Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

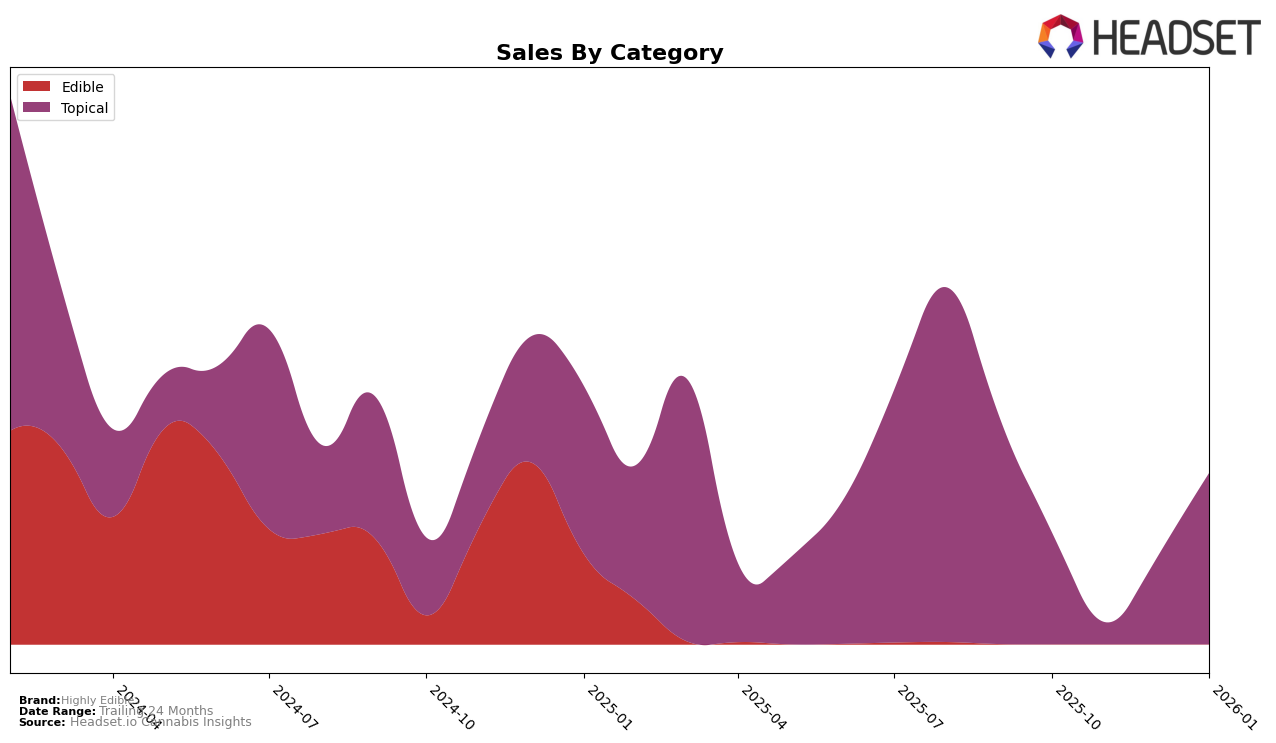

Highly Edible has shown interesting dynamics in its performance across different categories and states. In the Colorado market, the brand has consistently maintained a strong presence in the Topical category. Notably, in October 2025, Highly Edible was ranked 7th, and despite dropping out of the top 30 in November, it bounced back to 8th in December and improved to 6th by January 2026. This upward trajectory indicates a recovery and potential growth in consumer interest or strategic adjustments that have paid off in the new year. The fluctuation in rankings suggests a competitive landscape, where Highly Edible's ability to regain a position in the top 10 is a positive indicator of its resilience and adaptability.

The absence of Highly Edible from the top 30 ranking in November 2025 in Colorado could be seen as a setback, yet their return to a higher rank by January 2026 highlights a significant rebound. This pattern might suggest that the brand faced challenges that were effectively addressed, leading to a doubling of sales from December to January. The reasons behind such movements could be attributed to seasonal demand, changes in consumer preferences, or marketing strategies that resonated well with their target audience. Understanding these dynamics can provide valuable insights into the brand's strategic decisions and market positioning, which might be of interest to stakeholders and competitors alike.

Competitive Landscape

In the competitive landscape of the Topical category in Colorado, Highly Edible has experienced notable fluctuations in its market position over recent months. In October 2025, Highly Edible was ranked 7th, but it did not appear in the top 20 in November, indicating a significant drop in visibility and potential sales. By December 2025, it regained its footing, ranking 8th, and further improved to 6th by January 2026. This rebound suggests a positive trend in consumer preference or strategic adjustments by Highly Edible. In contrast, NectarBee showed a consistent presence, maintaining a rank between 7th and 8th, while Care Division and My Brother's Flower consistently outperformed Highly Edible, holding ranks 4th to 5th. Nuo displayed a slight decline, dropping from 6th to 7th by January 2026. These dynamics highlight the competitive pressures Highly Edible faces and underscore the importance of strategic initiatives to maintain and improve its market position in the Colorado Topical category.

Notable Products

In January 2026, the CBD/THC 1:1 Nordic Goddess Body Balm (250 CBD, 250 THC, 2oz) maintained its position as the top-performing product for Highly Edible, continuing its consistent ranking at number one since October 2025. This product experienced a notable increase in sales to 412 units, which is a significant jump compared to previous months. This steady leadership in the Topical category highlights its enduring popularity among consumers. Other products in Highly Edible's lineup have not been able to surpass the sales figures of the Nordic Goddess Body Balm, indicating its strong market presence. The consistent top ranking of this product suggests a stable demand and possibly effective marketing strategies that have kept it at the forefront.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.