Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

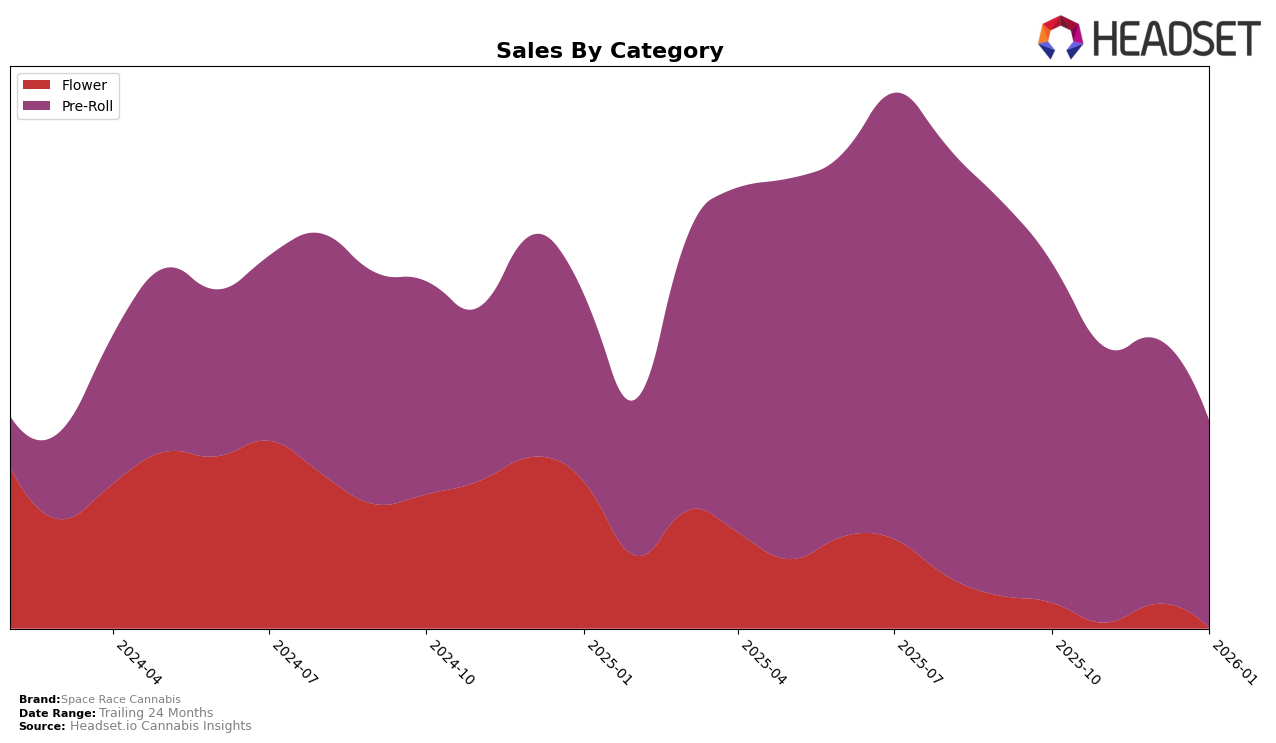

Space Race Cannabis has demonstrated varying performance across different categories and provinces. In the Flower category, the brand has shown fluctuations in its ranking in Alberta, moving from 13th in October 2025 to 19th by January 2026. This indicates a potential challenge in maintaining a strong market position. Meanwhile, in Saskatchewan, Space Race Cannabis experienced a notable improvement in the Flower category, climbing from 21st in November 2025 to 14th in December 2025, although it slightly fell back to 19th in January 2026. In Ontario, the brand has struggled to break into the top 30, maintaining a consistent position outside it, which suggests a need for strategic adjustments to capture more market share.

In the Pre-Roll category, Space Race Cannabis has maintained a stronger presence. In Alberta, the brand consistently ranked within the top 6, peaking at 4th in October 2025 before settling at 5th in January 2026. This stability highlights the brand's solid footing in this category within the province. Conversely, in Saskatchewan, the rankings have been more volatile; the brand reached as high as 3rd in December 2025 before dropping to 7th in January 2026, indicating potential competitive pressures. It's noteworthy that Space Race Cannabis has managed to maintain a strong presence in the Pre-Roll category across these provinces, suggesting a robust product offering that resonates well with consumers in this segment.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Space Race Cannabis has experienced some fluctuations in its market position from October 2025 to January 2026. Initially ranked 4th in October 2025, Space Race Cannabis saw a decline to 6th place by December 2025, before recovering slightly to 5th in January 2026. This movement reflects a dynamic market where competitors such as Redecan and Spinach have also experienced shifts in their rankings, with Spinach notably improving its position to 6th in January 2026. Meanwhile, Back Forty / Back 40 Cannabis and Castle Rock Farms have maintained stronger positions, consistently ranking in the top four. The sales trends indicate that while Space Race Cannabis has seen a decrease in sales over this period, the brand remains competitive, suggesting potential for strategic adjustments to regain higher rankings amidst the evolving market dynamics.

Notable Products

In January 2026, the top-performing product for Space Race Cannabis was Sputnik Pre-Roll (0.4g), maintaining its position as the number one ranked product for four consecutive months, despite a decline in sales to 16,840 units. Following closely, Apollo Pre-Roll (0.4g) secured the second spot, consistently holding this rank since October 2025. Voyager Pre-Roll (0.4g) remained steady at third place, showing consistent performance without any change in rank over the months. Stargirl Pre-Roll (1g) and Sky Rockets Pre-Roll 20 Pack (8g) were ranked fourth and fifth respectively, with Stargirl's sales slightly increasing from December 2025. Notably, Sky Rockets Pre-Roll 20 Pack (8g) debuted in the rankings in December and maintained its fifth position into January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.