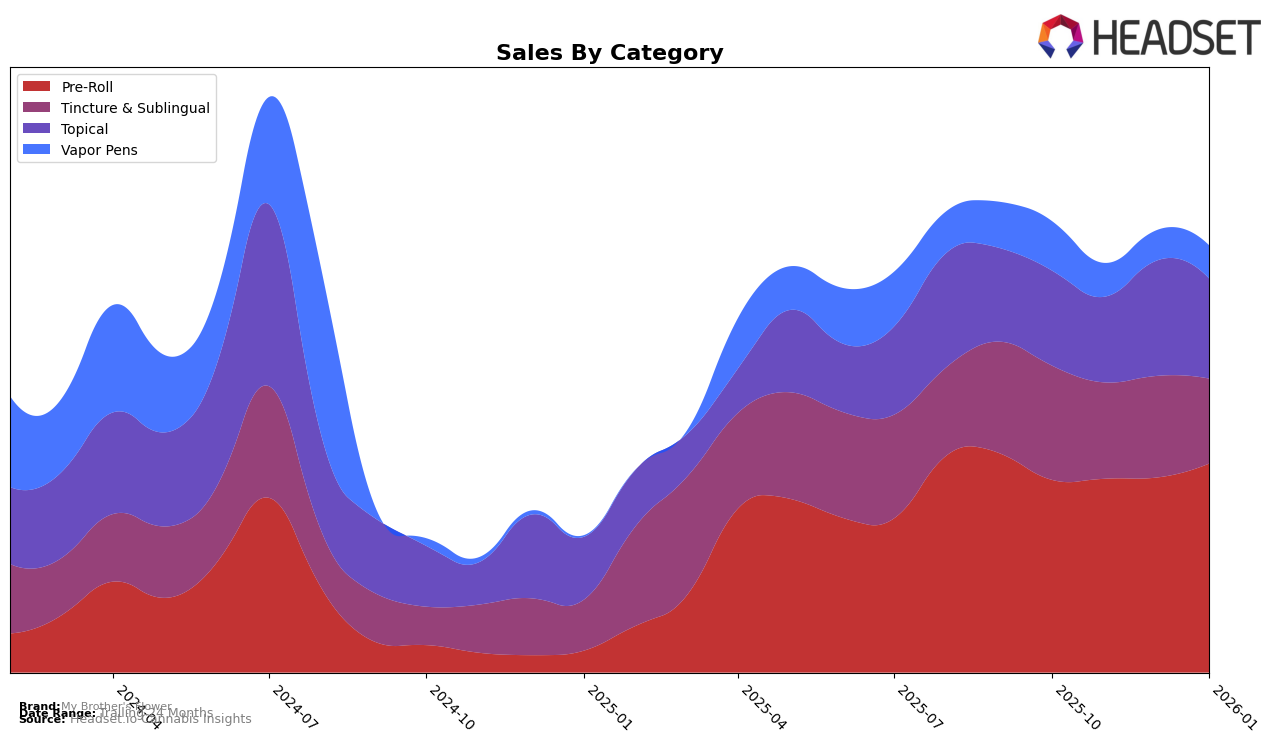

My Brother's Flower has shown notable performance across various product categories in Colorado. In the Pre-Roll category, the brand has made a significant leap, moving from a rank of 31 in October 2025 to 24 by January 2026, indicating a positive trajectory in this segment. This improvement in ranking suggests a growing consumer preference for their pre-roll products. On the other hand, their presence in the Vapor Pens category has not been as strong, consistently ranking outside the top 70, with a slight fluctuation, ending at rank 76 in January 2026. This could indicate either a highly competitive market or a need for a strategic pivot to enhance their offerings in this category.

In the Tincture & Sublingual category, My Brother's Flower has maintained a stronghold, consistently holding the second position from October 2025 through January 2026. This stability highlights the brand's strength and consumer trust in their tincture products. Meanwhile, their performance in the Topical category has been relatively stable, with a slight dip in November 2025 but recovering to the fourth position by January 2026. These rankings reflect a balanced portfolio with strong performances in certain categories, while others, like Vapor Pens, might require more focus to boost their market presence.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll market, My Brother's Flower has shown a notable upward trajectory in its rankings, moving from 31st place in October 2025 to 24th by January 2026. This positive shift indicates a growing consumer preference or effective marketing strategies that have enhanced its market presence. Comparatively, Binske and Seed and Smith (LBW Consulting) have experienced fluctuations, with Binske dropping out of the top 20 by January 2026 and Seed and Smith maintaining a relatively stable yet lower rank. Meanwhile, Joints (CO) has seen a slight decline in rank but remains ahead of My Brother's Flower, indicating strong competition. The sales figures suggest that while My Brother's Flower is still behind these competitors in raw sales, its consistent improvement in rank highlights a potential for future growth and increased market share.

Notable Products

In January 2026, My Brother's Flower saw Blueberry Kush Infused Pre-Roll (1.5g) maintain its top rank in the Pre-Roll category, with sales reaching 2039 units. Tahoe OG Infused Pre-Roll (1.5g) improved its position to second place, up from fifth in December 2025, indicating a rise in popularity. Pineapple Express Infused Pre-Roll (1.5g) entered the rankings at third place, showing strong sales performance since its absence in December. Dawn Infused Pre-Roll (1.5g) dropped to fourth place, a slight decline from its third-place ranking in the previous month. Dusk Infused Pre-Roll (1.5g) continued its downward trend, falling to fifth place, suggesting a decrease in consumer preference compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.